Many people are aware that $100 nowadays isn’t much, but if you want to trade the Forex market, it may get you started and even produce a new source of income from home. If you can create and implement a successful trading strategy, your first $100 Forex account might transform your life for the better.

However, if you only wish to enter the currency market for practice trades or gamble a bit, losing $100 is quite acceptable.

The secret to becoming a successful Forex trader is having a workable trading strategy that you can stick to, whether you’re dealing with $100 or $1 million in your margin account [1].

A good trading strategy will help you control your emotions, risk, and profit potential. It will also give you the ability to adapt to different market conditions.

If you’re not sure how to create a trading strategy, consider using a mechanical Forex trading system. These systems are designed by professional traders and can be bought or leased online. While they may require some tweaking to fit your specific trading style, they can provide valuable insights into how to make money in Forex without blowing up your account.

Forex trading can be a great way to make some extra money on the side, or even turn your $100 investment into $1000. However, it is important to remember that Forex trading is not a get-rich-quick scheme – it takes time and effort to become successful in this market.

In this blog post, we will discuss some tips for how you can turn your $100 investment into $1000 in the Forex market!

How to Trade Forex with $100: The Basics

Forex, or foreign exchange, trading is an international market for buying and selling currencies. It’s like the stock market, but with money instead of stocks. You can trade Forex with a small amount of money, like $100. All you need is a computer and an internet connection.

In order to make money in Forex, you need to understand how it works and what factors affect currency values. You also need to have a good strategy for making trades. With a little effort, you can learn all of this and start making profitable trades in no time.

Research The Market

Fundamental Analysis

The impact of economic news and releases on the market is investigated using this method. The relative value of each currency generally reflects the status of that nation’s economy and geopolitical climate when compared to the currency being quoted against.

The following are the most crucial news events and indicators tracked by fundamental currency investors [2]:

- Changes in geopolitical balances and other major world news developments;

- The Bank of Canada manages the economy and sets interest rates;

- GDP, or total output, is the measure of all goods and services produced in a country during one year;

- Statistics on employment (non-farm payrolls, unemployment rate, weekly initial jobless claims, and so on);

When you trade, fundamental analysis can provide you with a significant advantage. It may help predict long-term exchange rate trends as well as explain and forecast short-term movements, such as those that occur around important economic announcements.

Traders who use an online Forex broker will most likely have a news feed included in their trading platform to assist you with fundamental analysis. The economic calendar, which lists all of the important upcoming economic events for many major economies, is another essential source of fundamental trading information.

Technical Analysis

Technical analysis, which uses charts and computational technical indicators to analyze market conditions that may influence and predict an exchange rate’s future movement, is one way to study the Forex market.

Understanding the differences in exchange rate fluctuations is a key element of Forex trading. The goal of this section is to help you identify recurring patterns in the market that may have predictive value. You may also utilize a variety of popular indicators based on market observable data to assist forecast short- and long-term trends in the market.

Moving averages, momentum oscillators, overbought or oversold indicators, and volume figures are all examples of this.

The Moving Average Convergence Divergence indicator (MACD), the Relative Strength Index (RSI), and the 200-day moving average are just a few key indicators.

Trading volume is also an essential market metric to watch, especially when viewed in conjunction with the trading activity. Additionally, support and resistance levels indicate the degree of supply and demand at various exchange rate settings.

The charts themselves may also contain vital information that you can act on. Japanese rice merchants invented a fascinating method of interpreting and trading candlestick graphs that is still utilized today. Opening and closing exchange rates, the currency pair’s range, and whether the exchange rate rose or fell for each period shown on the chart are all indicated by these informative charts.

Technical analysis, in general, provides a relatively objective method to analyze the Forex market that may be used to predict short-term market changes. Technical analysis is commonly utilized by scalpers and day traders to guide their trading activities.

Open a Demo Account

The first step you need to take is to open a demo account with a broker. A demo account is like a training ground for Forex trading. It will allow you to practice your strategies and get familiar with the Forex market without risking any real money.

Once you have opened a demo account, the next step is to start practicing your trading strategies. You can do this by using the virtual money that comes with your account. Try out different strategies and see which ones work best for you.

When you feel confident enough, it’s time to start trading with real money. Remember to trade small amounts at first so that you don’t risk too much capital. Once you’ve made some profits, you can then start increasing your trade size.

Fund an Account and Start Trading

The next step is to fund your account and start trading. You can do this by depositing money into your account using a credit card, bank transfer, or e-wallet.

Once you have deposited money into your account, you can start trading immediately. Just remember to trade responsibly and not to risk more than you can afford to lose.

By following these steps, you can turn $100 into $1000 in the Forex market. Just remember to be patient and disciplined with your trading, and always keep learning so that you can continue to improve your skills.

Review Your Budget

The final step is to review your budget and make sure that you are comfortable with the amount of money you are trading with. Remember, Forex trading is a risky business and you can lose all of your capital if you’re not careful.

Just remember to never risk more than you can afford to lose, and always trade responsibly.Tips to Turn $100 into $1000 in Forex Trading

Have The Right Mindset

In life, as in Forex trading, your mindset is everything. You must have the appropriate mentality when it comes to entering Forex trading, otherwise, you will lose more than you will gain. Forex trading has the ability to remove everything from your account in a matter of seconds; all you have to do is push any key and your money is gone. You must be aware that losing money is a possibility, which is where risk management comes into play [3].

You should learn to balance your risk in each transaction. In managing your own risk, you must understand the importance of entry and exit points. An entry point is one of the sexiest aspects of Forex trading- with the correct entrance point, your trades can generate enormous profits instantly. The ideal entry point will allow you to turn $100 into $1000 in no time.

Find The Right Broker

Finding the correct broker is critical to Forex trading success.

Certain brokers, on the other hand, can be a bit shady – so beware of them. You’ll find everything you need to begin Forex trading by choosing one of the authorized Forex brokers that are right for your needs and standards.Find The Right Trading Strategy

To find the right trading strategy, you must first understand what your objectives are. What are you looking to achieve? What is your time frame? How much money do you want to make? Once you’ve answered these questions, finding the perfect strategy will be a breeze.

There are many different strategies out there – some more complex than others. You can use technical analysis or fundamental analysis (or a combination of both) to develop your own personal strategy. The most important thing is that the strategy works for you. Test it out on a demo account first to see if it’s profitable.

Long-Term Trading

If you want to turn $100 into $1000 in the foreign exchange market, you need to take a long-term approach. This means that you should be looking to hold your trades for weeks or even months at a time.

The reason why this is the case is that the Forex market is very volatile and prices can move a lot in a short space of time. By holding your trades for longer periods of time, you give yourself more room for error and more time for the market to move in your favor.

Of course, this doesn’t mean that you will always make money by taking a long-term approach. However, it does increase your chances of making profitable trades over the course of time.

There are a number of things that you need to do in order to be successful at long-term trading:

- Firstly, you need to make sure that you have a sound strategy in place. This should include an analysis of the market and an understanding of what factors can move prices;

- Secondly, you need to be disciplined in your approach. This means sticking to your strategy even when it is not working out in the short term;

- Finally, you need to have patience. Making money in the Forex market takes time and there will be periods where it can be tough going;

FAQ

Can you double your money in Forex?

The answer is yes, you can. However, it will take time, dedication, and effort. You need to have a solid plan and know what you’re doing in order to make this happen.

Here are a few tips on how to turn $100 into $1000 in Forex:

- Start with a demo account. This will allow you to get familiar with the Forex market and learn how to trade without risking any real money. Once you feel comfortable, you can start trading with a live account;

- Set realistic goals. Don’t expect to double your money overnight. It takes time to build up your account balance and increase your profits. Set small goals that you can realistically achieve and work your way up;

- Be patient. Rome wasn’t built in a day and neither will your account balance. Be patient and don’t get discouraged if you don’t see results immediately. Just keep working at it and eventually, you will start seeing the profits roll in;

- Make use of leverage. Leverage can help you increase your profit potential, but it can also lead to bigger losses if you’re not careful. Use leverage wisely and only when you’re confident in your ability to trade successfully;

What is the best leverage for $100?

This leverage ratio is highly popular among professional traders. If your leverage is 1:100, it means that for every $1 you deposit, the broker lends you $100.

So if your trading balance is $100, you may trade $10,000 ($100*100) [4].

How do I trade Forex with $100?

There are a few things you need to do in order to trade Forex with $100:

- Open a micro account. A micro account allows you to trade with very small amounts of money. This is perfect if you’re starting out with a small amount of capital;

- Deposit your $100. You can’t start trading without money in your account! Once you’ve opened a micro account, simply deposit your $100 and you’ll be ready to start trading;

- Choose your currency pair. There are dozens of different currency pairs that you can trade. Do some research and decide which one is right for you;

- Set up your stop loss and take profit levels. These are important risk management tools that will help you limit your losses and maximize your profits;

- Start trading. Once you’ve done all of the above, you’re ready to start trading. Open up a chart and start placing orders. Remember to always use risk management tools such as stop losses to protect your account balance;

What is a flip in Forex?

The moment when a trader switches from having more long bets to more short bets. A trader “flips” when they have been holding a losing trade for too long and finally decides to close it out at a loss. Many traders will avoid flipping at all costs because it means they have made a mistake and are now trying to salvage the situation.

Flipping can also refer to taking profits on a short-term trade and then immediately entering into another trade in the opposite direction. This is commonly done by scalpers who are looking to make small profits on very short-term trades [5].

What does it mean to flip a trading account?

It means to turn a profit. If you’re “flipping” your account, it means you’re making money. This is the goal of every trader, to flip their account and make a profit. There are many different ways to do this, but the most important thing is to have a solid plan and know what you’re doing.

How do I trade $10 in Forex?

You can get started with just $10. For many offshore brokerages, the minimal deposit is usually $10 for a live trading account. However, we would recommend depositing at least $100 to give yourself some room to maneuver in case of losses. If you’re able to deposit more than that, even better. The more money you have in your account, the more potential profits you can make.

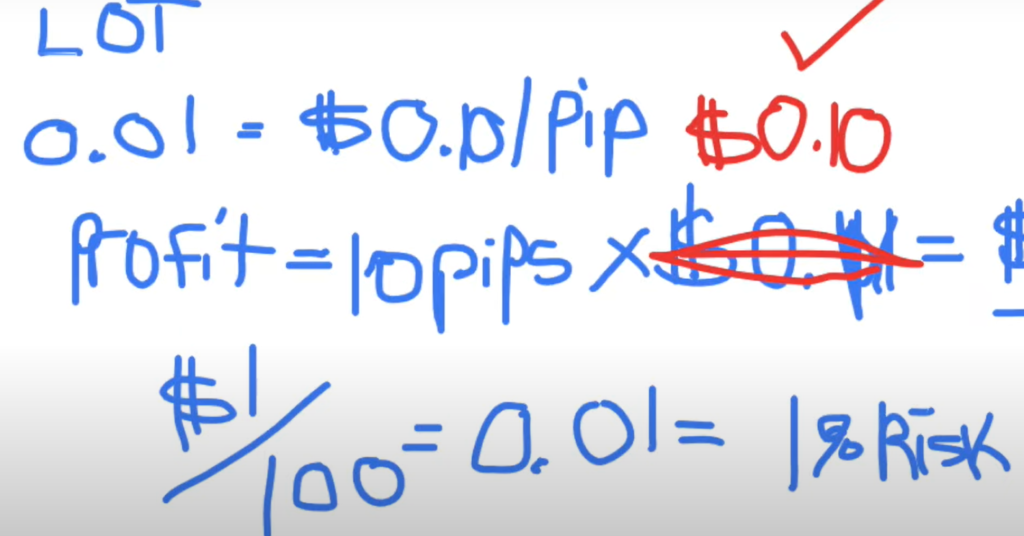

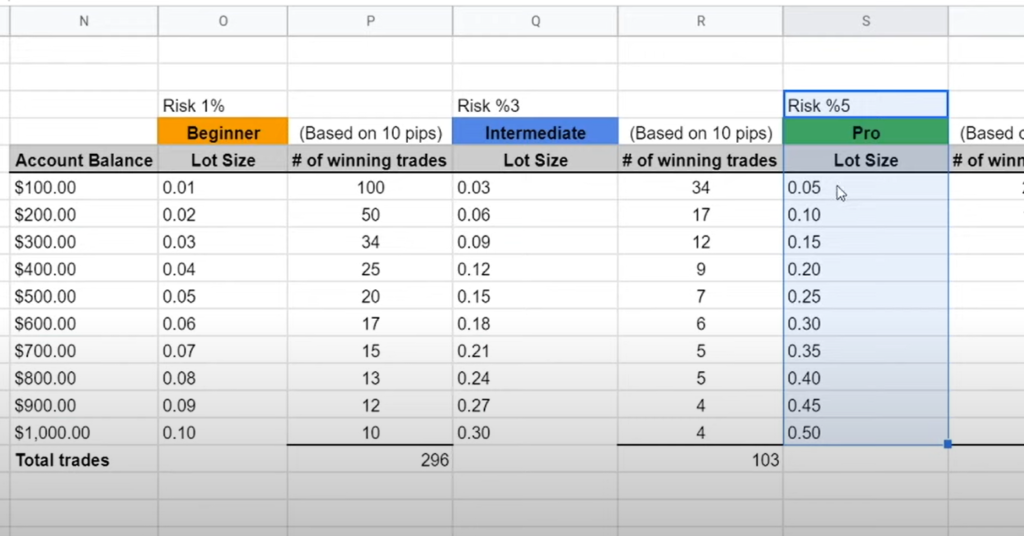

When it comes to trading with $100 or less, micro-lot contracts are usually the way to go. A micro-lot is a trade worth 0.01 of a standard lot (or 1000 units of the base currency). So if you’re trading EUR/USD, a micro-lot would be worth €0.01 x 1000 = €1000. This is the perfect size for someone who’s starting out with a small account balance and doesn’t want to risk too much money per trade [6].

How does Forex make money for beginners?

In order to make money in Forex, you need to have a basic understanding of how the market works. The foreign exchange market is where currencies are traded. Currencies are important to most people around the world because they need them to trade goods and services.

Most currency pairs are quoted in terms of how much one unit of the base currency is worth in the quote currency. For example, if the EUR/USD pair is quoted as “one euro equals one point two dollars”, that means that one euro can buy you one point two US dollars. If you think that the euro will appreciate against the dollar, then you would buy euros and sell dollars.

How many lots can I trade with $30?

The ideal risk of $30 per trade will enable you to trade 0.1 lots with a 30-pip SL. This is a risk of $30 (or one percent of the account) on an account size of $3000. You can also trade 0.01 lots, which would be a risk of only $0.30 per trade with the same SL [7].

The lot size you choose to trade will also affect your pip value and therefore your potential profit or loss from each trade.

A standard lot is 100,000 units, so if you were trading EUR/USD and bought one standard lot at $0.9050 your position would be worth $90,500 ($100,000 * 0.9050).

How can I make $100 at Forex in 1 hour?

While it is possible to make $100 in an hour with Forex trading, it is not easy to do. You need to have a solid understanding of the market and be able to make quick decisions. If you are new to Forex trading, it is advisable to start with a demo account so that you can get some experience before risking real money.

In order to make $100 in one hour, you would need to trade a very large amount of money. This is not recommended for beginners as it can quickly lead to big losses. It is also important to remember that the market can be very volatile and there is always the potential for losing money.

Useful Video: How to Flip $100 to $1000 in Forex | FREE Trading Plan – For Beginners

References:

- https://www.benzinga.com/money/how-to-trade-forex-with-100

- https://www.benzinga.com/money/how-to-trade-forex-with-100

- https://omegaunderground.com/how-to-turn-100-into-1000-in-forex-trading

- https://sureshotfx.com/best-leverage-for-100-forex-account

- https://www.babypips.com/forexpedia/flip

- https://forexbrokerreport.com/can-i-start-forex-trading-with-10

- https://fbs.com/analytics/guidebooks/how-much-money-do-i-need-for-forex-trading-265

Leave a Review