Forex trading, also known as foreign exchange trading, is a popular form of financial trading that involves the buying and selling of currencies. This type of trading is highly accessible and can be done with a relatively small amount of capital, making it an attractive option for individuals looking to invest with limited funds.

However, Forex trading also comes with its own set of risks and challenges. Due to the high levels of leverage that are often used in forex trading, even small movements in the market can have a significant impact on a trader’s account balance. As a result, it’s important for traders to have a solid understanding of the markets they are trading in, and to use risk management strategies to minimize potential losses.

In this article, we will cover some of the key considerations for trading forex with a small amount of capital, including how to choose a broker, how to manage risk, and how to develop a trading strategy that suits your individual needs and goals. By the end of this article, you will have a solid foundation for trading forex with $ 100, and be well on your way to building a successful trading career.

Advantages Of Forex Trading:

Using Margin and Leverage

One of the biggest advantages of Forex trading is the ability to use margin and leverage. Margin trading allows you to trade with more money than you have in your account, while leverage amplifies your potential profits and losses.

Margin and leverage allow traders to increase their buying power and take advantage of small price movements in the market. This can lead to higher profits than would be possible with a smaller account.

However, it is essential to use proper risk management when using margin and leverage. This involves setting stop-loss orders and using proper position sizing to avoid significant losses [2].

No Middleman

Another advantage of Forex trading is that there is no middleman involved. This means that you can trade directly with the market and avoid brokerage fees and commissions.

In Forex trading, the market is decentralized, which means that there is no central exchange. Instead, traders buy and sell currencies directly with each other through electronic platforms.

This can result in lower transaction costs for traders and more transparent pricing. It also allows traders to take advantage of global market opportunities and trade 24 hours a day.

Flexible Timing

Forex trading is a flexible investment option that allows traders to trade at any time of the day or night. The Forex market is open 24 hours a day, five days a week, which means that you can trade whenever it is convenient for you.

This flexibility is particularly beneficial for traders who have other commitments or live in different time zones. It also allows traders to react quickly to news and events that could affect their trades.

However, it is important to have a solid understanding of market dynamics and to use proper risk management principles when trading at non-standard times.

Liquidity

The Forex market is one of the most liquid financial markets in the world. This means that there is a high volume of trades and transactions happening at any given time.

High liquidity is particularly important for traders who use short-term trading strategies such as scalping and day trading. It also makes it easier to execute larger trades without affecting the market price.

Is Trading Forex With $ 100 a Good Idea?

Trading Forex for $ 100 is possible, but it may not be the best idea for everyone. Forex trading involves significant risk, and traders should only invest money that they can afford to lose.

The amount of money you need to start trading Forex will depend on various factors, such as the leverage you use and the trading strategy you employ. With a $ 100 account, you may not have enough capital to employ certain strategies or withstand significant losses [3].

Moreover, it is essential to keep in mind that Forex trading involves a steep learning curve. It takes time and effort to develop the necessary skills and knowledge to be successful in Forex trading. A $ 100 account may not provide you with enough capital to learn and practice the necessary skills and strategies.

However, there are still some ways to trade Forex with a $ 100 account. One option is to start with a micro account, which allows you to trade with smaller position sizes and lower risk. Some brokers offer micro accounts with a minimum deposit of $ 100 or less. These accounts allow traders to practice their skills and test their strategies without risking significant amounts of capital.

Another option is to use low leverage. Leverage amplifies your potential profits and losses, and higher leverage can lead to significant losses if not used correctly. Using low leverage can help you minimize your risk and protect your account from significant losses.

It is also important to choose the right trading strategy when trading Forex with a $ 100 account. Strategies such as scalping or day trading may not be suitable for small accounts, as they require frequent trading and high transaction costs. Instead, longer-term strategies such as swing trading or position trading may be more appropriate.

What Are The Implications Of Trading Forex With $ 100?

Trading Forex with a $ 100 account has several implications that traders should consider before getting started. Here are some of the key implications [4]:

- Limited Capital: With only $ 100, traders will have limited capital to work with. This can be a significant disadvantage, as Forex trading requires traders to risk capital to make a profit. The limited capital means that traders may have to take on more risk than they are comfortable with to make a meaningful profit;

- Limited Flexibility: With a small account, traders may not have the flexibility to trade multiple currency pairs or to use more advanced trading strategies. They may be limited to trading a few currency pairs, which may not provide enough opportunities to make a profit;

- High Leverage: To make the most of a small account, traders may be tempted to use high leverage. This can amplify their potential profits, but it can also amplify their potential losses. Using a high leverage can also increase the risk of a margin call, which can result in a forced liquidation of open positions;

- Higher Transaction Costs: Forex trading involves transaction costs such as spreads, commissions, and swaps. With a small account, these costs can have a significant impact on profitability. Traders may have to focus on lower-cost trading strategies or look for brokers with lower transaction costs to maximize their profitability;

- Psychological Pressure: With a small account, traders may feel more psychological pressure to make a profit quickly. This can lead to impulsive and emotional trading decisions, which can lead to significant losses. Traders need to develop the discipline and patience to stick to their trading plan and manage their risk effectively;

How To Start Forex Trading With $ 100:

1) Manage Expectations

Before you start trading Forex for $ 100, it’s important to have realistic expectations about what you can achieve. It’s essential to understand that Forex trading is a high-risk activity that involves the potential for significant financial losses. As a beginner, you should not expect to make large profits right away. Instead, you should focus on building your skills and knowledge as a trader. Keep in mind that even experienced traders experience losses from time to time. Therefore, it’s crucial to approach Forex trading with a long-term perspective and not expect to get rich quickly.

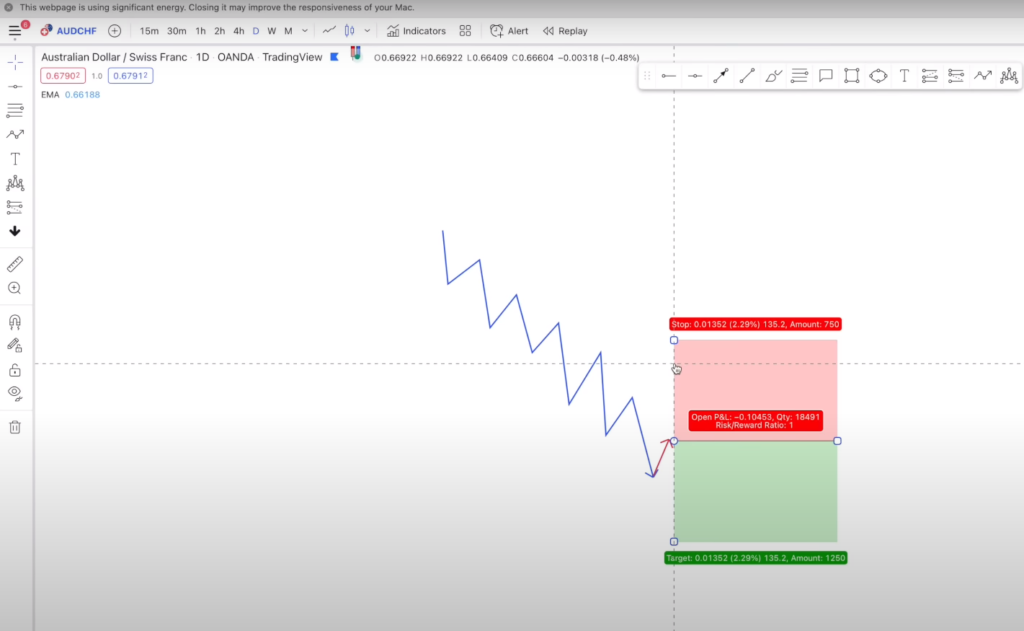

2) Apply Risk Management

Risk management is crucial in Forex trading, regardless of the amount of money you are trading. As a beginner, it’s essential to understand the concept of risk management and apply it consistently in your trades. One of the essential risk management strategies is the use of stop-loss orders.

3) Find A Broker That Offers Nano Lots

When starting Forex trading with $ 100, it’s important to find a broker that offers nano lots. A nano lot is a unit of currency that is equal to 100 units of the base currency. For example, if you are trading the EUR/USD currency pair, a nano lot would be 100 Euros. By trading nano lots, you can manage your risk more effectively and trade with smaller position sizes. This can help you avoid blowing your account and allow you to trade with a small account balance.

4) Look To Grow Your Trading Account

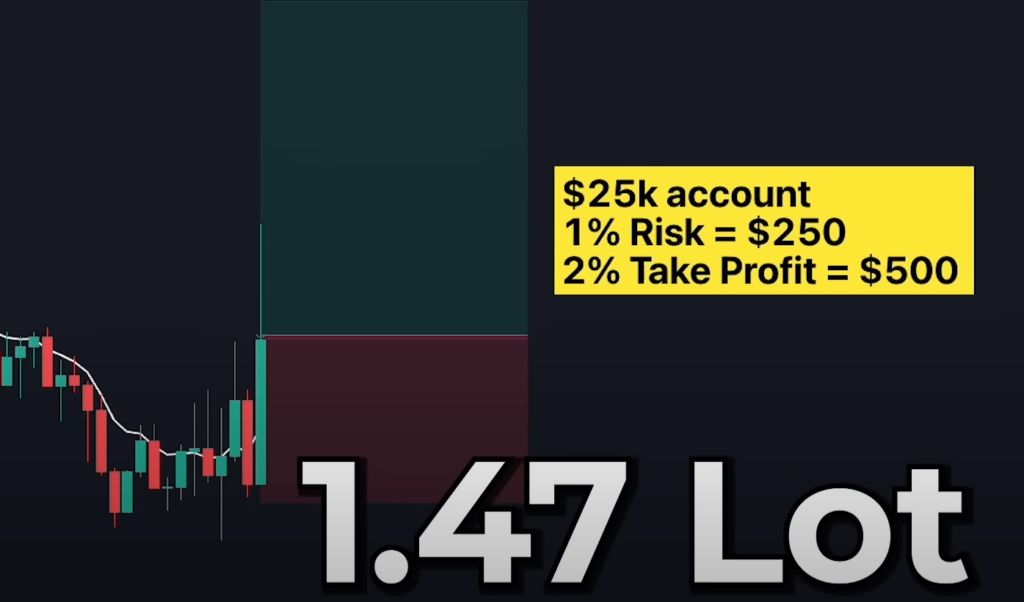

When starting Forex trading with $ 100, it’s important to have a plan for growing your account over time. You should aim to make consistent profits and reinvest them in your trading account. One way to do this is to use a percentage-based risk management strategy.

For example, you could risk 1% of your account balance on each trade. If you make a profit, you will reinvest that profit into your account, allowing you to increase your position size over time. As your account balance grows, you can consider increasing your risk per trade.

5) Trade A Lower Timeframe

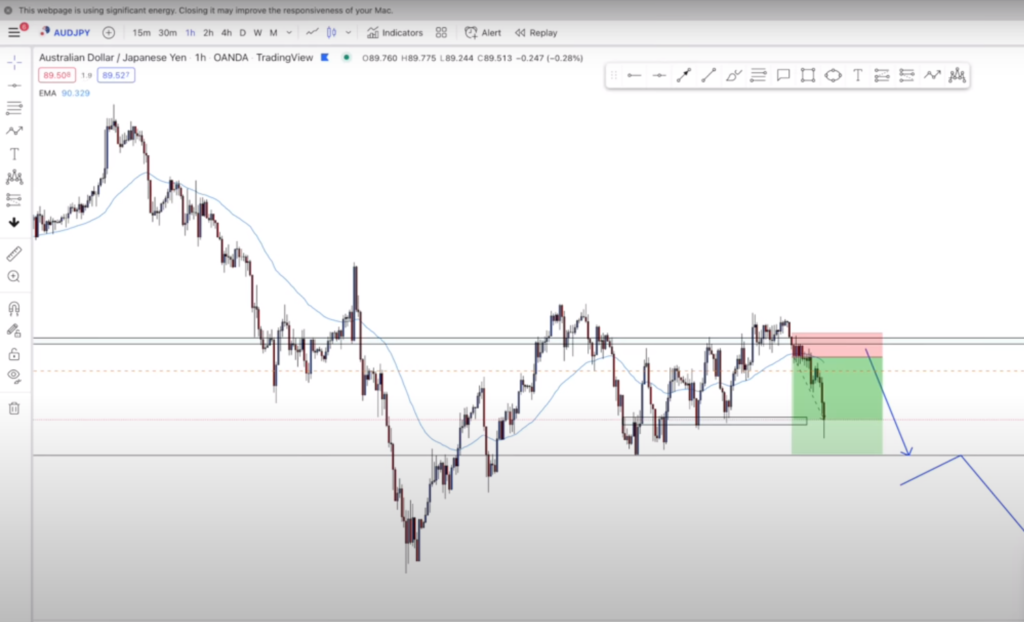

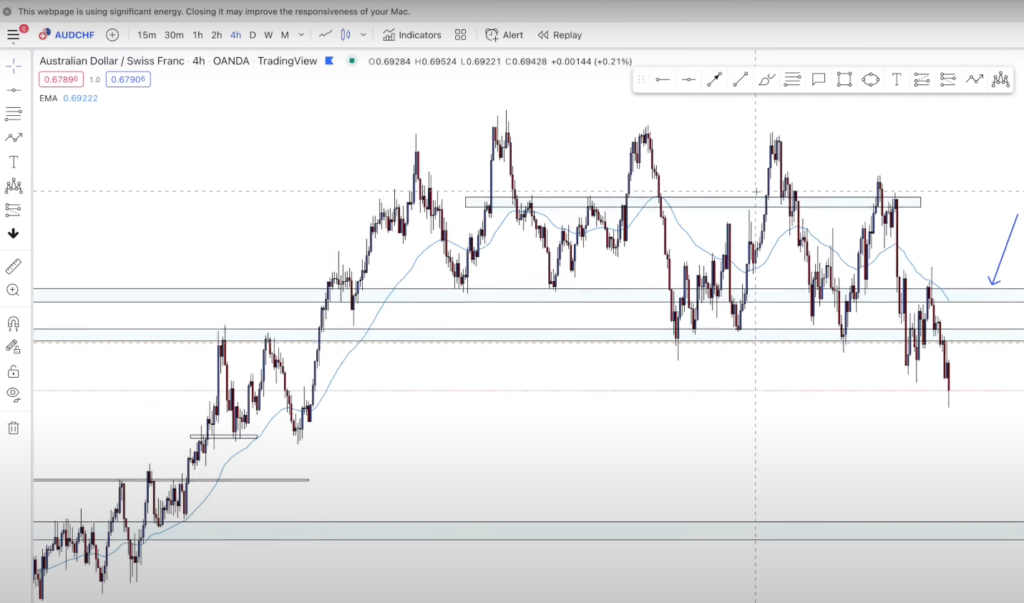

When starting Forex trading with $ 100, it’s generally best to trade a lower timeframe, such as the 1-hour or 4-hour chart [5]. Trading on these lower timeframes can allow you to make more trades and take advantage of shorter-term price movements. However, it’s important to keep in mind that trading on lower timeframes also comes with higher risks. You should ensure that you have a solid understanding of price action and technical analysis before trading on lower timeframes.

Trading Scenario – What Happens If You Trade With Just $ 100:

Deposit Funds into a Trading Account

Before you start trading, you need to deposit funds into your trading account. The amount you deposit will determine the size of your trades and the potential profits or losses you can make. When you have just $ 100, you need to be very careful with how you allocate your funds. You should aim to deposit the full amount into your trading account to give yourself the best chance of success.

Calculate Required Margin

Margin is the amount of money you need to open a position. It is calculated based on the size of your trade and the leverage you use. Leverage allows you to control a large amount of money with a small deposit, but it also increases your risk. When trading with $ 100, you should use low leverage to minimize your risk. For example, if you use a leverage of 1:10, you can open a position worth $ 1,000 with just $ 100.

To calculate the required margin, you need to multiply the size of your trade by the margin percentage.

For example, if you want to trade 1,000 units of EUR/USD and the margin percentage is 1%, the required margin would be $ 10.

Calculate Used Margin

Used margin is the amount of money you have currently locked up in open positions. When you open a position, the required margin is taken from your account balance and held as a used margin until the position is closed. If the position moves against you, the used margin increases, reducing your available funds for opening new positions.

For example, if you open a position worth $ 1,000 with a leverage of 1:10, the required margin is $ 100. If the position moves against you and your loss reaches $ 50, your used margin would be $ 150 (the $ 100 required margin plus the $ 50 loss).

Calculate Equity

Equity is the value of your account after taking into account any open positions. It is calculated by subtracting your used margin from your account balance. For example, if you have a balance of $ 100 and a used margin of $ 50, your equity would be $ 50.

Calculate Margin Level

To calculate the margin level, you need to divide your equity by your used margin and multiply by 100. For example, if you have an equity of $ 50 and a used margin of $ 50, your margin level would be 100%.

Choose a Forex Trading Strategy:

Forex Scalping

Forex scalping is a popular trading strategy that involves making numerous small trades throughout the day. The goal of Forex scalping is to make a profit from small price movements by buying and selling quickly.

One of the benefits of Forex scalping is that it requires less capital than other trading strategies. It is also a good option for traders who do not have a lot of time to dedicate to trading.

However, Forex scalping is also a high-risk strategy and requires a lot of focus and discipline. It is important to have a solid understanding of technical analysis and to use proper money management principles when scalping.

Day Trading

Day trading is another popular Forex trading strategy that involves making trades within a single trading day. Day traders aim to take advantage of short-term price movements by buying and selling multiple times throughout the day.

One of the benefits of day trading is that it allows traders to take advantage of intraday volatility and make quick profits. However, day trading also requires a lot of focus and discipline and can be emotionally challenging.

To be successful in day trading, it is essential to have a solid understanding of technical analysis and to use proper money management principles. It is also important to stay up to date with market news and events that could affect your trades.

Swing Trading

One of the benefits of swing trading is that it allows traders to take advantage of trends and make significant profits. It is also a good option for traders who do not have a lot of time to dedicate to trading.

To be successful in swing trading, it is essential to have a solid understanding of technical analysis and to use proper money management principles. It is also important to stay up to date with market news and events that could affect your trades.

Position Trading

Position trading is a Forex trading strategy that involves holding positions for an extended period, often several months or even years. Position traders aim to take advantage of long-term price movements and trends by using fundamental analysis and other tools.

One of the benefits of position trading is that it requires less time and attention than other trading strategies. It is also a good option for traders who prefer to take a more passive approach to trade.

To be successful in position trading, it is essential to have a solid understanding of fundamental analysis and to use proper money management principles. It is also important to stay up to date with market news and events that could affect your trades.

Grow Your Trading Account

Regardless of which Forex trading strategy you choose, it is important to focus on growing your trading account. This involves using proper money management principles, such as setting stop loss and take profit levels, using proper risk-reward ratios, and avoiding over-leveraging.

One of the best ways to grow your trading account is to focus on consistency. This involves developing a trading plan, sticking to it, and avoiding emotional trading decisions. It is also essential to track your progress and continually improve your trading skills and knowledge.

Things To Do Before You Can Start Trading Forex:

Practice

The first thing you need to do before you can start trading Forex is to practice. Forex trading is not something you can learn overnight, and it requires a lot of practice and patience. You need to develop your skills and knowledge of the market to be successful in Forex trading.

One of the best ways to practice trading Forex is to use a demo account. A demo account is a free account that allows you to trade Forex with virtual money. It is an excellent way to test your trading strategy and get a feel for the market without risking any real money.

Using a demo account also allows you to learn how to use the trading platform and familiarize yourself with the various features and tools available. Once you feel confident in your trading skills, you can then move on to a live account.

Plan Your Strategy

The next step in preparing to trade Forex is to plan your strategy. A trading strategy is a set of rules and guidelines that you follow when trading Forex. It helps you to make informed decisions and manage your risk effectively.

There are several different trading strategies you can use when trading Forex, and the one you choose will depend on your personal preferences and trading style. Some popular strategies include trend trading, scalping, and swing trading.

When planning your strategy, it is essential to consider your risk tolerance, trading goals, and the amount of time you can dedicate to trading. It is also important to backtest your strategy to ensure it is effective and profitable.

Choose The Right Broker

Choosing the right broker is essential when trading Forex. A broker is a company that provides you with access to the Forex market and the trading platform. They also execute your trades and provide you with essential information and tools to help you make informed decisions.

When choosing a broker, it is important to consider their reputation, trading platform, fees, and customer support. You should also ensure that the broker is regulated by a reputable authority, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US.

Gather The Necessary Funds

The final step in preparing to trade Forex is to gather the necessary funds. Forex trading requires a significant amount of capital, and it is essential to ensure that you have enough funds to cover your trades and manage your risk effectively.

Before you start trading, it is also important to have a solid understanding of money management principles. This includes setting a stop loss and take profit levels, using proper risk-reward ratios, and avoiding over-leveraging.

FAQ:

- What are the working hours of the Forex market?

The Forex market is open 24 hours a day, 5 days a week. Trading begins on Sunday at 5:00 PM EST and ends on Friday at 5:00 PM EST [7]. However, it’s important to note that different currency pairs have different trading hours, and certain market hours may be more active and volatile than others.

- What is the best Forex trading strategy?

There is no one “best” Forex trading strategy that works for everyone. The best strategy for you will depend on your individual trading goals, risk tolerance, and trading style. Some popular strategies include trend following, range trading, and breakout trading. It’s important to research and test different strategies to find one that works for you.

- What do I need to open a Forex account?

To open a Forex account, you will typically need to provide identification documents, such as a passport or driver’s license, and proof of address. You will also need to deposit funds into the account, either through a bank transfer or a credit/debit card.

- Can I start Forex trading with $ 1?

While it is technically possible to start Forex trading with just $ 1, it is not recommended as the amount is too small to make meaningful trades [8]. In general, traders should aim to have a minimum of $ 100 in their account to ensure they have enough capital to cover potential losses.

- Do I need a lot of money to start trading Forex?

No, you do not need a lot of money to start trading Forex. In fact, many brokers offer the ability to open a trading account with as little as $ 10 or $ 20. However, it’s important to keep in mind that having a larger account balance can provide more flexibility and reduce the impact of losses.

- Are there risks with Forex trading?

Yes, there are risks with Forex trading. Due to the high levels of leverage that are often used in Forex trading, even small movements in the market can result in significant gains or losses. Additionally, there is no guarantee of profits in the Forex market, and traders should be prepared to lose money.

- How do I trade a $ 100 account in Forex?

To trade a $ 100 account in Forex, traders should focus on managing their risk and using strategies that are appropriate for a small account balance. This may involve using smaller position sizes, setting stop-loss orders, and focusing on high-probability trades.

- What lot size is good for a $ 100 Forex account?

The lot size that is appropriate for a $ 100 Forex account will depend on the individual trader’s risk tolerance and trading strategy. In general, traders should aim to use smaller lot sizes to reduce their risk and maximize their chances of success.

- Can I make $ 100 a day with day trading?

While it is possible to make $ 100 a day with day trading in Forex, it is not guaranteed. The amount of money a trader can make depends on their trading strategy, risk management, and market conditions.

- What is the best leverage for $ 100?

The best leverage for a $ 100 account will depend on the individual trader’s risk tolerance and trading strategy. In general, traders should aim to use lower leverage to reduce their risk.

- Can you make $ 300 a day from Forex?

While it is possible to make $ 300 a day from Forex, it is not guaranteed. The amount of money a trader can make depends on their trading strategy, risk management, and market conditions.

- Can I trade Forex for $ 25?

Yes, it is possible to trade Forex for $ 25. However, it’s important to keep in mind that having a larger account balance can provide more flexibility and reduce the impact of losses.

- Can you make $ 10,000 a day with Forex?

While it is technically possible to make $ 10,000 a day with Forex, it is highly unlikely and not guaranteed. Making consistent profits in Forex requires discipline, skill, and knowledge of the market, and it is important to approach trading with realistic expectations.

- Can I make 50 dollars a day with Forex?

It is possible to make $ 50 a day with Forex trading, but it is not guaranteed. The amount of money a trader can make depends on their trading strategy, risk management, and market conditions.

- Can I trade Forex having only $ 10?

Yes, it is possible to trade Forex with as little as $ 10. However, it’s important to keep in mind that having a larger account balance can provide more flexibility and reduce the impact of losses.

- Can you make billions from Forex?

While it is technically possible to make billions from Forex trading, it is highly unlikely and not guaranteed. Trading in the Forex market requires a significant amount of skill, knowledge, and experience, and even the most successful traders can experience losses.

- How much can $ 1000 make in Forex?

The amount of money a $ 1000 account can make in Forex depends on the individual trader’s trading strategy, risk management, and market conditions. While there is no guaranteed profit in Forex, a skilled and disciplined trader can make consistent profits over time.

- Can I earn $ 1000 through Forex trading?

It is possible to earn $ 1000 through Forex trading, but it is not guaranteed. The amount of money a trader can make depends on their trading strategy, risk management, and market conditions.

- How to make money in Forex fast?

Making money in Forex requires discipline, skill, and knowledge of the market. While there is no guaranteed way to make money fast in Forex, traders can focus on using a sound trading strategy, managing their risk, and taking advantage of market opportunities.

- Is 100x leverage risky?

Yes, 100x leverage is considered very risky in Forex trading. While high leverage can potentially increase profits, it can also increase losses and magnify the impact of market volatility.

- How to turn $ 100 into $ 1 million?

Turning $ 100 into $ 1 million in Forex trading is highly unlikely and not guaranteed. To make consistent profits in Forex, traders should focus on using a sound trading strategy, managing their risk, and building their account balance over time [9].

- How to make $ 100 cash a day?

Making $ 100 cash a day in Forex trading is not guaranteed and depends on the individual trader’s trading strategy, risk management, and market conditions.

- How can I flip $ 100 dollars fast?

Flipping $ 100 dollars fast in Forex trading is not recommended, as it can lead to impulsive trading decisions and high levels of risk. To build wealth through Forex trading, traders should focus on long-term growth and use a sound trading strategy.

Useful Video: How To Trade FOREX with $100?

References:

- https://www.benzinga.com/money/how-to-trade-forex-with-100

- https://www.babypips.com/learn/forex/trade-forex-with-100-dollars

- https://www.tradingwithrayner.com/how-to-start-forex-trading-with-100/

- https://tradersunion.com/interesting-articles/how-to-trade-forex-with-100-dollars-beginners-guide/

- https://www.publicfinanceinternational.org/how-to-trade-forex-with-100/

- https://admiralmarkets.sc/education/articles/forex-basics/forex-trading-how-much-money-do-you-need-to-start

- https://coinstatics.com/how-to-trade-forex-with-100/

- https://www.fpmarkets.com/education/forex-trading/much-money-need-to-trade-forex/

- https://www.dumblittleman.com/how-to-trade-forex-with-100/

Leave a Review