US30, also known as the Dow Jones Industrial Average (DJIA), is one of the most widely recognized stock market indices in the world. It is a collection of 30 major American companies and is often used as a benchmark to gauge the performance of the US economy.

The Dow Jones Industrial Average was first created in 1896 by Charles Dow, the co-founder of Dow Jones & Company [1]. The original purpose of the index was to provide a snapshot of the US economy by tracking the performance of major industrial companies. Since then, the index has evolved to include companies from a variety of industries, including technology, finance, and healthcare.

In this article, we will explore US30 in more detail, examining how it is calculated, how forex traders use it, and what factors can influence its movements. We will also look at some of the other major indices used in forex trading and discuss their significance for traders looking to navigate the global financial markets.

What Is US30 In Forex?

In the world of forex trading, US30 refers to the value of the Dow Jones Industrial Average as it relates to currency pairs. Forex traders use this index to speculate on the direction of the US economy and to make profitable trades based on their predictions.

Today, the Dow Jones Industrial Average is one of the most closely watched indices in the world, with investors and traders alike keeping a close eye on its movements. As the index rises or falls, it can have a significant impact on the US dollar and other major currencies. Forex traders often use technical analysis and charting tools to study the movements of the US30 index and to identify trends that can help them make profitable trades.

Despite its popularity, US30 is just one of many indices used by forex traders to analyze market trends and make informed trading decisions. Other popular indices include the S&P 500, the NASDAQ, and the FTSE 100 [2]. Each of these indices has its own unique characteristics and can provide valuable insights into the performance of different markets around the world.

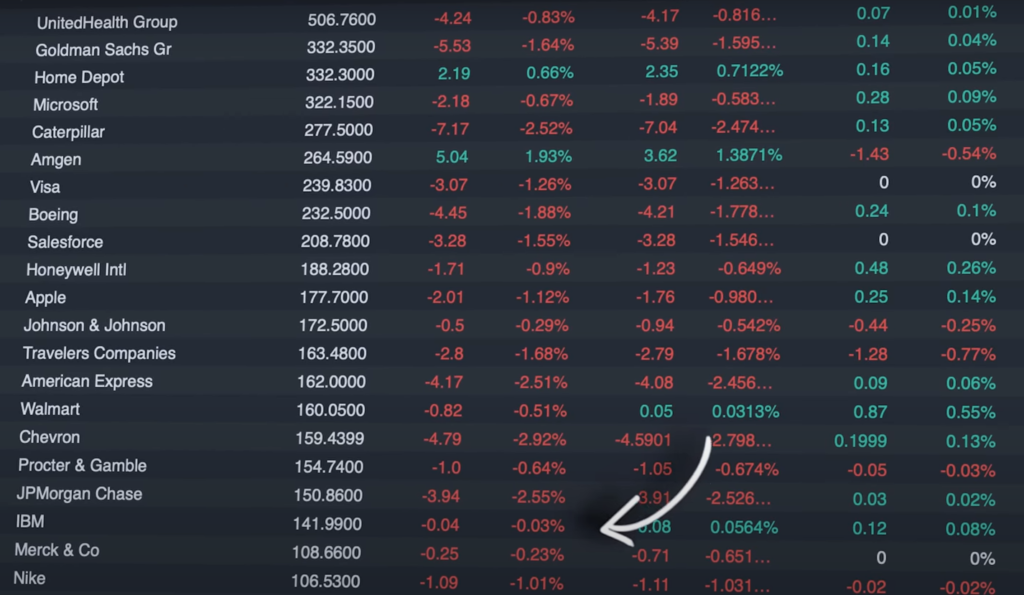

What Are the US30 Companies?

The companies included in the US30 are typically leaders in their respective industries, with a long history of stability and consistent profitability. They are spread across a range of sectors, including technology, healthcare, finance, consumer goods, and energy.

US30 Historical Data

The US30 was first introduced in 1896 by Charles Dow, a financial journalist and founder of The Wall Street Journal. The original index included just 12 companies, and its purpose was to provide a snapshot of the overall health of the US economy.

Over time, the US30 has undergone several changes and revisions, with new companies being added and others being removed. Today, the index includes 30 of the largest and most influential companies in the US, making it a key indicator of the strength of the American economy.

Over the years, the US30 has seen its fair share of market fluctuations and volatility. During the Great Depression of the 1930s, the index lost more than 80% of its value, while in the 2008 financial crisis, it dropped by more than 50%.

Despite these challenges, however, the US30 has always managed to bounce back and recover, reflecting the resilience of the US economy and its ability to weather even the toughest economic storms.

Price Drivers and Indicators For the US30

There are several key drivers and indicators that can influence the price of the US30, including:

1) Economic Data

One of the biggest drivers of the US30 is economic data, such as GDP growth, inflation rates, and employment figures. Positive economic news can cause the index to rise, as investors become more optimistic about the health of the US economy and the prospects for future growth.

Conversely, negative economic news can cause the US30 to fall, as investors become more cautious and risk-averse.

2) Company Earnings Reports

Another important factor that can influence the price of the US30 is the earnings reports of the individual companies included in the index. Strong earnings reports can drive up the price of the US30, as investors become more confident in the future prospects of these companies and the index as a whole.

Conversely, weak earnings reports can cause the US30 to fall, as investors become more concerned about the long-term viability and profitability of these companies.

3) Geopolitical Events

Geopolitical events, such as wars, political instability, and natural disasters, can also have a significant impact on the price of the US30. These events can create uncertainty and volatility in the markets, causing investors to become more risk-averse and leading to a drop in the price of the US30.

4) Interest Rates

Changes in interest rates can also have a significant impact on the price of the US30. When interest rates are low, investors tend to be more willing to take on risk and invest in stocks, driving up the price of the US30. Conversely, when interest rates are high, investors tend to be more risk-averse and may pull their money out of the stock market, leading to a drop in the price of the US30.

5) Technical Analysis

Finally, technical analysis can also be used to identify trends and patterns in the price of the US30. This involves using charts and other technical indicators to analyze historical price and volume data in order to predict future price movements.

Traders who use technical analysis may look for patterns such as support and resistance levels, moving averages, and chart patterns in order to make buy and sell decisions.

Why Should You Trade the Dow 30:

Diversification

One of the primary benefits of trading the Dow 30 is that it provides exposure to a wide range of companies across multiple industries. This can help to diversify a trader’s portfolio, reducing their overall risk and potentially increasing their long-term returns.

High Liquidity

The Dow 30 is one of the most heavily traded indices in the world, with high levels of liquidity and trading volume. This means that traders can easily enter and exit positions in the index, without having to worry about liquidity issues or slippage.

Predictability

Because the Dow 30 is composed of large, established companies with a long history of stable performance, it tends to be less volatile and more predictable than other indices. This can make it a good choice for traders who are looking for a less risky, more stable investment opportunity.

Access to Professional Research

Many brokerage firms and financial institutions provide access to professional research and analysis on the Dow 30, which can help traders make more informed investment decisions. This can include insights into economic data, earnings reports, and other factors that can impact the price of the index.

Potential for High Returns

Despite its stability, the Dow 30 has still seen significant gains over the years, with an average annual return of around 5-7% over the past century. For traders who are willing to hold positions over the long term, this can provide the potential for high returns and long-term growth.

How Much Do You Need To Trade US30 Forex?

Trading US30 Forex requires a certain amount of capital to start with. The amount you need depends on the broker you use and the leverage you choose. Some brokers may require a minimum deposit of $ 100, while others may require several thousand dollars.

When trading US30 Forex, it is important to remember that leverage can amplify both profits and losses.

For example, if you have a trading account with a balance of $ 1,000 and you use 1:100 leverage, you can open a position worth $ 100,000. This means that a 1% change in the price of US30 would result in a $ 1,000 profit or loss.

In general, it is recommended that traders have at least $ 1,000 in their trading account when trading US30 Forex. However, this amount can vary depending on your trading style, risk tolerance, and financial goals.

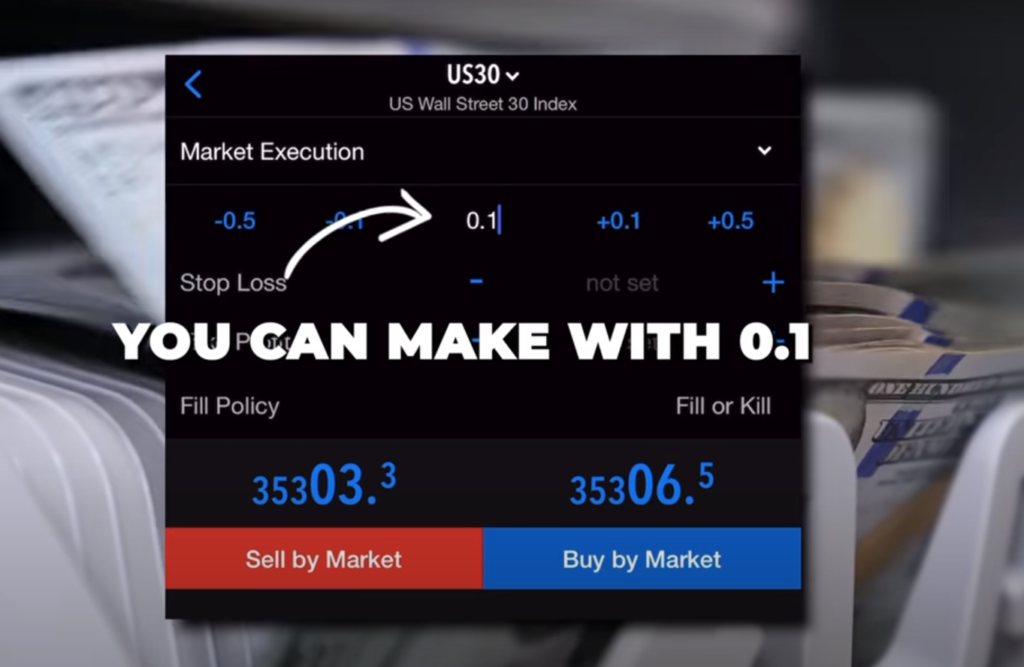

What Is US30 on MT4?

US30 on MT4 refers to the Dow Jones Industrial Average (DJIA) index, which is a stock market index that tracks the performance of 30 large and well-established companies in the United States. It is one of the most widely followed stock market indices in the world and is often used as a benchmark for the overall health of the US economy.

On MT4, US30 is typically listed as “US30” or “Dow Jones Industrial Average”. Traders can use MT4 to analyze historical price data, place trades, and manage their positions in US30 Forex.

Can I Trade US30 Anytime?

US30 Forex is a 24-hour market, which means that traders can technically trade the index anytime the market is open. However, it is important to remember that trading volumes and volatility can vary depending on the time of day.

Outside of the US trading session, trading volumes may be lower and the market may be less volatile. Traders who choose to trade outside of the US trading session should be aware of these potential limitations and adjust their trading strategy accordingly.

How to Count Pips on US30:

When trading US30 Forex, pips are used to measure price movement. One pip is equal to 0.01% of the price of the index.

To calculate the value of one pip on US30 Forex, you first need to determine the pip value. This is calculated by multiplying the position size (in lots) by the pip value (which is determined by the currency in which your trading account is denominated).

For example, if you have a trading account denominated in USD and you open a position of 1 lot on US30 Forex, the pip value would be $ 0.10. This is calculated as follows [5]:

1 lot * 0.01 (pip value) * $ 10 (tick size of US30) = $ 0.10

To calculate the profit or loss on your trade, you would then multiply the number of pips gained or lost by the pip value. For example, if you opened a long position on US30 Forex at 34,000 and closed it at 34,500, you would have gained 500 pips. If the pip value is $ 0.10, then your profit would be $ 50.

What Is One Pip Change in US30?

For example, if the US30 index is currently trading at 34,000 and it increases to 34,001, this would represent a one-point movement. If you have a position of 1 lot on US30 Forex, this would represent a $ 10 change in the value of your position.

It is important to note that the value of one pip in US30 Forex can vary depending on the currency in which your trading account is denominated. For example, if your trading account is denominated in EUR, the pip value for US30 Forex would be calculated based on the EUR/USD exchange rate.

How Many Pips Does US30 Move Daily?

However, it is important to note that US30 is a highly liquid market, and it can experience significant price movements in a short amount of time. For example, during periods of high volatility or major economic news releases, US30 may move several hundred pips in just a few hours.

Traders who are interested in trading US30 Forex should be aware of the potential for significant price movements and should have a sound trading strategy in place that accounts for volatility and risk management. Additionally, traders should monitor economic calendars and other news sources in order to stay up-to-date on events that may impact the price of the index.

FAQ:

- How much money do you need to trade US30?

The amount of money needed to trade US30 depends on the trading platform and the specific account requirements of the broker. Some brokers may offer the ability to trade US30 with a minimum account balance of as little as $ 50, while others may require a minimum balance of several thousand dollars. Additionally, traders must take into account the cost of spreads, commissions, and other fees associated with trading US30.

- Is US30 difficult to trade?

As with any financial instrument, trading US30 comes with its own set of challenges and requires a solid understanding of market dynamics, technical analysis, and risk management. However, with the right education, tools, and strategies, trading US30 can be both rewarding and profitable.

- How much is 1.0 US30?

The value of 1.0 US30 varies depending on the current market price of the Dow Jones Industrial Average. US30 is a derivative of the Dow Jones Industrial Average, and its value is based on the performance of the 30 major American companies that make up the index.

- How much USD do I need to trade on US30?

The amount of USD required to trade on US30 depends on the leverage offered by the broker and the size of the position taken by the trader. With leverage of 1:100, for example, a trader could control a position of $ 10,000 with just $ 100 of their own capital.

- Does US30 use pips?

No, US30 is not typically traded in pips, which are a unit of measurement used in forex trading to calculate profit and loss. Instead, the value of US30 is typically measured in points, which represent a one-point movement in the Dow Jones Industrial Average.

- What time is US30 most volatile?

The US30 index can be volatile at various times throughout the trading day, but it is generally most active during the opening hours of the New York Stock Exchange (NYSE) from 9:30 am to 4:00 pm EST.

- What is the minimum lot size to trade US30?

The minimum lot size to trade US30 depends on the specific account requirements of the broker. Some brokers may offer micro-lot sizes, which allow traders to open positions with smaller amounts of capital.

- Is US30 bullish or bearish?

The direction of the US30 index can be either bullish or bearish, depending on the current market conditions and sentiment. When the index is rising, it is said to be in a bullish trend, while a falling index indicates a bearish trend.

- Which broker has US30?

Many online brokers offer US30 trading, including well-known names such as eToro, Plus500, and IG.

- Can I trade US30 for 50 dollars?

Some brokers may offer the ability to trade US30 with a minimum account balance of as little as $ 50, but traders must also take into account the cost of spreads, commissions, and other fees associated with trading.

- What is US30 vs. NAS100?

US30 and NAS100 are both stock market indices used to track the performance of major American companies, but they represent different sets of companies. US30 is composed of 30 blue-chip companies, while NAS100 is composed of the 100 largest non-financial companies listed on the NASDAQ stock exchange.

- Why is it called US30?

US30 is another name for the Dow Jones Industrial Average, which was created by Charles Dow in 1896. The index was originally composed of 12 major industrial companies but has since expanded to include 30 companies from a variety of industries.

- How do I invest in US30?

Investors can invest in the US30 index by purchasing shares of exchange-traded funds (ETFs) or mutual funds that track the performance of the index. Additionally, some brokers may offer the ability to trade US30 through derivatives such as contracts for difference (CFDs) [7].

- What is the symbol for US30?

The symbol for US30 is typical “DJIA” or “Dow Jones Industrial Average”, although some brokers may use different symbols.

- Is NASDAQ called US100?

NASDAQ is a stock exchange that lists over 3,000 companies, including the 100 largest non-financial companies that make up the NASDAQ-100 index [8]. While the NASDAQ-100 index is sometimes referred to as the “US100”, it is not synonymous with the US30 index.

- Is US30 the same as Wall Street?

US30 is a stock market index that tracks the performance of 30 major American companies, while Wall Street is a physical street in lower Manhattan that is home to the New York Stock Exchange (NYSE) and several other financial institutions.

- What is the US30 9/30 strategy?

The US30 9/30 strategy is a trading strategy that involves buying or selling the US30 index when it crosses above or below its 9-period and 30-period moving averages. The strategy is based on the idea that these moving averages can help identify trends in the market.

- Can you trade US30 on weekends?

Most brokers do not allow trading on US30 or any other financial instruments on weekends, as the markets are typically closed.

- How much is 1 pip in NASDAQ?

NASDAQ is not typically traded in pips, which are a unit of measurement used in forex trading to calculate profit and loss. Instead, the value of the NASDAQ is typically measured in points, which represent a one-point movement in the NASDAQ-100 index.

- What to trade at night?

Traders looking for opportunities to trade at night may consider trading on markets in other time zones, such as the Asian or European markets. Additionally, some brokers may offer after-hours trading on certain instruments, although liquidity and volatility may be lower during these times.

- Why is US30 better than Forex?

US30 and forex trading are two different asset classes with different risks and opportunities. While US30 may offer exposure to the performance of major American companies, forex trading offers the ability to trade currencies from around the world. Whether one asset class is “better” than the other depends on an individual trader’s goals, preferences, and risk tolerance.

- Can you trade US30 all day?

US30 can be traded during the hours that the underlying market is open, which is typically from 9:30 am to 4:00 pm EST. Some brokers may offer extended trading hours, but liquidity and volatility may be lower during these times.

Useful Video: What is the US30?

References:

- https://www.alphaexcapital.com/what-is-us30-in-forex/

- https://www.quora.com/What-is-US30-in-Forex

- https://www.instatrade.com/blog/13-what-is-us30-in-forex

- https://www.eightcap.com/en/trading/instruments/indices/us30/

- https://www.dailyforex.com/forex-articles/us30/188441

- https://www.fxtradingrevolution.com/forex-blog/how-to-trade-us30-basics-about-the-dow-jones-industrial-average-index

- https://www.forex.in.rs/how-many-pips-does-us30-move-daily/

- https://pepperstone.com/en/trading/instruments/index-cfds/us-30

Leave a Review