Foreign exchange trading, commonly known as forex, is a decentralized market that allows traders to buy, sell, and exchange currencies. It is the largest financial market in the world, with an average daily turnover of over $ 6 trillion. Forex trading involves speculating on the movement of currency prices, with the aim of making a profit. One of the fundamental concepts in forex trading is a lot, which refers to the standard unit size of a transaction. Understanding lots is crucial in forex trading, as it determines the amount of currency that can be traded and the potential profit or loss of a trade.

In conclusion, lots are a critical concept in forex trading. They represent the volume of currency being traded and determine the potential profit or loss of a trade. Traders must understand the different lot sizes and how they impact their risk and reward. By mastering lots, traders can develop effective risk management strategies and improve their chances of success in the forex market.

What Is A Lot In Forex?

In forex trading, lots are used to standardize the size of a transaction. A lot is a unit of measure that indicates the volume of currency being traded. A regular-sized lot amounts to 100,000 pieces of the first currency stated in a currency couple [1].

For example, when it comes to EUR/USD pairings, the euro is the base money so a standard lot would signify 100,000 euros. Alternatively, you can opt for mini lots which are worth 10,000 units of the base payment, or micro lots which represent 1,000 units of the primary currency.

Understanding lots is important for forex traders, as it impacts the amount of money they are risking in a trade.

For example, if a trader buys one standard lot of EUR/USD at 1.2000 and sells it at 1.2050, they have made a profit of $ 500 (50 pips x $ 10 per pip). However, if they had bought 10 standard lots of EUR/USD, their profit would have been $ 5,000, but their potential loss would also have been ten times higher.

What Is The Purpose Of Lot Size?

The standard lot size in forex trading is 100,000 units of the base currency, which is the first currency in a currency pair [2].

For example, in the EUR/USD pair, the base currency is the euro. Thus, a standard lot in EUR/USD represents 100,000 euros. Traders can also trade in mini lots, which represent 10,000 units of the base currency, or micro lots, which represent 1,000 units of the base currency.

Forex Lot Sizes Explained:

What Is A Standard Lot In Forex?

A standard lot is the go-to traded quantity in forex trading, worth a total of 100,000 units of whatever base currency you are using.

Generally speaking, the first listed currency in any given pair acts as the base — such as EUR/USD with the euro being your foundation and the US dollar its quote partner.

A standard lot size of 100,000 units means that if a trader wants to buy the EUR/USD currency pair, they would need to invest $ 100,000. If the trader’s account has a leverage ratio of 1:100, they would only need to put up $ 1,000 to control the full position.

Standard lots are used by experienced traders who have a significant amount of capital to invest in the forex market. It is also suitable for traders who are confident in their trading strategies and have a high risk tolerance.

One of the advantages of trading with standard lots is that the profit potential is higher than trading with smaller lot sizes. However, the risk is also higher, and a trader can easily lose a significant amount of money if the trade goes against them.

What Is A Mini Lot In Forex?

A mini lot is one-tenth the size of a standard lot, and it is equivalent to 10,000 units of the base currency [3].

Using the EUR/USD currency pair as an example, if a trader wants to buy one mini lot, they would need to invest $ 10,000. The margin requirement for a mini lot is also lower than a standard lot, which means that a trader can control a larger position with less capital.

Mini lots are ideal for traders who are new to forex trading and want to minimize their risk exposure. It is also suitable for traders who have a smaller trading account and want to trade with smaller positions. Mini lots allow traders to test their trading strategies without risking too much capital.

One of the disadvantages of trading with mini lots is that the profit potential is lower than trading with standard lots. However, the risk is also lower, and a trader can manage their risk exposure better.

What Is A Micro Lot In Forex?

A micro lot is one-tenth the size of a mini lot, and it is equivalent to 1,000 units of the base currency.

Using the EUR/USD currency pair as an example, if a trader wants to buy one micro lot, they would need to invest $ 1,000. The margin requirement for a micro lot is also lower than a mini lot, which means that a trader can control a larger position with even less capital.

Micro lots are ideal for traders who have very small trading accounts and want to trade with very small positions. It is also suitable for traders who want to test their trading strategies without risking too much capital.

One of the disadvantages of trading with micro lots is that the profit potential is even lower than trading with mini lots. However, the risk is also lower, and a trader can manage their risk exposure even better.

What Is A Nano Lot In Forex?

Nano lots are ideal for traders who want to test their trading strategies with minimal risk exposure. It is also suitable for traders who have very small trading accounts and want to trade with very small positions.

One of the disadvantages of trading with nano lots is that the profit potential is the lowest of all lot sizes. However, the risk is also the lowest, and a trader can manage their risk exposure very well.

How To Calculate Lot Size In Forex:

Forex trading involves buying and selling different currencies with the aim of making a profit. One of the essential aspects of forex trading is calculating the lot size. Lot size determines the amount of money a trader invests in a trade and manages the risk exposure.

1) For Direct Currency Quotes

Direct currency quotes refer to currency pairs where the US dollar is the quote currency. Examples of direct currency quotes include EUR/USD, GBP/USD, and AUD/USD.

The formula for calculating lot size for direct currency quotes is straightforward:

Lot size = (Margin * Percentage of Margin) / Pip Value

Margin refers to the amount of money a trader needs to invest in a trade to open a position. The percentage of Margin is the percentage of the account balance that a trader wants to risk in a trade. Pip value is the value of a pip, which is the smallest unit of measurement in forex trading.

To calculate the pip value for direct currency quotes, we use the following formula:

Pip value = (0.0001 / Exchange rate) * Lot size

To put into practice how to compute the ideal lot size for direct currency quotes, let’s consider this example: a trader has $ 10,000 in their trading account and aims to trade EUR/USD. The risk they would like to take is 2% of their total balance; additionally, the present exchange rate stands at 1.2000 [4].

First, we need to calculate the margin:

- Margin = Account balance * Percentage of Margin

- Margin = $ 10,000 * 0.02

- Margin = $ 200

Next, we need to calculate the pip value:

Pip value = (0.0001 / 1.2000) * Lot size

Suppose the trader wants to trade one lot. The pip value will be:

- Pip value = (0.0001 / 1.2000) * 1

- Pip value = 0.00008333

Finally, we can calculate the lot size:

- Lot size = (Margin * Percentage of Margin) / Pip Value

- Lot size = ($ 200 * 0.02) / 0.00008333

- Lot size = 4.8 lots

2) For Cross Rates

The formula for calculating lot size for cross rates is:

Lot size = (Margin * Percentage of Margin) / (Pip Value * Exchange rate)

To calculate the pip value for cross rates, we use the following formula:

Pip value = (0.0001 / Exchange rate) * Lot size * Quote currency exchange rate

The quote currency exchange rate is the exchange rate of the quote currency to the US dollar. For example, if we are trading the EUR/GBP currency pair, and the exchange rate is 0.8500, the quoted currency exchange rate is 1/0.8500 = 1.1765.

Let’s use an example to illustrate how to calculate lot size for cross rates. Suppose a trader has a trading account with a balance of $ 10,000 and wants to trade the EUR/GBP currency pair. The trader wants to risk 2% of their account balance in the trade, and the current exchange rate is 0.8500 [5].

First, we need to calculate the margin:

- Margin = Account balance * Percentage of Margin

- Margin = $ 10,000 * 0.02

- Margin = $ 200

Next, we need to calculate the pip value:

Pip value = (0.0001 / 0.8500) * Lot size * Quote currency exchange rate

Suppose the trader wants to trade one lot. The pip value will be:

- Pip value = (0.0001 / 0.8500) * 1 * 1.1765

- Pip value = 0.00013843

Finally, we can calculate the lot size:

- Lot size = (Margin * Percentage of Margin) / (Pip Value * Exchange rate)

- Lot size = ($ 200 * 0.02) / (0.00013843 * 0.8500)

- Lot size = 2.94 lots

Example of Lot Size Calculation in Forex

Let’s use another example to illustrate how to calculate lot size in Forex. Suppose a trader has a trading account with a balance of $ 5,000 and wants to trade the USD/JPY currency pair. The trader wants to risk 1% of their account balance in the trade, and the current exchange rate is 110.50.

First, we need to calculate the margin:

- Margin = Account balance * Percentage of Margin

- Margin = $ 5,000 * 0.01

- Margin = $ 50

Next, we need to calculate the pip value:

Pip value = (0.01 / 110.50) * Lot size

Suppose the trader wants to trade one mini lot (0.1 lots). The pip value will be:

- Pip value = (0.01 / 110.50) * 0.1

- Pip value = 0.00000904

Finally, we can calculate the lot size:

- Lot size = (Margin * Percentage of Margin) / Pip Value

- Lot size = ($ 50 * 0.01) / 0.00000904

- Lot size = 552.65 nano lots

How To Choose Lot Size In Forex?

Choosing the right lot size is an essential aspect of forex trading. Traders need to consider their risk tolerance, trading experience, and account size when selecting a lot size.

Experienced traders with a significant amount of capital can consider trading with standard lots. This lot size offers high profit potential but also comes with high-risk exposure. Traders must have a solid trading strategy and risk management plan in place when trading with standard lots [6].

New traders with smaller trading accounts can consider trading with mini or micro lots. These lot sizes offer lower risk exposure and allow traders to test their trading strategies without risking too much capital. Traders must have a good understanding of their trading strategies and risk management plans when trading with mini or micro lots.

Traders with very small trading accounts can consider trading with nano lots. This lot size offers the lowest risk exposure and is ideal for testing trading strategies with minimal capital. Traders must have a clear understanding of their trading strategy and risk management plan when trading with nano lots.

What Is The Connection Between Lot, Point, And Leverage?

In the world of forex trading, lot, point, and leverage are interconnected concepts. The lot size refers to the size of a position in forex trading. A point is a unit of measurement that represents the change in the price of a currency pair. Leverage is the amount of money a trader can borrow from a broker to open a larger position.

Leverage amplifies the trader’s purchasing power, allowing them to open a larger position than their account balance.

For example, a trader with $ 1,000 in their account and a leverage of 1:100 can open a position worth $ 100,000. This is because the broker provides the trader with $ 99,000 in borrowed funds.

What Determines The Lot Size In Forex?

The lot size in forex is determined by the trader’s account balance, risk tolerance, and leverage. A trader’s account balance and risk tolerance will determine the amount of money they are willing to invest in a trade. Leverage will determine the size of the position that the trader can open with their account balance.

The lot size should be chosen based on the trader’s risk management strategy. A larger lot size will result in higher profits or losses, depending on the price movement of the currency pair. However, a larger lot size also means a higher risk exposure. Traders must assess their risk tolerance and only invest the amount they can afford to lose.

How Does Equity Change Depending On The Lot Size?

If a trader opens a position with a lot size of 0.1 and the price of the currency pair moves in their favor by 50 pips, they will earn a profit of $ 50 (assuming a pip value of $ 1). If the same trade is opened with a lot size of 1, the profit will be $ 500. Similarly, if the price moves against the trader, the losses will be higher with a larger lot size.

It is important to note that equity can also be affected by other factors, such as trading fees, slippage, and margin requirements. Traders must take these factors into account when calculating their potential profits or losses.

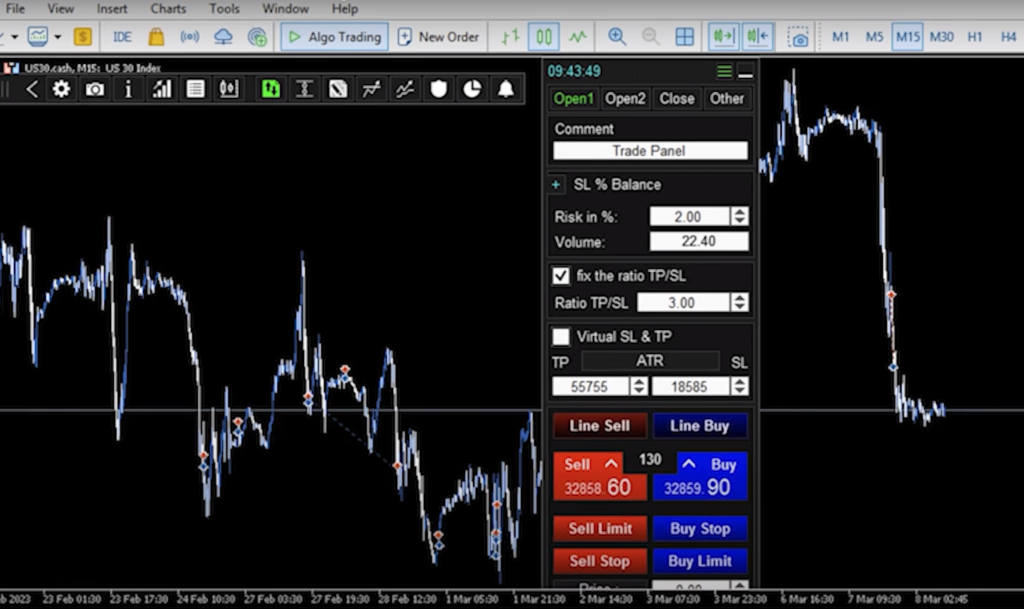

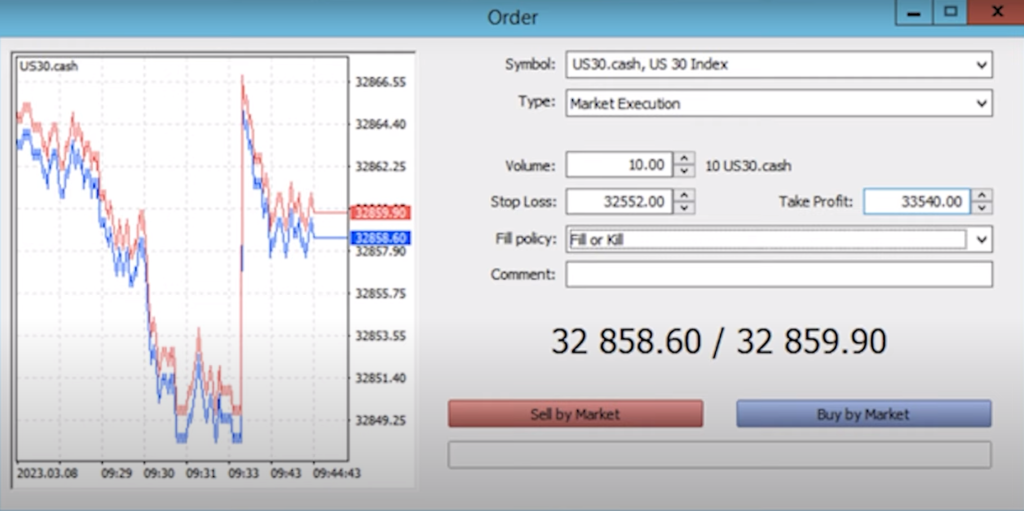

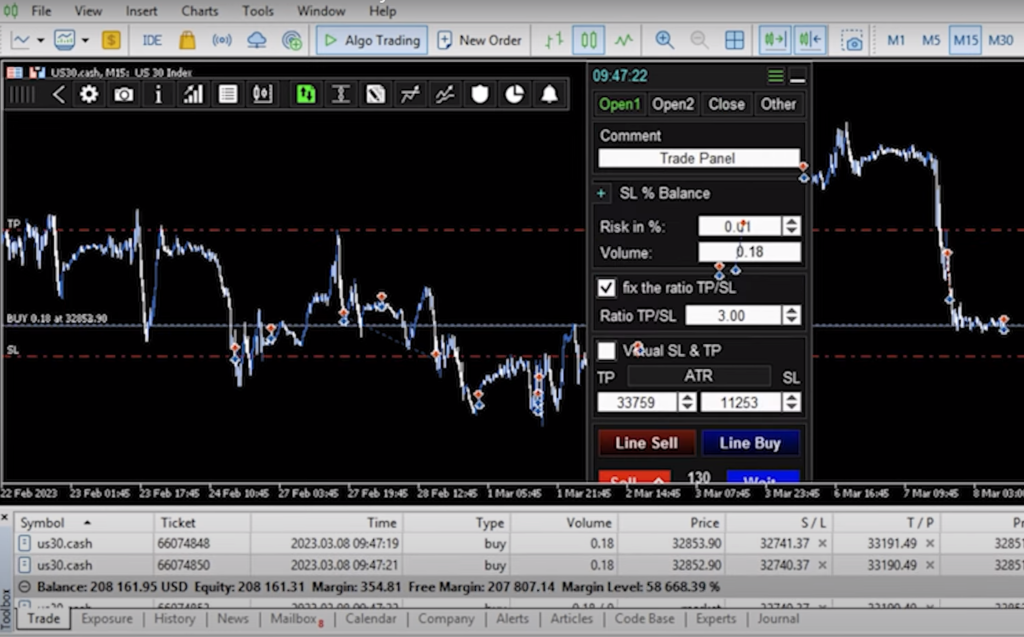

How To Set The Lot Size In MT4?

MT4 (MetaTrader 4) is a popular trading platform used by many forex traders. To set the lot size in MT4, follow these steps [7]:

- Open the order window by clicking on the “New Order” button or pressing F9;

- Choose the currency pair you want to trade and select “Market Execution” or “Pending Order” depending on your trading strategy;

- Enter the lot size you want to trade in the “Volume” field. You can choose from standard, mini, or micro lots, or enter a custom lot size;

- Set your stop loss and take profit levels, and adjust the order type and duration if necessary;

- Click on the “Buy” or “Sell” button to open the position;

It is important to double-check the lot size and other order details before clicking the “Buy” or “Sell” button. Traders should also monitor their open positions and adjust their lot size and risk management strategy as necessary.

FAQ:

- How big is 1 lot in Forex?

In Forex trading, 1 lot is the standard unit of measurement used to represent the volume of a particular currency pair traded. The size of 1 lot is equal to 100,000 units of the base currency. For example, if you are trading the EUR/USD currency pair, 1 lot would be 100,000 euros.

- What does 0.01 lot size mean?

0.01 lot size, also known as a micro lot, is one-hundredth of a standard lot. It means that the volume of currency being traded is 1,000 units of the base currency. For example, if you are trading the EUR/USD currency pair and you open a position with a 0.01 lot size, you are trading 1,000 euros [8].

- What are 5 lots in Forex?

5 lots in Forex is equivalent to 500,000 units of the base currency being traded. For example, if you are trading the EUR/USD currency pair and you open a position with a 5-lot size, you are trading 500,000 euros.

- What does 1.00 lot size mean?

1.00 lot size, also known as a standard lot, is the standard unit of measurement used to represent the volume of a particular currency pair traded. It means that the volume of currency being traded is 100,000 units of the base currency.

- How much is 1 lot of EUR/USD?

The value of 1 lot of EUR/USD depends on the current exchange rate. If the current exchange rate is 1.2000, then 1 lot of EUR/USD would be worth 100,000 x 1.2000 = 120,000 US dollars.

- What lot size is good for a $ 50 Forex account?

It is generally not recommended to trade with a $ 50 Forex account as it is too small to withstand potential losses. However, if you decide to trade with a $ 50 account, a lot size of 0.01 or 0.02 would be appropriate to minimize your risk.

- What lot size for a $ 1,000 account?

With a $ 1,000 Forex account, a lot size of 0.10 or 0.20 would be appropriate. This will allow you to take advantage of potential profits while still managing your risk appropriately.

- How many pips is a lot?

The number of pips in a lot depends on the currency pair being traded and the exchange rate. In general, a lot size of 1 will result in a profit or loss of 10 pips for each pip movement in the exchange rate.

- How much are 0.10 pips?

Pips are a unit of measurement for currency fluctuations, and they are generally measured to four decimal places. Therefore, 0.10 pips would be equivalent to 0.0010 in currency value.

- What lot size is good for a $ 200 Forex account?

A $ 200 Forex account is considered small, and it is recommended to trade with a lot size of 0.01 or 0.02 to minimize risk.

- What is the best lot size for $ 500?

With a $ 500 Forex account, a lot size of 0.05 or 0.10 would be appropriate. This will allow you to take advantage of potential profits while still managing your risk appropriately.

- How much are 1000 lots in Forex?

1000 lots in Forex is equivalent to 100,000,000 units of the base currency being traded. This is a large trade and is typically not made by retail traders.

- How many lots can I trade with $ 10,000?

The number of lots that can be traded with $ 10,000 will depend on the lot size and the currency pair being traded. For example, if you are trading the EUR/USD currency pair with a standard lot size of 1.00, you would be able to trade 10 lots with $ 10,000.

- How much is 1 lot in Forex gold?

The value of 1 lot in Forex gold depends on the current market price of gold. For example, if the market price of gold is $ 1,800 per ounce, 1 lot of gold (which is equivalent to 100 ounces) would be worth $ 180,000 [9].

- What is a decent lot size?

The lot size that is considered “decent” will depend on the individual trader’s risk tolerance and account size. Generally, a lot size of 0.01 to 0.10 is considered reasonable for most retail traders.

- What is a normal lot size?

The normal lot size in Forex is 1.00, which is equivalent to 100,000 units of the base currency being traded.

- Does lot size affect the price?

Lot size does not directly affect the price of a currency pair, but it does affect the potential profit or loss that can be made from a trade.

- What lot size should I use for a 100k account?

With a 100k account, a lot size of 1.00 or lower would be appropriate. This will allow you to take advantage of potential profits while still managing your risk appropriately.

- How much money do I need for a 1.00 lot size?

The amount of money needed for a 1.00 lot size trade will depend on the currency pair being traded and the current exchange rate. For example, if the exchange rate for EUR/USD is 1.2000, you would need $ 120,000 to open a 1.00 lot size trade.

- How much is 1000 lot in USD?

The value of 1000 lots in USD will depend on the currency pair being traded and the current exchange rate. For example, if the exchange rate for EUR/USD is 1.2000, 1000 lots of EUR/USD would be worth $ 120,000,000.

- How do I calculate my lot size?

To calculate your lot size, you will need to consider your account balance, risk tolerance, and the currency pair being traded. You can use a lot size calculator to help you determine the appropriate lot size for your trade based on these factors.

Useful Video: What is a Lot in Forex?

References:

- https://www.ig.com/en/trading-strategies/what-is-a-lot-in-forex-and-how-do-you-calculate-the-lot-size–210312

- https://www.babypips.com/learn/forex/lots-leverage-and-profit-and-loss

- https://www.investopedia.com/terms/s/standard-lot.asp

- https://howtotrade.com/courses/introduction-to-forex-trading/what-is-a-lot-in-forex/

- https://fbs.com/analytics/guidebooks/what-are-pips-and-lots-17

- https://www.litefinance.org/blog/for-beginners/how-to-calculate-a-lot-on-forex/

- https://www.dailyforex.com/forex-articles/what-is-lot-size-in-forex-trading/188453

- https://www.tradingwithrayner.com/course/5-what-is-a-forex-lot-size/

- https://www.fullertonmarkets.com/blog/what-is-a-lot-in-forex-trading

Leave a Review