In the world of financial trading, there are various markets available for investors and traders to choose from. Two of the most popular options are Forex and stocks.

Forex, short for foreign exchange, is the global decentralized market for trading currencies, while stocks refer to the buying and selling of shares of ownership in publicly traded companies.

Both Forex and stocks offer opportunities for profit, but there are important differences between the two markets that should be taken into consideration when deciding which one to trade [1].

In this article, we will explore the question of whether Forex or stocks are more profitable, as well as other related questions such as which type of trading is the most profitable, which type of trading gives the highest return, and why people may prefer Forex trading over stocks.

We will also examine some of the challenges and risks associated with both markets and offer tips and strategies for successful trading. By the end of this article, readers should have a better understanding of the pros and cons of Forex and stock trading, and be better equipped to make informed decisions about which market is right for them.

What is Forex?

Forex, or foreign exchange, refers to the market where currencies are traded. It is the largest and most liquid financial market in the world, with an average daily turnover of over $ 6 trillion.

What are Stocks?

Stocks, on the other hand, refer to shares of ownership in a company. When investors buy a share of a company, they are essentially buying a piece of the company and become shareholders. The value of a company’s shares is influenced by a range of factors, including its financial performance, market trends, and global events.

Pros And Cons Of Being A Forex Trader

Forex trading can be an attractive option for many traders due to the potential for high returns, flexible trading hours, and low transaction costs. However, like any investment, there are also risks involved.

Pros:

- High potential for returns: Forex trading offers the potential for high returns, with traders able to take advantage of leverage to increase their buying power and potentially earn significant profits;

- Flexible trading hours: Forex trading is open 24 hours a day, five days a week, which allows traders to choose when to trade based on their schedule;

- Low transaction costs: Compared to other financial markets, the Forex market has relatively low transaction costs, making it an attractive option for traders;

Cons:

- High risk: The potential for high returns in Forex trading also comes with a high level of risk. Traders can quickly lose money if they make the wrong trading decisions or fail to manage their risks effectively;

- Complex market: The Forex market is complex and constantly changing, which can make it challenging for traders to stay up-to-date with market trends and make informed trading decisions;

- High volatility: The Forex market is highly volatile, with exchange rates fluctuating rapidly and often unpredictably. This can lead to significant losses for traders who are not prepared to manage their risks effectively [3];

Pros And Cons Of Being A Stock Trader

Stock trading offers investors the opportunity to own a piece of a company and potentially earn profits through the appreciation of the company’s shares. However, like Forex trading, there are risks involved.

Pros:

- Potential for high returns: Stock trading offers the potential for high returns, with investors able to profit from the appreciation of a company’s shares over time;

- Ownership in a company: When investors buy shares of a company, they become shareholders and have a say in the company’s decisions through voting rights;

- Diversification: Stock trading allows investors to diversify their portfolio by investing in a range of companies and sectors;

Cons:

- High risk: The potential for high returns in stock trading also comes with a high level of risk, with investors at risk of losing their investment if the company’s shares decrease in value;

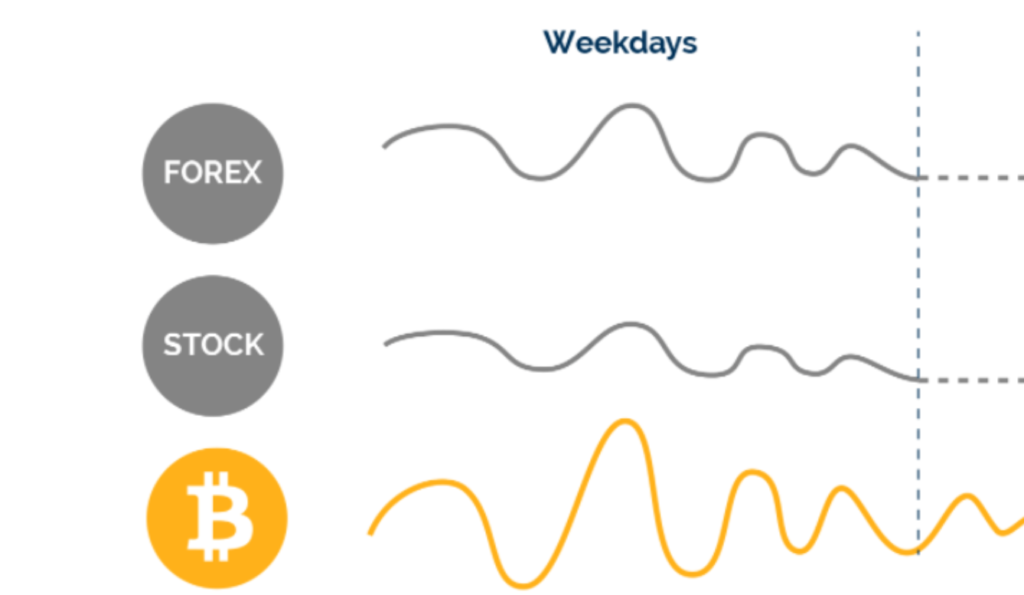

- Limited trading hours: Stock trading is only open during specific trading hours, which can make it difficult for investors to take advantage of market movements;

- High transaction costs: Compared to Forex trading, stock trading has relatively high transaction costs, including commissions, fees, and taxes;

Correlations And Divergences Between Forex and Stocks

While Forex and stock trading are two separate markets, they are often closely linked, with factors affecting one market having an impact on the other.

Here are some of the key correlations and divergences between Forex and stocks:

1) Correlations:

- Economic Factors: Economic indicators such as interest rates, inflation, and GDP can have a significant impact on both the Forex and stock markets. For example, if a country’s interest rates rise, its currency is likely to appreciate, and its stock market may experience a boost;

- Political Factors: Political events such as elections, wars, and trade deals can also have an impact on both the Forex and stock markets. For example, political instability can lead to uncertainty and market volatility, which can affect both markets;

- Investor Sentiment: The sentiment of investors in one market can also spill over into the other. For example, if investors are optimistic about the stock market, they may also be bullish on the currency of the country where the stocks are traded;

2) Divergences:

- Trading Hours: While the Forex market is open 24 hours a day, the stock market has set trading hours, which can lead to divergences in trading activity and market movements;

- Trading Strategies: Traders in the Forex and stock markets may have different trading strategies and risk management techniques, leading to divergences in market movements and volatility;

- Market Structure: The Forex and stock markets have different market structures, with the Forex market being decentralized and over-the-counter, while the stock market is centralized and exchange-based. This can lead to divergences in market movements and liquidity [4];

Similarities Between Forex and Stocks Trading

Forex and stock trading systems share many similarities. Here are some of the key similarities between these two markets:

- High-Risk, High-Reward: Both Forex and stock trading options are high-risk, high-reward investments. Traders can make substantial profits, but they can also lose significant amounts of money;

- Fundamental Analysis: Both Forex and stocks trading require traders to analyze fundamental factors such as economic indicators, political events, and investor sentiment;

- Technical Analysis: Technical analysis is also an essential aspect of trading in both markets. Traders use charts, patterns, and indicators to identify trends and potential trading opportunities;

- Leverage: Both Forex and stock trading systems offer leverage, which allows traders to control larger positions with a smaller amount of capital. However, leverage also increases the risk of losses;

- Market Volatility: Both Forex and stock markets are volatile and subject to sudden market movements, which can result in substantial profits or losses;

- Brokerage and Trading Platforms: Both Forex and stock trading are conducted through brokerage firms that offer trading platforms and tools to help traders make informed trading decisions;

- Trading Psychology: Successful trading in both Forex and stocks markets requires traders to maintain discipline, control emotions, and manage risk effectively;

What’s the Difference Between Forex Trading and Stock Trading:

Leverage Limits

One of the key differences between forex trading and stock trading is the amount of leverage that is available.

On the one hand, higher leverage means that traders can potentially earn much larger profits than they would be able to with stock trading. On the other hand, higher leverage also means that traders can potentially lose much more money than they would be able to with stock trading.

Stock trading, on the other hand, typically offers lower leverage limits than forex trading. While some brokers may offer leverage of up to 5:1 or 10:1, most brokers will offer leverage of around 2:1 or 3:1. This means that traders will need to invest more capital to control the same amount of shares as they would be able to with forex trading [5].

It is important to note that leverage can be a double-edged sword. While it can amplify profits, it can also amplify losses. It is important for traders to use leverage responsibly and to be aware of the risks involved.

Liquidity

Another major difference between forex trading and stock trading is liquidity. Forex markets are the largest financial markets in the world, with an average daily trading volume of over $ 6 trillion. This means that forex markets are highly liquid, with plenty of buyers and sellers at any given time. As a result, traders can enter and exit trades quickly and easily, without worrying about price slippage.

Stock markets, on the other hand, can be less liquid, particularly for small-cap stocks or stocks that are less frequently traded. This can make it more difficult for traders to enter and exit positions at the desired price.

Trade Pairing

In Forex trading, traders buy and sell currency pairs, such as EUR/USD or USD/JPY. This means that when a trader buys one currency, they are simultaneously selling another currency. In stock trading, traders buy and sell individual stocks, such as Apple or Amazon.

Profit Potential

Forex trading and stock trading offer different profit potentials.

That being said, stock trading does offer the potential for significant long-term gains, particularly if traders can identify high-quality companies that are undervalued by the market.

Market Hours

Forex trading is a 24-hour market, with trading taking place around the clock from Monday to Friday. This means that traders can trade at any time of the day or night, depending on their schedule. Stock markets, on the other hand, are typically only open during regular business hours, which can make it more difficult for traders who have other commitments during the day.

Fees And Commission

Fees and commissions are another important consideration when comparing forex trading and stock trading. Both forms of trading typically involve paying some sort of fee or commission to the broker.

In forex trading, brokers typically make money by charging a spread, which is the difference between the bid and ask price of a currency pair. The spread can vary depending on market conditions and the broker’s fee structure, but it is generally lower than the commissions charged by stock brokers.

Stockbrokers, on the other hand, typically charge a commission for each trade, which can vary depending on the size of the trade and the broker’s fee structure. In addition, some brokers may charge additional fees for services such as account maintenance or data feeds.

Trading Platforms

The trading platforms used for forex trading and stock trading can also differ. Forex brokers typically offer their proprietary trading platforms, which are designed specifically for forex trading. These platforms may offer features such as advanced charting tools, real-time news feeds, and customizable trading algorithms.

Stockbrokers may offer a range of different trading platforms, including proprietary platforms, third-party platforms, and mobile apps. These platforms may offer features such as real-time market data, research reports, and trading algorithms.

Short-Term Trading

Short-term trading is another area where forex trading and stock trading can differ. Forex markets are highly liquid, which makes them well-suited for short-term trading strategies such as day trading or scalping. In these strategies, traders enter and exit trades quickly, often within a matter of seconds or minutes.

Stock markets can also be used for short-term trading strategies, but they may be less suited to this type of trading due to lower liquidity and greater volatility.

Which Is Easier To Trade?

Whether forex trading or stock trading is easier will depend on a variety of factors, including the trader’s experience, risk tolerance, and trading strategy. Forex trading can be more complex than stock trading due to the need to understand currency pairs and exchange rates, as well as the potential for high leverage and market volatility.

Stock trading, on the other hand, can be more straightforward for traders who are familiar with individual companies and the factors that can affect their stock prices.

The Cost Of Trading

Traders should also be aware of other costs associated with trading, such as overnight financing charges, currency conversion fees, and withdrawal fees. These costs can vary depending on the broker and the trading platform used.

Forex vs. Stocks. Which Is More Profitable?

When it comes to Forex vs. stocks, there is no clear winner in terms of profitability. Both markets offer opportunities for investors to make money, but the potential returns and risks differ. Forex trading has the potential for higher returns due to the high leverage available, but it also carries a higher risk due to the volatile nature of the market. On the other hand, stock trading is generally less risky, but the returns are typically lower.

Which Is Right for You As A Trader:

When Forex Trading Works Best:

- High Liquidity: Forex trading works best when you need to enter or exit a position quickly. Due to the high liquidity of the market, it’s easy to buy or sell a currency pair at any given time;

- Volatility: If you enjoy trading in a fast-paced and dynamic market, Forex trading may be right for you. The volatility of the Forex market means that there are always opportunities to make money, but it also means that losses can happen quickly;

- Global Economic Events: Forex trading works best when you have a good understanding of global economic events and how they can impact currency values. Economic data releases, political developments, and central bank decisions can all affect the Forex market [6];

When Stock Trading Works Best:

- Long-Term Investing: If you’re looking for a long-term investment option, stock trading may be right for you. Stocks offer the potential for consistent returns over time, and many companies pay dividends to their shareholders;

- Predictable Trends: Stock trading works best when you can identify predictable trends in the market. This requires a good understanding of industry trends, financial performance, and economic data;

- Risk Management: If you’re looking for a lower-risk investment option, stock trading may be a better choice. While there is always some level of risk involved, the stock market is generally less volatile than the Forex market;

FAQ:

- Are stocks more profitable than Forex?

The profitability of stocks versus Forex trading depends on various factors such as the individual’s trading strategy, risk appetite, and market conditions. Generally, the potential for profits in the stock market tends to be more predictable and stable over the long term, while the Forex market offers higher volatility and potential for rapid gains or losses. Therefore, both markets can be profitable depending on the individual’s trading approach.

- What is the most profitable type of trading?

There is no single “most profitable” type of trading, as profitability depends on various factors such as market conditions, individual skill and experience, and the chosen trading strategy. However, some types of trading that have been historically profitable for some traders include day trading, swing trading, and long-term investing [7].

- Which trading gives the highest return?

The trading method that provides the highest return depends on various factors, including market conditions, individual skill and experience, and the chosen trading strategy. For instance, day trading and swing trading can provide high returns for experienced traders who employ effective risk management techniques.

- Do traders do better than investors?

Traders and investors have different goals and approaches to the market. Investors typically focus on long-term gains, while traders aim to profit from short-term price movements. Therefore, the success of traders versus investors depends on their individual goals and strategies.

- How many Forex traders are successful?

The percentage of successful Forex traders is difficult to determine, as it varies depending on the source of the data and the definition of “success”. Some studies suggest that only a small percentage of Forex traders are consistently profitable, while others indicate that a larger proportion of traders achieve success over the long term.

- Why do people prefer Forex trading?

Forex trading is popular among traders because it offers high liquidity, low transaction costs, and the ability to trade 24 hours a day [8]. Additionally, the Forex market offers a diverse range of trading instruments and opportunities for traders to profit from currency fluctuations.

- What is the easiest market to trade?

The easiest market to trade depends on an individual’s experience, skills, and preferences. However, some markets that are often considered relatively easy to trade include the stock market, the Forex market, and the cryptocurrency market.

- Why is making money on Forex so hard?

Making money on Forex can be difficult due to the high level of volatility and unpredictability of the currency markets. Additionally, many traders struggle with emotional biases and ineffective trading strategies that lead to losses.

- Is Forex harder to learn than stocks?

Both Forex and stocks require a certain level of knowledge and skill to trade successfully. However, Forex trading can be more complex due to the vast number of currency pairs, geopolitical events, and economic indicators that can impact currency prices.

- Why do 95% of traders lose money?

There are many reasons why the majority of traders lose money, including lack of proper education and training, ineffective trading strategies, emotional biases, and poor risk management. Additionally, the high level of volatility and unpredictability of the markets can lead to losses.

- What is a Forex trader’s salary?

Forex trader salaries can vary widely depending on factors such as experience, skill level, and the trader’s chosen market. Entry-level traders can earn salaries of around $ 50,000 – $ 60,000 per year, while experienced traders can earn six-figure salaries or more [9].

- What is the biggest secret in Forex trading?

There is no single “biggest secret” to Forex trading, as success depends on a combination of factors such as effective risk management, a solid trading strategy, and the ability to control emotions and avoid impulsive trading decisions.

- Which country has the most Forex traders?

It is difficult to determine which country has the most Forex traders, as the Forex market is global and there is no centralized exchange or regulator. However, some of the countries with high levels of Forex trading activity include the United States, United Kingdom, Japan, Hong Kong, Singapore, and Australia.

- Do people become rich trading stocks?

Some people have become wealthy through trading stocks, but success depends on a combination of factors such as skill level, market conditions, and trading strategy. It is important to note that trading stocks carry a high level of risk and potential for significant losses as well.

- Which is safer to trade stocks or Forex?

Both trading stocks and Forex carry risks and potential for losses. However, Forex trading can be riskier due to the higher level of leverage used in the market, which can amplify gains and losses. It is important for traders to understand the risks involved in both markets and to employ effective risk management techniques.

- Can Muslims do Forex trading?

Forex trading is permissible under Islamic law as long as it is conducted by the principles of Islamic finance. This includes avoiding interest-based transactions and ensuring that trades are backed by real assets. Some brokers offer Islamic accounts that comply with these principles.

- Can Forex trading be a full-time job?

Forex trading can be a full-time job for those who have developed a profitable trading strategy and have the discipline to stick to their trading plan. However, it is important to note that Forex trading can be emotionally and mentally demanding, and requires continuous education and monitoring of market conditions.

- Did Warren Buffett do Forex?

Warren Buffett is primarily known for his long-term investments in stocks, and there is no evidence to suggest that he has engaged in Forex trading. However, Buffett has been known to hedge currency risks associated with his investments in foreign markets [10].

- Which is better for a beginner – Forex or stocks?

This depends on the beginner’s investment goals, risk tolerance, and trading style. Forex trading may be more suitable for those who enjoy fast-paced trading and have a good understanding of global economic events, while stock trading may be better for those who prefer a long-term investment option with a lower level of risk.

- What should I consider before investing in Forex or stocks?

Before investing in Forex or stocks, it’s important to consider your investment goals, risk tolerance, and trading style. You should also do your research and develop a solid trading strategy to maximize your chances of success. Finally, always practice risk management and never invest more than you can afford to lose.

Useful Video: Forex Vs. Stock Trading – Which One Is More Profitable?

References:

- https://www.avatrade.com/education/trading-for-beginners/forex-vs-stocks

- https://www.nextmarkets.com/en/trading/learn/forex-stocks

- https://www.cmcmarkets.com/en/trading-guides/forex-vs-stocks

- https://admiralmarkets.com/education/articles/forex-basics/forex-vs-stocks-should-you-trade-forex-or-stocks

- https://www.benzinga.com/money/stocks-vs-forex

- https://www.thebalancemoney.com/forex-vs-stocks-1345042

- https://rockfortmarkets.com/educational-resource/forex-vs-stocks-which-is-more-profitable/

- https://elliottwave-forecast.com/trading/forex-vs-stocks/

- https://statrys.com/blog/forex-vs-stock-market

- https://www.makeuseof.com/forex-vs-crypto-vs-stocks-trading/

Leave a Review