The foreign exchange market, also known as forex or FX, is the largest and most liquid financial market in the world, with an estimated daily turnover of over $ 6.6 trillion. Forex trading involves buying and selling different currencies with the aim of making a profit from the fluctuations in their exchange rates. As with any other form of trading, the goal of Forex trading is to make money, and many people are drawn to the market because of the potential for high returns. However, the question that is on many people’s minds is: How much do Forex traders make a day?

The answer to this question is not straightforward and varies greatly depending on various factors. Some traders make millions of dollars a year, while others struggle to break even. Factors such as a trader’s experience, trading strategy, risk management, and market conditions all play a role in determining how much money they can make from Forex trading.

Another important factor to consider when trying to determine how much forex traders make is the type of trader they are. There are different types of Forex traders, such as day traders, swing traders, and position traders, each with its own approach to trading and varying levels of profitability.

For instance, day traders aim to make profits by taking advantage of short-term price movements, while position traders may hold their positions for weeks or even months, hoping to profit from long-term trends.

What Is the Average Salary of an Employed Forex Trader?

The average salary of an employed Forex trader varies depending on their experience and the company they work for.

Bonuses and commissions can significantly increase a Forex trader’s salary, with the average bonus being around $ 20,000 and commissions ranging from $ 10,000 to $ 80,000 per year.

It is important to note that the salary of a Forex trader can vary greatly depending on their location. For example, Forex traders in New York City typically earn more than those in smaller cities or towns. Additionally, the size and reputation of the company can also impact a Forex trader’s salary.

What Makes Up the Salary of an Employed Forex Trader?

The salary of an employed Forex trader is typically made up of a base salary, bonuses, and commissions. The base salary is the fixed amount of money that the trader receives each year. Bonuses and commissions are additional payments that a forex trader can earn based on their performance and the profitability of the company.

The number of bonuses and commissions that a Forex trader can earn can vary greatly depending on the company they work for. Some companies may offer higher bonuses and commissions to attract top talent, while others may offer lower bonuses and commissions but provide other benefits such as health insurance and retirement plans.

What Might Affect the Salary of an Employed Forex Trader?

Several factors can affect the salary of an employed Forex trader. One of the most important factors is experience. Forex traders with more experience typically earn higher salaries than those with less experience. This is because experienced traders are more likely to generate profits for the company and are often responsible for managing larger sums of money.

The size and reputation of the company can also impact a Forex trader’s salary. Larger companies tend to offer higher salaries and bonuses to attract top talent. Additionally, reputable companies may be able to offer more lucrative trading opportunities, which can increase a trader’s earnings potential.

The location of the company can also impact a Forex trader’s salary [2]. Traders in larger cities such as New York City or London typically earn higher salaries than those in smaller cities or towns. This is because the cost of living in larger cities is typically higher, and companies may need to offer higher salaries to attract and retain employees.

Finally, market conditions can also impact a Forex trader’s salary. If the markets are volatile and unpredictable, it can be more difficult for traders to generate profits, which can result in lower bonuses and commissions. Conversely, if the markets are stable and profitable, traders may be able to earn higher bonuses and commissions.

The Average Monthly Salary of an Employed Forex Trader

While the average annual salary of a Forex trader is important, it is also useful to consider their monthly earnings. Based on the average annual salary of $ 90,000, the average monthly salary of an employed forex trader would be approximately $ 7,500 [3]. However, this amount can vary depending on the specifics of the trader’s salary package.

For example, some companies may offer a higher base salary with lower bonuses and commissions, resulting in a more stable monthly income. On the other hand, other companies may offer a lower base salary but higher bonuses and commissions, resulting in a more variable monthly income.

Overall, the average monthly salary of an employed Forex trader is dependent on several factors, including the trader’s experience, the size and reputation of the company, and the performance of the markets.

What Is the Average Salary of an Independent (at Home) Forex Trader?

The average salary of an independent Forex trader can vary greatly, as it is dependent on several factors such as experience, trading strategy, and market conditions. As an independent trader, you are not limited to a fixed salary and have the potential to earn more money than traditional salaried forex traders:

Return on Investment (ROI)

For example, if you invested $ 10,000 and made a profit of $ 2,000, your ROI would be 20% [4].

The ROI for Forex traders can vary greatly depending on their trading strategy, risk tolerance, and the markets they trade-in. As an independent trader, you have the flexibility to adjust your trading strategy to maximize your ROI and minimize your risks.

The Amount of Money You Start With

One of the advantages of Forex trading is that you can start with a relatively small amount of money. Many brokers offer accounts with low minimum deposits, allowing traders to get started with as little as a few hundred dollars.

However, the amount of money you start with can have a significant impact on your earnings potential. With a larger starting balance, you have the potential to make larger trades and earn higher profits. Conversely, with a smaller starting balance, you may need to make more trades to earn a significant profit, which can increase your risk of losses.

Costs Incurred Through Forex Trading

Forex trading incurs various costs that can impact your earnings potential. These costs can include:

- Brokerage fees: Forex brokers charge fees for each trade you make, typically in the form of a spread, which is the difference between the buy and sell price of a currency pair;

- Transaction costs: In addition to brokerage fees, forex traders may also incur transaction costs such as wire transfer fees, credit card fees, and currency conversion fees;

- Software and data fees: To trade forex effectively, you may need to invest in software and data feeds, which can come with a monthly or annual subscription fee;

It is important to factor in these costs when calculating your earnings potential as an independent Forex trader.

Examples of Profit Earned by an Independent Forex Trader

The amount of profit earned by an independent Forex trader can vary greatly depending on their trading strategy and market conditions.

Here are a few examples of profit earned by independent forex traders:

- Trader A uses a high-risk, high-reward trading strategy and earns an average ROI of 50%. They invest $ 5,000 and earn a profit of $ 2,500 in their first year of trading;

- Trader B uses a low-risk, low-reward trading strategy and earns an average ROI of 10%. They invest $ 10,000 and earn a profit of $ 1,000 in their first year of trading;

- Trader C uses a combination of high-risk and low-risk trades and earns an average ROI of 25%. They invest $ 20,000 and earn a profit of $ 5,000 in their first year of trading [5];

As you can see, the amount of profit earned by independent forex traders can vary greatly depending on their trading strategy and level of risk tolerance.

Average Salary of an Independent Forex Trader

The average salary of an independent forex trader can vary greatly, as it is dependent on several factors such as experience, trading strategy, and market conditions. However, the average Forex trader’s annual profit is $ 30,000, while the top 25% of traders earn an average of $ 103,000 per year [6].

It’s worth noting that as an independent forex trader, you are not limited to a fixed salary and have the potential to earn more money than traditional salaried forex traders. However, this potential for higher earnings comes with greater risks and requires a higher level of skill and discipline to succeed.

What Are The Essentials To Make Money Trading Forex:

- Education

The first essential to make money trading forex is education. Forex trading is complex and involves a significant amount of risk. Therefore, it’s important to have a strong understanding of the fundamentals of forex trading, including technical analysis, fundamental analysis, and risk management.

There are several resources available for Forex traders to learn, including online courses, webinars, and trading books. It’s essential to invest time and effort into learning the basics of forex trading before jumping into the market.

- Trading Strategy

A trading strategy is a plan that outlines when and how to enter and exit trades. It’s an essential component of successful forex trading. A trading strategy should be based on a trader’s goals, risk tolerance, and market analysis.

There are several types of trading strategies, including trend following, range trading, and breakout trading. A successful trading strategy should be backtested and optimized to ensure that it’s profitable in various market conditions.

- Risk Management

Risk management is an essential component of successful forex trading. It involves using techniques to minimize losses and protect capital. Risk management strategies include setting stop-loss orders, limiting position size, and diversifying trading strategies.

Traders should never risk more than they can afford to lose. Risk management is an ongoing process and should be monitored and adjusted as market conditions change.

- Discipline and Patience

Discipline and patience are essential traits for successful forex trading. It’s important to stick to a trading strategy and avoid impulsive trades based on emotions. Patience is also necessary as forex trading involves waiting for the right opportunities to arise.

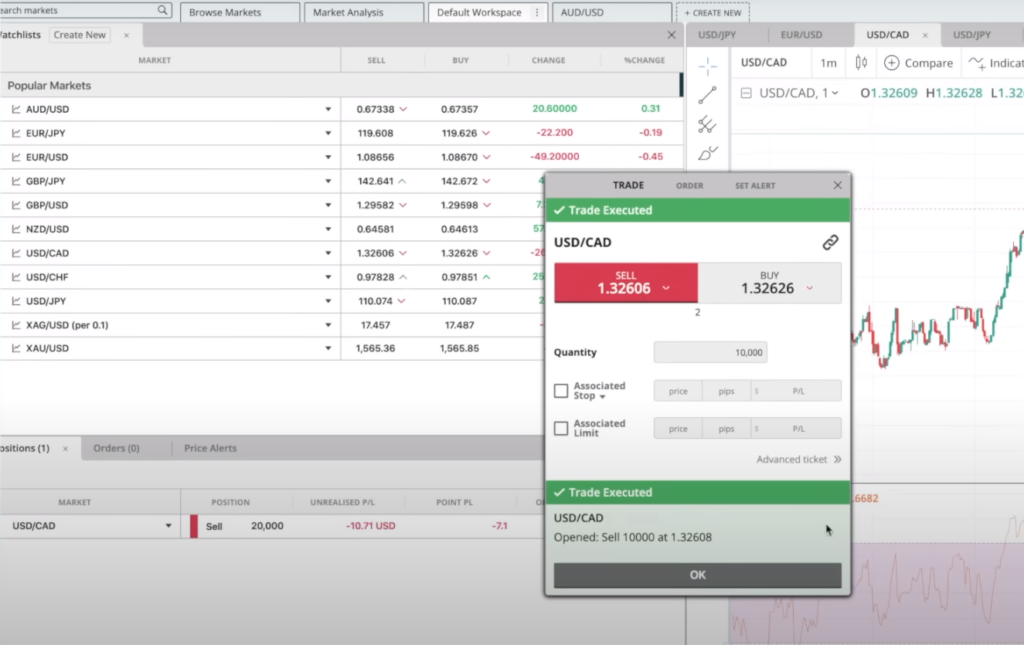

- Choosing the Right Broker

Choosing the right broker is an essential component of successful forex trading. A broker should offer competitive spreads, reliable execution, and a user-friendly trading platform. It’s also essential to choose a regulated broker to ensure that funds are protected.

How Do Forex Trader Salaries Differ by Location?

Forex trading is a global industry, and salaries for forex traders can vary significantly by location.

Several factors influence forex trader salaries, including the cost of living, demand for traders, and the strength of the local economy:

North America

Forex trader salaries in North America are among the highest in the world. In the United States, the average salary for a Forex trader is $ 102,000 per year, according to Glassdoor. However, salaries can range from $ 35,000 to $ 192,000 depending on experience, location, and performance.

Canada is also a popular location for Forex traders, with an average salary of $ 78,000 per year, according to Glassdoor. Salaries can range from $ 31,000 to $ 162,000 depending on experience and location [7].

Europe

Forex trader salaries in Europe can vary significantly by country. In the United Kingdom, the average salary for a forex trader is £ 63,000 per year, according to Glassdoor. However, salaries can range from £25,000 to £120,000 depending on experience and location.

In Switzerland, one of the world’s leading financial centers, forex traders can earn an average salary of CHF 101,000 per year, according to Glassdoor. Salaries can range from CHF 60,000 to CHF 195,000 depending on experience and location [8].

Asia

Forex trading is popular in Asia, and salaries for forex traders can vary significantly by country. In Japan, the average salary for a Forex trader is ¥ 8.2 million per year, according to eFinancialCareers. However, salaries can range from ¥ 3.6 million to ¥ 20 million depending on experience and location.

In Singapore, one of the world’s leading financial centers, forex traders can earn an average salary of SGD 96,000 per year, according to Glassdoor. Salaries can range from SGD 47,000 to SGD 180,000 depending on experience and location [9].

Middle East

The Middle East is home to several emerging financial centers, including Dubai and Abu Dhabi. In Dubai, forex traders can earn an average salary of AED 234,000 per year. However, salaries can range from AED 72,000 to AED 558,000 depending on experience and location.

How Much Money Forex Day Traders Can Make?

The amount of money a Forex day trader can make is highly dependent on a variety of factors, such as experience, skill level, trading strategy, risk management, and the size of their trading account.

Forex day traders aim to make profits by buying and selling currency pairs within the same trading day. Some traders can make a few hundred dollars a day, while others may make thousands or tens of thousands of dollars per day.

It’s important to note that Forex trading carries a significant risk of loss, and many traders end up losing money instead of making a profit. Therefore, it’s essential for traders to have a solid understanding of the markets and to implement effective risk management strategies.

Furthermore, Forex day trading requires a significant amount of time, effort, and discipline. Traders need to stay up-to-date with economic news and events, monitor their trades carefully, and make quick decisions when necessary.

How Much Money Do I Need to Trade Forex:

Why Does It Matter?

Before we delve into the specifics of how much money you need to trade Forex, let us first discuss why it matters. The amount of money you need to trade forex will depend on several factors such as your trading style, risk tolerance, and trading objectives.

Knowing how much money you need to trade Forex will also help you manage your emotions when trading. If you do not have enough capital to trade, you may feel anxious and stressed, leading to irrational trading decisions.

How Much Money Do I Need to Day Trade Forex?

Day trading involves opening and closing positions within a day. Day traders aim to profit from short-term price movements in the Forex market. Day traders typically use leverage to amplify their profits.

The amount of money you need to day trade Forex will depend on the size of your trading account and the leverage you use. As a general rule of thumb, you should have at least $ 25,000 in your trading account to meet the minimum equity requirements of a pattern day trader.

Pattern day traders are traders who execute four or more day trades within a five-day period. If you are a pattern day trader, you are subject to the SEC’s day trading rules, which require a minimum equity of $ 25,000 in your trading account [10].

Assuming you are not a pattern day trader, the amount of money you need to day trade Forex will depend on the leverage you use.

If you use a 50:1 leverage, you will need at least $ 500 in your trading account to open a position of $ 25,000. If you use a 100:1 leverage, you will need at least $ 250 in your trading account to open a position of $ 25,000.

However, keep in mind that day trading is a high-risk, high-reward activity. It requires a lot of skill, discipline, and emotional control. Therefore, it is essential to have enough capital to withstand any losses and not blow up your trading account.

How Much Money Do I Need to Swing Trade Forex?

Swing trading involves holding positions for several days to weeks. Swing traders aim to profit from medium-term price movements in the Forex market. Swing trading requires less time and attention than day trading.

The amount of money you need to swing trade forex will depend on your trading style and risk tolerance. As a general rule of thumb, you should have at least $ 10,000 in your trading account to swing trade forex.

Assuming you use a 10:1 leverage, you will need at least $ 1,000 in your trading account to open a position of $ 10,000. However, keep in mind that swing trading requires patience and discipline. You should be prepared to hold your positions for several days or weeks and withstand any temporary price fluctuations.

How Much Capital For Longer-Term Forex Trades/Investing?

Long-term forex trading or investing involves holding positions for several months to years. Long-term traders aim to profit from long-term price movements in the forex market. Long-term forex trading requires a different approach than day trading and swing trading.

Assuming you use a 5:1 leverage, you will need at least $ 1,000 in your trading account to open a position of $ 5,000. However, keep in mind that long-term forex trading requires a lot of patience and a willingness to hold your positions for an extended period.

Long-term forex trading or investing is suitable for traders who do not have the time or expertise to actively manage their trades. Instead, they take a more passive approach, focusing on the long-term outlook of the forex market.

How Much Do Forex Traders Make a Day: Factors

Win Rate

Win rate refers to the percentage of winning trades compared to the total number of trades placed. It’s an important factor that determines how much forex traders can make in a day. For example, if a trader has a win rate of 60%, it means that they win 60 out of 100 trades. A higher win rate means that a trader is more successful in their trades and is likely to earn more money.

However, it’s important to note that the win rate alone is not a reliable indicator of a trader’s profitability. A trader could have a high win rate but still, lose money if their risk-reward ratio is not favorable.

Risk-Reward Ratio

For example, if a trader risks $ 100 on a trade and stands to gain $ 200 if it’s successful, their risk-reward ratio is 1:2. A favorable risk-reward ratio means that a trader can still make a profit even if they lose a significant number of trades.

How Much Money Do You Need To Start Day Trading?

The amount of money needed to start day trading in forex depends on the trader’s trading strategy, risk tolerance, and the broker they choose. Some brokers allow traders to open an account with as little as $ 100, while others require a minimum deposit of $ 10,000 or more.

It’s important to note that starting with a small amount of capital can limit a trader’s earning potential. This is because most forex brokers offer leverage, which allows traders to control larger positions with a smaller amount of capital. However, leverage also increases the risk of losses and can lead to margin calls if a trade goes against a trader.

Therefore, it’s important to have a realistic understanding of the risks involved in forex trading and to start with an amount of capital that you can afford to lose.

FAQ:

- How can I make money with Forex trading in Nigeria?

Forex trading in Nigeria involves buying and selling currencies to make a profit. To make money with Forex trading in Nigeria, you need to have a good understanding of the market, trading strategies, risk management, and discipline. You also need to choose a reliable Forex broker and open a trading account.

It is essential to learn and practice on a demo account before investing real money. You can make money with Forex trading in Nigeria by taking advantage of market fluctuations, using technical and fundamental analysis, and having a solid trading plan.

- How much do day traders make?

The amount of money day traders make varies widely depending on their trading strategy, capital, and risk management. According to a study by the US Securities and Exchange Commission, the average day trader earns around $ 16,000 per year. However, some day traders can make significantly more or less than this amount, depending on their experience, skill level, and market conditions.

- What do traders do?

Traders buy and sell financial instruments such as stocks, bonds, currencies, commodities, and derivatives to make a profit. They analyze the market using technical and fundamental analysis to identify trends, patterns, and price movements. They also manage risk by using various strategies such as stop-loss orders, position sizing, and diversification.

- How to start day trading?

To start day trading, you need to educate yourself about the markets, trading strategies, and risk management. You also need to choose a reliable broker, open a trading account, and fund it with capital. You can start trading with a demo account to practice your skills and strategies. Once you feel confident, you can start trading with real money. It is crucial to develop a trading plan and stick to it.

- Can you make a living trading Forex?

Yes, it is possible to make a living trading Forex, but it requires discipline, patience, and a solid trading plan. Traders need to manage their risk carefully and not rely on luck to make a profit. It is also essential to have realistic expectations and not to expect to get rich overnight. Successful Forex traders are those who can consistently make a profit over the long term.

- How many trades can a day trader execute in one day?

The number of trades a day trader can execute in one day depends on their trading strategy, risk management, and capital. Some day traders execute hundreds of trades per day, while others may only make a few trades. It is essential to focus on quality trades rather than quantity and to avoid overtrading, which can lead to losses.

- What’s the difference between day trading and active trading?

Day trading is a type of active trading where traders buy and sell securities within the same trading day. Active trading, on the other hand, refers to buying and selling securities frequently, but not necessarily within the same day. Day traders focus on short-term price movements, while active traders may hold their positions for days, weeks, or even months.

- How much do most Forex traders make a day?

The amount of money most Forex traders make a day varies widely depending on their trading strategy, risk management, and capital. Some traders may make only a few dollars per day, while others may make thousands of dollars per day.

- Can you make $ 10,000 a day with Forex?

It is possible to make $ 10,000 a day with Forex, but it requires a significant amount of capital, skill, and discipline. Traders need to have a solid trading plan and manage their risk carefully. It is also essential to avoid overtrading and not rely on luck to make a profit.

- Can you make billions from Forex?

While it is possible to make a significant amount of money trading Forex, it is unlikely that one can make billions solely from Forex trading. Making billions would require a massive amount of capital and successful trading strategies that are consistently profitable over the long term. However, many successful traders have made millions of dollars from Forex trading by focusing on quality trades, managing their risk, and sticking to their trading plans.

- Is $ 1000 enough to trade Forex?

Yes, $ 1000 can be enough to trade Forex, but it depends on your trading strategy, risk management, and expected returns. It is important to start small and gradually increase your capital as you gain experience and improve your trading skills. It is also essential to practice on a demo account before trading with real money.

- Is Forex the highest-paying job?

Forex trading can be a high-paying job, but it is not necessarily the highest-paying job. The amount of money you can make trading Forex depends on your trading strategy, capital, risk management, and skill level. Many other professions, such as doctors, lawyers, and business executives, can pay significantly more than Forex trading.

- Can you make $ 300 a day from Forex?

Yes, it is possible to make $ 300 a day from Forex, but it depends on your trading strategy, risk management, and capital. It is important to have realistic expectations and not to rely on luck to make a profit. Traders who can consistently make a profit over the long term can make a significant amount of money trading Forex.

- How much can I make with 100k in Forex?

The amount of money you can make with 100k in Forex depends on your trading strategy, risk management, and expected returns. It is important to start small and gradually increase your capital as you gain experience and improve your trading skills. Traders who can consistently make a profit over the long term can make a significant amount of money trading Forex.

- Can I make Forex a full-time job?

Yes, it is possible to make Forex a full-time job, but it requires discipline, patience, and a solid trading plan. Traders need to manage their risk carefully and not rely on luck to make a profit. It is also essential to have realistic expectations and not to expect to get rich overnight. Successful Forex traders are those who can consistently make a profit over the long term.

- Is Forex a skill or luck?

Forex trading is both a skill and luck. Successful Forex traders have a solid understanding of the market, trading strategies, and risk management. However, luck can also play a role in trading, such as unexpected news events that can affect the market. Traders need to focus on developing their skills and strategies and managing their risk to be consistently profitable.

- Is crypto or Forex better for beginners?

Both crypto and Forex trading can be suitable for beginners, but it depends on your interests and risk tolerance. Crypto trading can be more volatile than Forex trading, but it can also offer higher returns. Forex trading is more established and has more resources and educational materials available. It is important to do your research and choose the market that is best suited to your goals and risk tolerance.

- Can I make 50 dollars a day with Forex?

Yes, it is possible to make 50 dollars a day with Forex, but it depends on your trading strategy, risk management, and capital. Traders who can consistently make a profit over the long term can make a significant amount of money trading Forex.

- Is $ 500 enough to trade Forex?

Yes, $ 500 can be enough to trade Forex, but it depends on your trading strategy, risk management, and expected returns. It is important to start small and gradually increase your capital as you gain experience and improve your trading skills. It is also essential to practice on a demo account before trading with real money.

- How to earn $ 1,000 per day in intraday trading?

Earning $ 1,000 per day in intraday trading requires a solid trading plan, discipline, and risk management. Traders need to focus on quality trades and manage their risk carefully. It is important to have realistic expectations and not rely on luck to make a profit. Traders who can consistently make a profit over the long term can make a significant amount of money trading.

- Can you turn $ 100 into $ 1,000-day trading?

While it is possible to turn $ 100 into $ 1,000-day trading, it is not easy and requires a solid trading plan, discipline, and risk management. Traders need to focus on quality trades and manage their risk carefully. It is important to have realistic expectations and not rely on luck to make a profit.

- What is the 3-day trade rule?

The 3-day trade rule is a rule that applies to trading stocks in the United States. It states that if you buy and sell a stock within a 3-day period, the transaction is considered a “day trade”. Day trading requires a minimum account balance of $ 25,000 and is subject to additional restrictions and requirements.

- How much can I make with $ 5000 in Forex?

The amount of money you can make with $ 5000 in Forex depends on your trading strategy, risk management, and expected returns. It is important to start small and gradually increase your capital as you gain experience and improve your trading skills. Traders who can consistently make a profit over the long term can make a significant amount of money trading Forex.

- What is the average monthly return of a Forex trader in the top 10%?

There is no definitive answer to this question as the average monthly return of a Forex trader in the top 10% varies depending on their trading strategy, capital, risk management, and skill level. Traders who can consistently make a profit over the long term can make a significant amount of money trading Forex.

- Are there any super-successful female Forex traders?

Yes, there are many successful female Forex traders. Forex trading is a profession that does not discriminate based on gender, and anyone can become successful with hard work and dedication.

- How long does it take you to become profitable at Forex trading?

The amount of time it takes to become profitable at Forex trading depends on your trading strategy, risk management, and skill level. It is important to start small and gradually increase your capital as you gain experience and improve your trading skills. Traders who can consistently make a profit over the long term can make a significant amount of money trading Forex.

- When should you quit your job as a Forex trader?

Deciding when to quit your job as a Forex trader depends on your individual circumstances, financial goals, and risk tolerance. It is important to have realistic expectations and not to rely on luck to make a profit. Traders who can consistently make a profit over the long term can consider quitting their jobs and trading Forex full-time.

- Can you make a living as a Forex trader?

Yes, it is possible to make a living as a Forex trader, but it requires discipline, patience, and a solid trading plan. Traders need to manage their risk carefully and not rely on luck to make a profit. It is also essential to have realistic expectations and not to expect to get rich overnight. Successful Forex traders are those who can consistently make a profit over the long term.

Useful Video: How Much Money Can I Make Trading Forex?

References:

- https://www.wikijob.co.uk/trading/forex/forex-trader-salaries

- https://www.investopedia.com/articles/active-trading/053115/average-rate-return-day-traders.asp

- https://tradethatswing.com/scenarios-for-how-much-money-forex-day-traders-can-make/

- https://ca.indeed.com/career-advice/pay-salary/how-much-do-day-traders-make

- https://www.ziprecruiter.com/Salaries/Forex-Trader-Salary

- https://440.ng/forex-traders-in-nigeria/

- https://fbs.com/analytics/guidebooks/how-much-money-do-i-need-for-forex-trading-265

- https://invezz.com/forex/trading/how-much-money-need-to-start/

- https://www.topfxbrokersreview.com/how-much-do-forex-traders-make-a-day/

- https://www.ramseysolutions.com/retirement/what-is-day-trading

Leave a Review