Gold is one of the most popular commodities traded in the forex market. The price of gold is influenced by a variety of factors, including supply and demand, geopolitical events, inflation, and interest rates.

Trading gold in the forex market requires a combination of technical and fundamental analysis. Technical analysis involves studying charts and using indicators to identify trends and patterns in the price of gold. Fundamental analysis involves analyzing economic data and news events to determine the underlying factors driving the price of gold. Successful traders use a combination of both types of analysis to make informed trading decisions.

In this article, we will discuss how to trade gold in the forex market, including the basics of forex trading, the factors that influence the price of gold, and trading strategies for beginners and experienced traders alike.

What Is Gold Trading (XAU/USD)?

Gold trading, also known as XAU/USD trading, is the process of buying and selling gold in the foreign exchange market [1]. This type of trading involves trading gold against the US dollar. It is one of the most popular forms of trading in the forex market, attracting many traders due to the liquidity and stability of gold as a commodity. Gold trading is usually carried out using either gold futures or gold options.

Forex Vs. Gold Trading

Forex trading involves the exchange of currencies, while gold trading involves the exchange of gold. The Forex market is the largest financial market in the world, with over $ 5 trillion traded every day. Forex trading is highly volatile and involves a lot of risks. In contrast, gold trading is relatively stable, as the value of gold tends to remain constant over time. Gold trading is popular among traders who are looking for a safe and stable investment.

What Factors Move Gold Prices?

There are several factors that can influence the price of gold. The most significant factor is the supply and demand for gold. If there is a high demand for gold and the supply is limited, the price of gold is likely to increase. Another factor that can influence the price of gold is inflation. When inflation is high, the value of the paper currency tends to decrease, which makes gold more attractive as an investment. The political and economic stability of a country can also influence the price of gold. If a country experiences political or economic instability, investors may turn to gold as a safe haven asset, which can drive up the price of gold.

What Are Gold Futures?

Gold futures are contracts that allow traders to buy or sell a specific amount of gold at a predetermined price and date. Gold futures are traded on various exchanges, including the Chicago Mercantile Exchange (CME) and the New York Mercantile Exchange (NYMEX). Gold futures contracts are standardized, which means that they have a fixed size, expiration date, and delivery date [2].

Traders who buy gold futures contracts are required to pay a margin, which is a percentage of the contract value. If the price of gold moves in the trader’s favor, they can sell the contract and make a profit. If the price of gold moves against the trader, they may be required to deposit additional funds to maintain their margin.

What Are Gold Options?

Gold options contracts are also standardized, which means that they have a fixed size, expiration date, and delivery date [3].

Traders who buy gold options contracts are required to pay a premium, which is the cost of the option. If the price of gold moves in the trader’s favor, they can exercise the option and make a profit. If the price of gold moves against the trader, they can let the option expire and limit their losses to the premium paid.

How Do I Get Started Trading Gold:

Day Trade With The New York Close In Mind

Day trading is a popular approach to trading gold. When trading gold, it is important to have a specific time in mind. One way to do this is to focus on the New York close, which occurs at 5 pm EST. This is because gold trading was heavily influenced by the New York trading session. Many traders believe that the New York close is a crucial time to take note of, as it can help determine the market trend for the next trading day.

Simplify Analysis By Targeting Previous Highs And Lows

Another helpful approach to trading gold is to target previous highs and lows. This method can help simplify analysis and provide a clear indication of the market trend. If the price of gold is currently trading higher than the previous high, it may indicate an upward trend, and vice versa.

When Trading Gold, Consider Geopolitical Implications On Currencies

Gold prices can be heavily influenced by geopolitical events. When trading gold, it is important to consider how these events may impact currency values. For example, if there is a major political event that affects the value of a currency, it can have a ripple effect on gold prices. Traders should keep up to date with news events and their impact on currencies to make informed trading decisions.

Use The Symmetrical Triangle For Analysis

The symmetrical triangle is a popular technical analysis tool that can be used to predict market trends. When trading gold, this can be a helpful tool to use. The symmetrical triangle can be identified by drawing a line connecting the lower highs and a line connecting the higher lows. If the lines intersect, it may indicate a breakout in either direction.

Track Industrial And Commercial Demand For Gold

Gold is not only used for investment purposes but also has practical uses in industrial and commercial settings. When trading gold, it is important to keep track of industrial and commercial demand. This can provide insight into market trends and potential price movements.

Monitor Central Bank Buying

Central banks are some of the largest buyers of gold. When trading gold, it is important to keep track of central bank buying. If central banks are buying more gold, it may indicate a positive outlook for the commodity and may result in higher prices.

Track Real Interest Rates

Real interest rates are a key indicator to monitor when trading gold. This is because gold is often used as a hedge against inflation. If real interest rates are low, it may indicate an increase in inflation, which can drive up the price of gold.

Target Moving Average Crossovers

Target moving average crossovers are a popular trading technique used by many gold traders. It involves buying or selling when the gold price crosses above or below a pre-determined target moving average. The idea behind this strategy is that when a short-term moving average crosses above a longer-term one, it signals that an uptrend might be beginning. Similarly, when it crosses below the longer-term one, it could indicate the start of a downtrend in gold prices.

Pay Attention To Changes In Gold Production

Gold production is another important factor to consider when trading gold in the forex market. Gold prices tend to move as a result of changes in supply and demand, so it’s important to pay attention to any news about gold mining or other factors that might affect the availability of gold. This information can give traders an idea of what direction the price may be headed and help them make more informed decisions when trading gold [4].

Popular Gold Trading Strategies When Trading Gold:

1) Fundamental Strategies

Fundamental analysis involves analyzing economic and financial data to determine the underlying value of an asset. Here are some of the most popular fundamental strategies used when trading gold:

Seasonal Gold Patterns

Seasonal patterns can have a significant impact on the price of gold. For example, the price of gold tends to rise in the fourth quarter of the year, as demand for jewelry and other gold products increases in preparation for the holiday season. Traders can use this seasonal pattern to their advantage by buying gold in the summer months and selling it in the fall.

Inverse Gold Prices and US Treasury Rates

Gold prices are often inversely correlated with US Treasury rates. When Treasury rates rise, the opportunity cost of holding gold increases, which can cause the price of gold to fall. Conversely, when Treasury rates fall, the opportunity cost of holding gold decreases, which can cause the price of gold to rise. Traders can use this inverse relationship to their advantage by buying gold when Treasury rates are low and selling it when rates are high.

2) Technical Strategies

Technical analysis involves analyzing price charts and other market data to identify patterns and trends. Here are some of the most popular technical strategies used when trading gold:

The Moving Average Crossover

The moving average crossover strategy is a popular trend-following strategy used by traders in all markets, including gold. The strategy involves using two moving averages of different lengths (e.g. a 50-day moving average and a 200-day moving average) and waiting for them to cross over each other. When the shorter moving average crosses above the longer moving average, it is a signal to buy. When the shorter moving average crosses below the longer moving average, it is a signal to sell [5].

The Relative Strength Index (RSI)

The RSI is a popular momentum indicator used by traders in all markets, including gold. The indicator measures the strength of a trend by comparing the average gains to the average losses over a specified period of time.

When the RSI is above 70, it is a signal that the market is overbought and a correction may be imminent. When the RSI is below 30, it is a signal that the market is oversold and a rally may be imminent.

The Fibonacci Retracement

The Fibonacci retracement is a popular tool used by traders to identify support and resistance levels in the market. The tool is based on the Fibonacci sequence, a mathematical sequence in which each number is the sum of the two preceding numbers (e.g. 0, 1, 1, 2, 3, 5, 8, 13, 21, etc.).

Traders use the Fibonacci retracement tool to draw lines between the high and low points of a price chart, and then look for potential support and resistance levels at the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8%, and 78.6% [6].

Things to Consider Before Trading Gold CFDs:

Find Out What Moves Gold

The price of gold is influenced by various factors, including economic data, geopolitical events, and market sentiment. Understanding what moves gold is crucial for traders who want to make informed trading decisions.

One of the main drivers of gold prices is the U.S. dollar. As gold is priced in dollars, any changes in the value of the dollar will have a direct impact on the price of gold. For example, when the dollar is weak, gold becomes more affordable for foreign buyers, leading to an increase in demand and, in turn, higher gold prices.

Another important factor is interest rates. When interest rates are low, investors tend to move their money out of low-yield investments and into higher-yielding assets such as gold, driving up its price. Conversely, when interest rates rise, investors may choose to move their money into interest-bearing assets, leading to lower gold prices.

Other factors that can impact the price of gold include inflation, supply and demand, and global events such as political unrest and natural disasters. Traders who stay up-to-date on these factors can make better trading decisions.

Understand the Market Participants

Another important factor to consider when trading gold CFDs is the market participants. Gold is traded by a wide range of investors, from central banks and large institutional investors to individual traders. Understanding who the major players are and their trading strategies can help traders make better decisions.

Central banks are one of the largest holders of gold and can influence the price of gold by buying or selling large amounts of the asset. Institutional investors such as hedge funds and asset managers also play a significant role in the gold market, often using gold as a hedge against inflation or economic uncertainty.

Individual traders, including retail traders, also participate in the gold market. These traders may use technical analysis, fundamental analysis, or a combination of both to make trading decisions.

Observe for Long-Term Gold Trends

While short-term price movements can be unpredictable, observing long-term gold trends can help traders identify potential trading opportunities. For example, gold prices tend to rise during times of economic uncertainty or when inflation is expected to rise. By keeping an eye on these long-term trends, traders can make more informed trading decisions.

Choose Where to Trade

Once traders have a good understanding of what moves gold and who the market participants are, the next step is to choose where to trade gold CFDs. There are many online brokers that offer gold CFD trading, each with its own advantages and disadvantages.

Some factors to consider when choosing a broker include the broker’s reputation, trading platform, fees, and customer support. Traders should also consider the broker’s regulatory status and ensure that they are authorized to operate in their jurisdiction.

Essential Gold Trading Strategies For All Traders:

Position Trading

Position trading is a long-term trading strategy that involves holding a position for an extended period of time, typically weeks or months. This strategy is ideal for traders who want to take advantage of long-term trends in the gold market.

Once a long-term trend has been identified, traders should enter a position and hold it for the duration of the trend. Traders should set stop-loss orders to limit their risk and should be prepared to hold their position even if the market experiences short-term fluctuations.

News Trading

News trading is a strategy that involves taking advantage of short-term price movements in response to economic or geopolitical news events. This strategy is ideal for traders who want to take advantage of market volatility in the short term.

To implement a news trading strategy, traders should stay up-to-date on economic and geopolitical news that can impact the price of gold. Traders should also have a solid understanding of how the market is likely to react to different news events [7].

When a news event occurs, traders should wait for the market to react and then enter a position in the direction of the price movement. Traders should set stop-loss orders to limit their risk and be prepared to exit their position quickly if the market moves against them.

Trend Trading Strategies

Trend trading is a strategy that involves taking advantage of long-term trends in the market. This strategy is ideal for traders who want to ride the trend and take advantage of the momentum in the market.

To implement a trend trading strategy, traders should start by identifying the direction of the trend using technical analysis tools such as moving averages and trend lines. Traders should then enter a position in the direction of the trend and hold it until the trend changes.

Traders should set stop-loss orders to limit their risk and be prepared to exit their position quickly if the market moves against them. Traders can also use trailing stop orders to lock in profits as the market moves in their favor.

Day Trading Strategy

Day trading is a strategy that involves buying and selling positions within the same trading day. This strategy is ideal for traders who want to take advantage of short-term price movements in the market.

Traders should set stop-loss orders to limit their risk and be prepared to exit their position quickly if the market moves against them. Traders can also use trailing stop orders to lock in profits as the market moves in their favor.

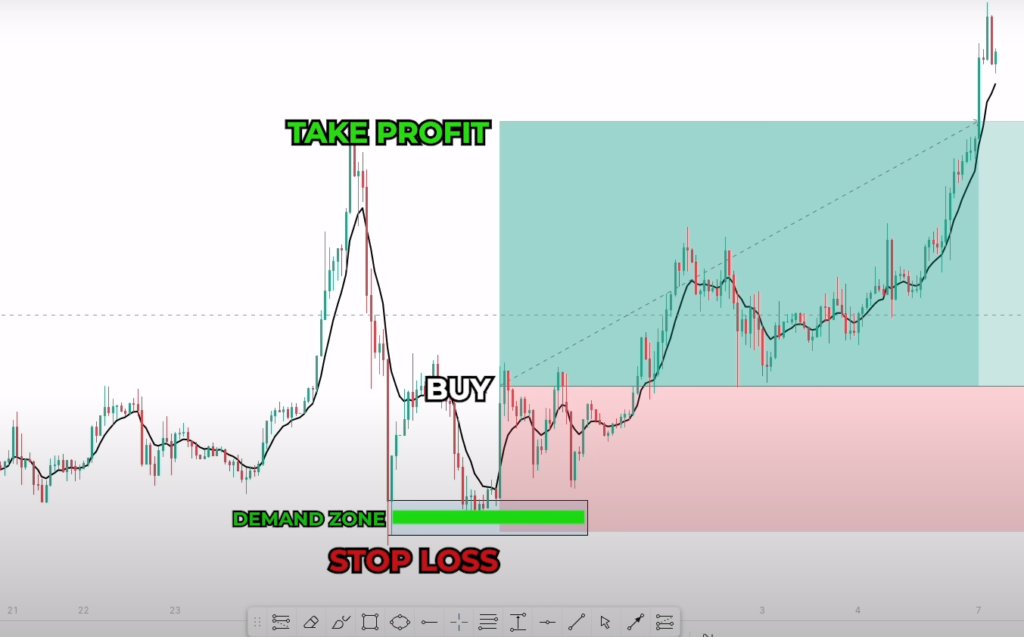

Price Action Trading

Price action trading is a strategy that involves analyzing the price movement of an asset without relying on technical indicators. This strategy is ideal for traders who want to focus on the price movement of the market and take advantage of short-term price movements.

To implement a price action trading strategy, traders should start by analyzing the price movement of gold using candlestick charts. Traders should look for patterns and formations in the price movement, such as support and resistance levels, and chart patterns such as head and shoulders or triangles.

Traders should then enter a position based on the price action signals. For example, if the price breaks through a resistance level, traders may enter a long position. Traders should set stop-loss orders to limit their risk and be prepared to exit their position quickly if the market moves against them.

Expert Advisors/Copy Trading

Expert advisors and copy trading are strategies that involve using automated trading systems or copying the trades of other traders. These strategies are ideal for traders who want to take a more hands-off approach to trade.

Expert advisors are automated trading systems that use algorithms to analyze the market and execute trades. Traders can program their own expert advisors or use pre-built systems that are available for purchase.

Copy trading involves copying the trades of other traders. Traders can choose to follow and copy the trades of successful traders, or they can use social trading platforms that allow them to automatically copy the trades of other traders.

Both expert advisors and copy trading can be effective strategies for traders who want to reduce the amount of time they spend analyzing the market and executing trades. However, traders should still have a solid understanding of the market and should monitor their automated trading systems or copied trades closely to ensure that they are performing as expected.

How To Trade Gold With Leverage?

Leverage is the use of borrowed funds to increase the size of a trading position. For example, if you have $ 1,000 in your trading account and you use the leverage of 1:100, you can open a position worth $ 100,000. This can potentially increase your profits, but it also increases your potential losses [8].

How to trade the gold with leverage:

- Choose a broker. The first step in trading gold with leverage is to choose a broker that offers leveraged trading on gold. Many brokers offer leveraged trading on gold, so it is important to choose a reputable and regulated broker;

- Open a trading account. Once you have chosen a broker, you will need to open a trading account. You will need to provide some personal and financial information, and in some cases, you may need to provide proof of identity and address;

- Deposit funds. To trade the gold with leverage, you will need to deposit funds into your trading account. The amount you need to deposit will depend on the leverage you want to use and the minimum deposit required by your broker;

- Choose your leverage. Once you have deposited funds into your trading account, you can choose the leverage you want to use. The amount of leverage you can use will depend on the broker and the account type you have;

- Choose your trading platform. Most brokers offer trading platforms that allow you to trade the gold with leverage. These platforms may be web-based, desktop-based, or mobile-based. Choose a platform that is easy to use and offers the features you need;

- Choose your trading strategy. Before you start trading gold with leverage, you need to have a trading strategy. This can be a fundamental or technical strategy or a combination of both.

- Monitor your trades. Once you have opened a position, it is important to monitor your trades closely. Keep an eye on the price of gold and any news or events that could affect the price. Use stop-loss orders to limit your potential losses and take-profit orders to lock in your profits;

Best Indicators For Gold Trading:

Relative Strength Indicator (RSI)

The Relative Strength Indicator (RSI) is a popular technical indicator that can be used to analyze the strengths and weaknesses of the market. The RSI is calculated by comparing the average gains and losses over a specified period of time, typically 14 days. The RSI is measured on a scale of 0 to 100, with readings above 70 indicating overbought conditions and readings below 30 indicating oversold conditions.

Traders can use the RSI to identify potential buy or sell signals. For example, if the RSI is above 70, this could indicate that the market is overbought and a potential sell signal. Conversely, if the RSI is below 30, this could indicate that the market is oversold and a potential buy signal.

Moving Averages Indicator

Moving averages are another popular technical indicator that can be used in gold trading. Moving averages are calculated by averaging the price of an asset over a specified period of time. The most common moving averages used in trading are the 50-day and 200-day moving averages [9].

Traders can use moving averages to identify trends in the market. For example, if the price of gold is consistently trading above the 50-day moving average, this could indicate an uptrend in the market. Conversely, if the price of gold is consistently trading below the 50-day moving average, this could indicate a downtrend in the market.

Traders can also use moving averages to identify potential support and resistance levels. For example, if the price of gold is approaching the 200-day moving average, this could indicate a potential support level. If the price of gold is approaching the 50-day moving average, this could indicate a potential resistance level. Bollinger Bands

Bollinger Bands are a technical indicator that can be used to measure the volatility of the market. Bollinger Bands consist of a moving average and two standard deviation bands. The upper band represents two standard deviations above the moving average, while the lower band represents two standard deviations below the moving average.

Traders can also use Bollinger Bands to identify potential support and resistance levels. For example, if the price of gold is consistently bouncing off the lower Bollinger Band, this could indicate a potential support level. Conversely, if the price of gold is consistently bouncing off the upper Bollinger Band, this could indicate a potential resistance level.

How To Choose The Best Gold Trading Strategy?

Risk Tolerance

One of the most important factors to consider when choosing a gold trading strategy is your risk tolerance. Some strategies, such as day trading, can be very high risk and require a significant amount of capital. Other strategies, such as position trading, can be a lower risk but may require a longer time horizon to see profits.

It is important to assess your risk tolerance and choose a strategy that is aligned with your goals and comfort level. Consider how much capital you are willing to risk and how much volatility you are comfortable with.

Time Horizon

Another important factor to consider when choosing a gold trading strategy is your time horizon. Some strategies, such as day trading, require constant monitoring of the market and quick decision-making. Other strategies, such as position trading, can be more hands-off and require a longer time horizon.

Consider how much time you have available to devote to trading and choose a strategy that is aligned with your schedule and lifestyle.

Market Conditions

Consider the current market conditions and choose a strategy that is aligned with those conditions. For example, if the market is volatile and experiencing significant swings in price, a strategy that incorporates stop-loss orders and risk management may be more appropriate.

Experience Level

Your experience level as a trader can also impact your choice of trading strategy. Some strategies, such as day trading, require a significant amount of skill and experience to execute effectively. Other strategies, such as position trading, can be more forgiving for novice traders.

Consider your experience level and choose a strategy that is aligned with your level of skill and expertise.

Gold Trading Tips:

- Remember to keep the size of your gold trading positions in check;

- Everything is connected – factor in the bigger picture of the market;

- Check if an analyst’s approach is a good match for you;

- Stick with and monitor your chosen analyst’s performance;

- Pay attention to real interest rates;

- Analyze ratios;

- Analyze other time frames rather than just the one that you’re focusing on;

- Don’t assume that all techniques are useful;

- Be on a constant lookout for anomalies;

- Pay attention to extreme inflows or outflows from popular ETFs (like GLD or SLV);

- Monitor investor sentiment;

- Pick the right broker;

FAQ:

- How do I trade gold in Forex?

To trade gold in Forex, you first need to choose a broker that offers gold as a trading instrument. Then, you need to open a trading account and deposit funds. Once your account is funded, you can start trading gold by selecting XAU/USD (XAU is the symbol for gold and USD is the symbol for the US dollar) on the trading platform. You can then buy or sell gold based on your trading strategy.

- How much money do you need to trade gold in Forex?

The amount of money you need to trade gold in Forex depends on the margin requirements of your broker and the size of the position you want to open. Most brokers offer leverage, which means you can control a larger position with a smaller amount of capital. However, trading with leverage can also increase your risk.

- What is the best way to trade in gold?

The best way to trade gold depends on your trading style and risk tolerance. Some traders prefer to use technical analysis to identify trading opportunities, while others rely on fundamental analysis. It’s important to have a trading plan and to manage your risk carefully.

- Is gold Forex profitable?

Gold Forex trading can be profitable if you have a solid trading strategy and manage your risk carefully. However, like any investment, there is always a risk of losing money.

- What time is best to trade gold?

The best time to trade gold depends on the market conditions and your trading strategy. Gold trading is open 24 hours a day, 5 days a week, so there are always opportunities to trade. However, the most active trading hours are usually during the European and US trading sessions.

- Is trading gold Forex risky?

Trading gold Forex can be risky, as with any investment. Gold prices can be influenced by a variety of factors, including economic data, geopolitical events, and market sentiment. It’s essential to have a solid trading strategy and to manage your risk carefully.

- Can beginners trade gold?

Yes, beginners can trade gold. However, it’s important to start with a solid understanding of the basics of Forex trading and to develop a trading plan before risking real money.

- How much is 0.01 lot of gold?

The value of 0.01 lot of gold depends on the current market price of gold and the exchange rate of the currency pair you are trading.

- Can I trade gold on MT4?

Yes, you can trade gold on the MT4 platform. Many brokers offer gold as a trading instrument on the MT4 platform.

- How much are 100 pips in gold?

The value of 100 pips in gold depends on the lot size of the trade and the current market price of gold.

- How much are 50 pips in dollars?

The value of 50 pips in dollars depends on the lot size of the trade and the exchange rate of the currency pair you are trading.

- How much gold trades per day?

The amount of gold traded per day varies depending on market conditions, but it is estimated that around $ 150 billion worth of gold is traded in the Forex market each day.

- How much is XAU in USD?

The value of XAU in USD depends on the current market price of gold.

- What is the best indicator for gold?

The best indicator for gold depends on your trading strategy and style. Some popular indicators for trading gold include moving averages, Fibonacci retracements, and Bollinger Bands.

- What is the easiest way to trade gold?

The easiest way to trade gold is to use a Forex broker that offers gold as a trading instrument and to use a simple trading strategy.

- What is the best time to trade gold?

The best time to trade gold depends on your trading strategy and market conditions. Generally, the most active trading hours for gold are during the European and US trading sessions, but it’s important to monitor the market and adjust your trading plan accordingly.

- How to use gold as money?

Gold has historically been used as a form of money and a store of value. However, in modern times, gold is primarily traded as a commodity and investment asset. To use gold as money, you would need to exchange physical gold for goods or services, which can be difficult and impractical in today’s economy.

- How many grams is 1 XAU?

XAU is the symbol for gold and represents one troy ounce of gold, which is equal to 31.1 grams.

- Is XAU bearish or bullish?

The direction of XAU (gold) depends on market conditions and can be influenced by a variety of factors, such as economic data, geopolitical events, and market sentiment. XAU can be bullish (rising in price) or bearish (falling in price) depending on these factors.

- Is it good to trade gold at night?

Gold trading is open 24 hours a day, so it is possible to trade gold at night. However, the market conditions and liquidity can vary depending on the time of day, so it’s important to monitor the market and adjust your trading plan accordingly.

- Why can’t I trade gold?

There could be several reasons why you are unable to trade gold. One possibility is that your broker does not offer gold as a trading instrument. Another possibility is that your trading account does not have sufficient funds or margin to open a position in gold. It’s important to check with your broker and ensure that you have met all the requirements to trade gold in Forex.

Useful Video: How To Trade GOLD : 3 Secrets of GOLD Trading

References:

- https://www.valutrades.com/en/blog/5-tips-for-trading-gold-xau-usd

- https://www.vantagemarkets.com/academy/gold-strategy/

- https://www.axi.com/int/blog/education/gold-trading-strategies

- https://www.dailyfx.com/gold-price/how-to-trade-gold.html

- https://fbs.com/analytics/tips/gold-trading-strategies-13825

- https://www.goldpriceforecast.com/gold-trading-tips/

- https://www.thinkmarkets.com/en/market-news/december-2022/how-to-trade-gold-with-leverage/

- https://www.romania-insider.com/gold-vs-forex-making-best-investment-option-press-release

- https://www.investopedia.com/articles/investing/100915/learn-how-trade-gold-4-steps.asp

Leave a Review