When it comes to forex trading, there are many different concepts and terms that you need to familiarize yourself with. One of these is “free margin”. So, what exactly is free margin in Forex?

Free margin in forex is the amount of money that you have available in your account to open new trades. It is the difference between your equity (the total value of your account) and the margin (the amount of money required to open a trade) [1].

For example, let’s say you have an account with a balance of $5000 and you want to open a trade that requires a margin of $1000. This means that you have $4000 in the free margin ($5000 equity – $1000 margin).

It’s important to keep an eye on your free margin, because if it falls below a certain level, your broker may start to require you to deposit more money into your account (known as a “margin call”).

Below our Forex experts explain the concept of free margin in more detail and provide some useful tips on how to manage your free margin.

What Is Margin in Forex Trading?

Margin stands for the collateral (or security) that a trader must deposit with their broker in order to cover some of the risks they generate for the broker. It’s generally a fraction of a trading position, and it’s usually expressed as a percentage. Consider your margin to be like an upfront payment for all of your open transactions [2].

The maximum leverage you can use in your Forex trading account is determined by the margin required by your broker. As a result, trading with leverage is sometimes known as margin trading.

Margin trading has a wide range of consequences. It may provide you with better or worse results, but either way, the potential profits, and losses are greatly amplified.

How to Calculate Forex Margin?

Let’s assume a Forex trader requires 20 units of currency as a margin for every 20 units of money invested in an open position. This implies that one unit of the currency is required as a margin for every 20 items in an open position. To put it another way, if you want to take a $20 long trade, the margin would be $1. As a result, the margin, in this case, is 5% [3].

To put it another way, if we knew a broker wanted a margin of 10%, we could figure out how much margin we’d have to supply for every $10 we want to trade. In other words, in this case, you might leverage your position 1:10.

What Is Free Margin in Forex?

The margin requirement for Forex is the amount of money in a trading account that may be used to open new positions. It can be determined by subtracting the utilized margin from the equity in the account.

You may be asking – “What is an account equity?” The equity is the sum of the account balance and any unrealized gain or loss from open positions. When we say account balance, we’re referring to the total amount deposited in the trading account (which includes any used margin).

The above-mentioned facts imply that any unrealized profit or loss on open trades is included in the Forex free margin. This indicates that you can use this profit to establish new trading positions on your account by utilizing it as an additional margin to open new positions.

Forex Free Margin Example

Suppose, you have a $1000 account and put down $500 as margin for a long EUR/USD position. Assume that the current price of EUR/USD is trading at around $0.9050, and you’d like to buy one standard lot (100,000 units) of the currency pair.

The total value of your trade would be 100,000 * 0.9050 = $90,500 ($90,550 – actual value) [4].

Now let’s assume that after some time has passed, the price of EUR/USD increases to $0.9150. You decide to close your trade because you don’t want it to lose any more profit potential and book your unrealized profit of 100 pips (0.9150 – 0.9050).

What Is Margin Level in Forex?

The margin level in Forex is a crucial concept, which indicates the percentage of the equity to utilized margin. So, how is the margin level determined?

The following formula may be used to calculate the margin level: Forex Margin Level = (Equity / Used Margin) * 100

To decide whether Forex traders can open new positions, brokers utilize margin level. A margin amount of 0% indicates that the account currently has no open positions.

A margin level of 100 percent indicates that your account equity equals the amount of used margin. This generally implies that until you add more money to your account or your unrealized profits rise, no additional transactions can be made on it by the broker.

ESMA Trading Margin and Leverage Limits

On August 1, 2018, the European Securities and Markets Authority (ESMA) raised the required CFD margin for retail clients (non-professional traders) by imposing leverage restrictions on spread betting, Forex, and CFD products. The main goal of this distinction between retail and professional investors is to safeguard less experienced traders from catastrophic losses resulting from high leverage.

On the Forex markets, retail traders have a maximum leverage of 1:30, which translates to a margin requirement of 3.33 percent.

Free Margin vs Used Margin

The overall amount of required margin from all of your open positions is referred to as “margin”. The gap between equity and used margin — the available margin not used by current positions — is known as free margin. You can utilize free margin to establish new forex market positions [5].

Margin vs Free Margin

The amount of margin in a trading account is the number of funds in the account currency that is kept open by a broker. The remainder of the equity in your account is known as free margin. The amount of funds in a trading account is different from the account equity. The funds include all deposits, both realized and unrealized profits or losses, and credit lines used [6].

The free margin is what allows you to open new positions. If your free margin drops to zero, it means that your account can no longer support any new trades. You will have to either deposit more money into the account or close some positions to reduce the overall margin requirements. In other words, when your free margin equals zero, you will no longer be able to take on any new leveraged trades.

FAQ

What happens when the free margin is 0?

The amount of money in your account that is not “locked up” owing to an open position, and can be used to create new ones. When the free margin is zero or less, additional positions cannot be opened [7].

What is the difference between margin and free margin in Forex?

Margin is the amount of money needed to open a position, and is taken from your account balance. Free margin is the amount of your account balance that is not “locked up” in an open position and can be used to open new ones. Therefore, free margin = account balance – margin.

For example, you have a $1000 account balance and you want to buy $100 worth of EUR/USD. The required margin for this trade would be $100 (or one percent of the total value of the trade). This leaves you with $900 in your account that can be used for other trades or withdrawn.

If your positions begin to lose value and approach zero, you will receive a margin call from your broker asking you to deposit more money or close out your positions to avoid having your account “go negative”.

What happens if my free margin is negative?

The difference between the required and available margin is known as free margin. This amount can change depending on the trader’s requirements, but, in general, it refers to money that will be used by the trader to establish new orders. Brokers determine whether a customer may place new orders or not based on the trader’s margin level. Traders should bear in mind that if their outstanding losses exceed margin requirements, the free margin might become negative [8].

This happens when the losses incurred by a trader are greater than the amount of money in their account. In such cases, brokers typically liquidate the trader’s position to cover the margin deficit.

It is important for traders to know that once their free margin reaches zero or falls into negative territory, they will no longer be able to place any new orders. This is because, at this point, all of the available funds have been used up and there is nothing left to support any additional positions.

Consequently, if a trader’s free margin becomes negative, it is essential that they take steps to reduce their exposure and bring it back into positive territory as soon as possible.

What is a good margin level in Forex?

The easiest way to tell whether your account is healthy or not is to make sure that your Margin Level is always greater than 100%. This means that as long as your equity is greater than your used margin, you will never be “Margin Called”.

Some brokers choose to set their own minimum margin level requirements, but the industry standard is a Margin Level of 100%. Anything lower than this and you may start receiving margin calls from your broker.

A good rule of thumb is to never use more than 20% of your account’s total equity at any one time. So, if you have $100 in your account, you should only ever be using $20 to place trades. This will help keep your account safe and ensure that you don’t blow all your capital in one go [9].

What is the best leverage level for a beginner?

The perfect beginning for anybody who is new to Forex is to use 1:10 leverage and a 10,000 USD balance. As a result, the finest leverage for a novice should not exceed 1:10. If you want to get started with a lower amount of money, you can use higher leverage, but be mindful of the inherent risks.

Leverage is an important concept in Forex trading. It allows traders to open positions that are larger than what their account balance would otherwise allow. In other words, it allows traders to control more money than they have in their accounts. Leverage is expressed as a ratio, and the higher the ratio, the more leverage a trader has.

For example, if a trader has a $100 account and opens a position with 100:001 leverage, they are effectively controlling $100,000 worth of currency.

How do you pay back the margin?

Margin loans, like margin trading, are geared toward investors. As a result of the extra risk associated with investing in other people’s money or buying an investment on margin, interest rates on margin loans are generally lower than those on credit cards and unsecured personal loans.

There is no set repayment plan for a margin loan; monthly interest charges accrue to your account, and you may pay off the principal at your leisure [10].

Can I withdraw money from a margin account?

You can use margin to borrow against the value of your account and take out cash payments in the form of a short-term loan. A margin account may be quite beneficial and cost-effective for investors who want to leverage their positions [11].

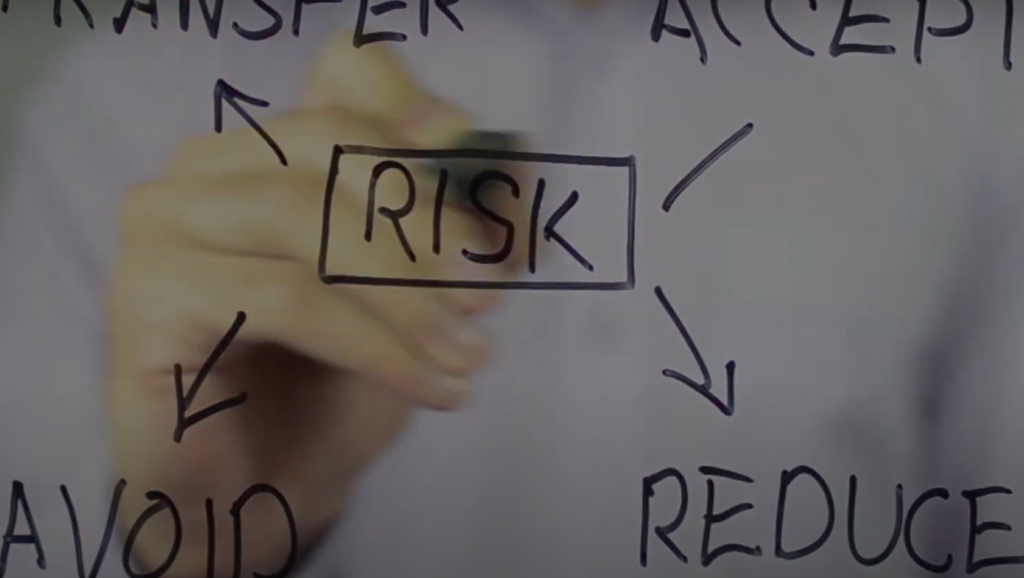

How do you avoid margin calls in Forex?

The best way to avoid a margin call is to use stop-loss orders. A stop-loss order is an order placed with a broker that exits the trade if it reaches a certain price.

For example, if you buy EUR/USD at $100 and place a stop-loss at $95, your position will be automatically closed by the broker if EUR/USD falls to $95. This limits your losses and protects your account from being wiped out by a sudden market move [12].

What is a safe level of margin for my Forex trading account?

Most brokers will require you to maintain a minimum margin level, typically between 0.50% and 20%. This means that if your account balance falls below this level, you will be subject to a margin call.

It is important to note that while leverage can help you gain exposure to larger position sizes, it also magnifies your losses. As a result, it is important to use stop-loss orders and limit your leverage to an amount that you are comfortable with.

What if my margin level runs low without me noticing?

If your margin level falls below the minimum required by your broker, you will be subject to a margin call.

A margin call is a demand from your broker for you to deposit more money or close out your positions in order to bring your account back up to the minimum required level.

If you do not meet the margin call, your broker may close out your positions.

How much margin do I need to trade at Forex?

The amount of margin you need to trade depends on the leverage you’re using. Leverage is a way to use borrowed money to increase your potential return on investment.

For example, if you’re using 100:001 leverage and trading one lot (100,000 units) of EUR/USD, your margin would be $100.

If the price of EUR/USD moves against you by 100 pips (0.0001), you would lose $100 (or 100%). To avoid this, most brokers require that traders maintain a certain amount of equity in their accounts, known as a margin requirement. This ensures that traders can cover their losses.

Margin requirements vary from broker to broker and can change depending on market conditions. For example, the margin requirement for EUR/USD might be 0.25%, meaning you would need to have $250 in your account for every $100,000 you wanted to trade. Some brokers offer lower margin requirements, but they may also charge higher fees.

It’s important to know that trading on margin is not suitable for everyone and carries a high level of risk. You should only trade with money you can afford to lose. Before trading, please carefully consider your financial objectives, experience level, and risk tolerance.

Useful Video: 15 What is Free Margin? – FXTM Learn Forex in 60 Seconds

References:

- https://www.fortrade.com/glossary/free-margin/

- https://www.investopedia.com/terms/m/margin.asp

- https://admiralmarkets.com/education/articles/forex-basics/margin-in-forex-trading-margin-level-vs-margin-call

- https://www.sofi.com/learn/content/free-margins

- https://www.tier1fx.com/faq/what-is-the-difference-between-margin-free-margin-and-margin-level

- https://get.exness.help/hc/en-us/articles/4402652706322-What-is-the-difference-between-margin-and-free-margin

- https://www.babypips.com/learn/forex/what-is-free-margin

- https://hercules.finance/faq/what-happens-if-i-have-no-free-margin-left-in-my-account-will-my-positions-be-liquidated

- https://www.forextime.com/education/videos/what-is-margin-level

- https://www.schwab.com/learn/story/margin-how-does-it-work

- https://www.investopedia.com/ask/answers/100314/whats-difference-between-cash-account-and-margin-account.asp

- https://www.babypips.com/learn/forex/how-to-avoid-margin-call

Leave a Review