Forex trading has become increasingly popular over the years, with more people trying their hand at trading currencies. The promise of making substantial profits from the comfort of one’s home has attracted many individuals to the market. However, the reality is that forex trading can be a challenging and unpredictable activity, and it is not always easy to determine how much one can make from it.

Forex traders come from various backgrounds, from experienced professionals to beginners with little knowledge of the market. Each trader has their own unique trading strategy, which influences their earning potential. Therefore, it is essential to understand the factors that affect forex trading profitability to determine how much a forex trader can realistically make.

In this article, we will explore the various factors that influence forex trading profits, such as market volatility, leverage, and risk management. We will also discuss the different types of forex traders and their earning potential, including day traders, swing traders, and position traders.

What Do I Need To Be a Successful Day Trader:

- Risk Involved: Day trading involves a significant amount of risk as traders make multiple trades in a single day, often with high leverage. It is important for traders to have a solid risk management plan to limit potential losses;

- Knowledge Investment: Successful day traders invest time and effort in educating themselves about the financial markets, technical analysis, trading strategies, and risk management. Traders need to be able to read charts, understand market trends, and analyze market data to make informed trading decisions;

- Discipline: Day trading requires discipline and emotional control. Traders need to be able to stick to their trading plan, manage their emotions, and avoid impulsive decisions. Successful day traders also have a routine and stick to a schedule, which helps them stay focused and disciplined;

What Makes Professional Forex Traders Different From Beginners:

Trading For A Hedge Fund

Trading for a hedge fund is one of the most challenging and rewarding jobs for a Forex trader. These professionals work for firms that manage large amounts of money for investors. Hedge funds are known for their aggressive trading strategies and the ability to generate high returns. Professional Forex traders who work for hedge funds are often the cream of the crop, with extensive experience, knowledge, and education.

Another key factor that sets professional Forex traders apart is their trading strategy. Hedge funds typically employ multiple trading strategies to maximize profits and minimize risk. Professional traders who work for hedge funds are skilled at analyzing market data and identifying trends. They use a range of technical and fundamental analysis tools to identify potential trades and make informed decisions.

Risk management is another critical factor that sets professional Forex traders apart from beginners. Hedge fund traders are responsible for managing large amounts of money and minimizing risk for their investors. They use a range of risk management techniques, such as stop-loss orders, to limit potential losses. They also diversify their portfolios and use hedging strategies to reduce risk.

One of the biggest advantages of trading for a hedge fund is access to resources. Hedge funds have access to real-time market data, sophisticated trading platforms, and research tools. They also have teams of analysts and traders who work together to identify trading opportunities and manage risk. This allows professional traders to make informed decisions and act quickly on market changes.

Traders Who Work For Themselves

Another category of professional Forex traders is those who work for themselves. These traders are self-employed and trade their own money. They do not have the resources of a hedge fund, but they have more freedom and flexibility in their trading strategy.

One of the main differences between self-employed Forex traders and beginners is their level of experience. Successful self-employed traders have years of experience trading in the Forex market. They have a deep understanding of the market and are skilled at analyzing market data.

Another factor that sets self-employed traders apart is their trading strategy. Successful self-employed traders have a well-defined trading plan that includes entry and exit points, risk management strategies, and a clear understanding of their trading goals. They use a range of technical and fundamental analysis tools to identify potential trades and make informed decisions.

Risk management is also critical for self-employed traders. They are responsible for managing their own money and must be diligent in minimizing risk. They use a range of risk management techniques, such as stop-loss orders, to limit potential losses. They also diversify their portfolios and use hedging strategies to reduce risk.

One of the main advantages of self-employed Forex traders is the flexibility and freedom that comes with trading for themselves. They can set their own schedule and work from anywhere in the world. They also have complete control over their trading strategy and can make decisions without the constraints of a hedge fund.

How Forex Traders Make Money:

- Calculate Your Potential Returns

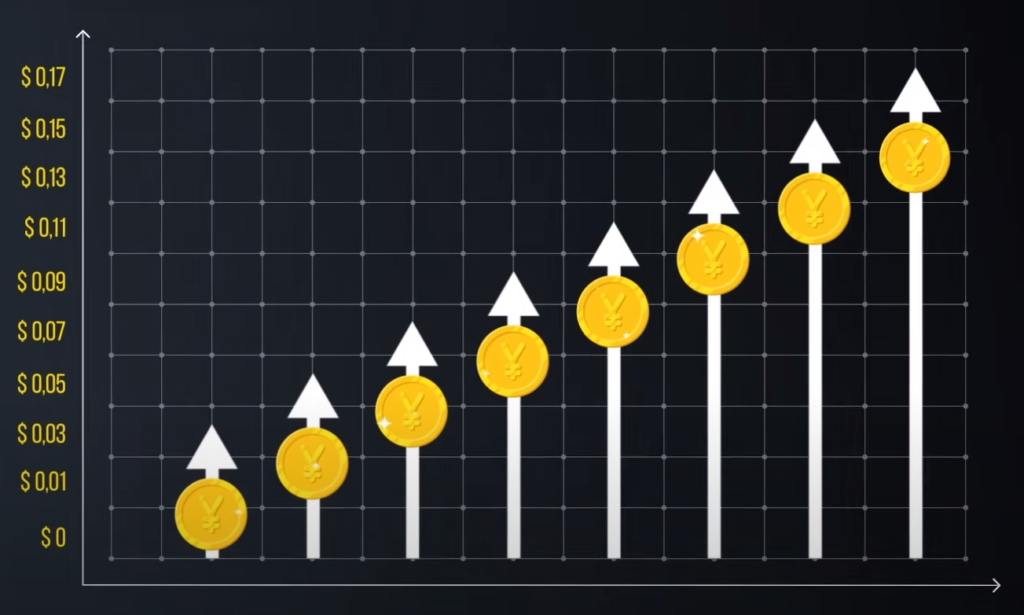

The first step in making money through forex trading is to calculate your potential returns. Forex traders make profits by buying currencies at a low price and selling them at a higher price. The difference between the buying price and the selling price is known as the spread. The larger the spread, the more profit you can make. However, the spread is not the only factor that determines your potential returns. You also need to consider the leverage you use, the size of your trades, and the volatility of the currency pair you are trading.

- Play More to Win More

One of the best ways to increase your potential returns in forex trading is to trade more frequently. The more trades you make, the more opportunities you have to profit. However, this does not mean you should trade blindly. It is important to have a solid trading strategy and to stick to it. This includes setting stop-loss orders to limit your losses and taking profits at predetermined levels.

- Larger Capital Means More Gains

Another way to increase your potential returns in forex trading is to trade with larger capital. The more money you have, the more you can invest in each trade, which can lead to larger profits. However, this also increases your risk. It is essential to manage your risk by diversifying your trades and not risking more than you can afford to lose.

- Find Out the Costs of Trading

To make money in forex trading, you need to understand the costs involved. Forex brokers make money by charging a commission on each trade or by marking up the spread. Some brokers also charge additional fees for withdrawals or deposits.

- Paying Taxes on Forex Trading

Forex trading is subject to taxes in most countries. The tax laws vary depending on your country of residence. In the United States, forex trading is taxed as ordinary income or capital gains, depending on the length of time you hold the currency. If you hold the currency for less than a year, it is taxed as ordinary income. If you hold it for more than a year, it is taxed as capital gains.

- Individual Filers

Individual filers in the United States are taxed at different rates depending on their income level. The tax rate ranges from 10% to 37% for ordinary income and from 0% to 20% for long-term capital gains. It is important to keep accurate records of your trades and to consult with a tax professional to ensure you are complying with all tax laws.

- Filing Jointly

If you are married and file jointly, your tax rate will be based on your combined income. The tax rate ranges from 10% to 37% for ordinary income and from 0% to 20% for long-term capital gains.

- Determine Your Forex Salary

Once you have calculated your potential returns and understood the costs involved, you can determine your forex salary. Your forex salary is the amount of money you can expect to make from forex trading in a given period, such as a month or a year. This will depend on your trading strategy, the size of your trades, and the volatility of the currency pair you are trading.

To determine your Forex salary, you need to subtract the costs of trading from your potential returns. This includes any commissions, spreads, and fees charged by your broker, as well as any taxes you need to pay. Once you have deducted these costs, you can determine your net profit.

To increase your chances of success in forex trading, it is important to have a solid understanding of the market and to develop a strong trading strategy. This includes setting clear entry and exit points, managing your risk, and having a disciplined approach to trading.

How Much Can a Forex Trader Make in 5 Years?

The amount of money a forex trader can make in five years depends on a variety of factors, including their trading strategy, the size of their trades, their level of experience, and the volatility of the currency pairs they are trading. It is impossible to predict with certainty how much money a trader will make in five years, as the forex market is highly unpredictable and subject to sudden changes.

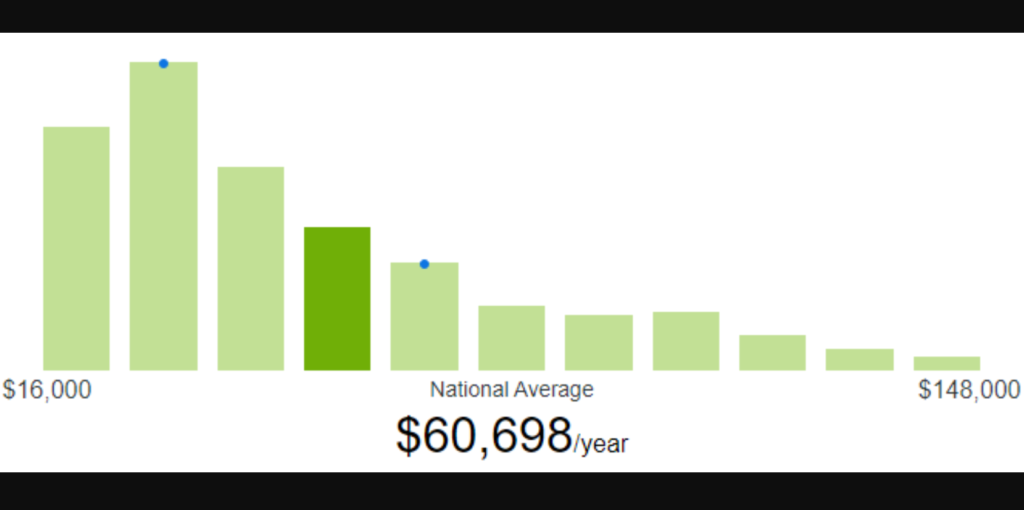

However, it is possible to estimate the potential earnings of a forex trader based on historical performance and industry benchmarks. According to a survey conducted by the Investment Trends research firm, the average forex trader in the United States makes an annual profit of $ 77,000. This includes both full-time and part-time traders, and the figures vary widely depending on the level of experience and trading volume.

Assuming a conservative estimate of $ 50,000 in annual profits, a forex trader could potentially earn $ 250,000 over a five-year period [1]. However, this figure does not take into account the costs of trading, including broker commissions, spreads, and taxes. It is important to factor in these costs when estimating potential earnings, as they can significantly impact overall profitability.

Is Making Money in Forex Risky?

Forex trading, like any form of trading, involves a certain level of risk. It is important for traders to understand the risks involved before entering the Forex market. However, it is possible to make money in Forex trading if proper risk management techniques are employed.

One of the biggest risks in Forex trading is leverage. Leverage allows traders to control a large amount of money with a small deposit. While this can increase potential profits, it also increases potential losses. Traders must use proper risk management techniques to limit their exposure to losses when using leverage.

Another risk in Forex trading is the win rate. Even the most successful traders will have losing trades, and it is important to manage these losses to protect capital. A lower win rate does not necessarily mean a trader cannot make money, as long as the losses are managed properly.

Currency pairs can also be risky. Some currency pairs are more volatile than others, and traders must be aware of the risks involved with each pair. Additionally, political and economic events can impact currency pairs, making them riskier to trade.

Finally, the “loop of losses” can be a risk in Forex trading. When traders experience losses, they may become emotional and make irrational decisions. This can lead to further losses, creating a cycle that is difficult to break. Traders must maintain discipline and use a trading plan to avoid the loop of losses.

How to Change Your Risk/Reward Ratio:

1) Using Leverage One of the primary reasons why Forex trading is considered risky is because of the high leverage that is used in this market. Leverage is a tool that allows traders to control a large amount of money with a relatively small investment. For example, if a broker offers a 1:100 leverage, a trader can control a $ 100,000 position with a $ 1,000 investment.

To change the risk/reward ratio, traders can adjust their leverage. Lower leverage will result in a lower potential profit but also a lower potential loss, while higher leverage will result in a higher potential profit but also a higher potential loss. Traders should choose leverage that is appropriate for their risk tolerance and trading strategy.

2) Win Rate

Another factor that affects the risk in Forex trading is the win rate. The win rate is the percentage of profitable trades out of all trades taken. For example, if a trader takes 10 trades and 6 of them are profitable, the win rate is 60%.

While a high win rate may seem desirable, it is not always an indicator of profitable trading. A high win rate can be achieved by taking small profits and large losses, which can result in a net loss. Therefore, it is essential to consider the risk/reward ratio along with the win rate.

Traders should aim to have a high win rate and a positive risk/reward ratio. This means that the potential profit of a trade should be larger than the potential loss, and the win rate should be high enough to generate a profit over a series of trades.

3) Risky Currency Pairs

Another factor that can increase the risk in Forex trading is the choice of currency pairs. Some currency pairs are more volatile than others, and they can have wider price fluctuations, which can increase the potential profits but also the potential losses.

Currency pairs that involve exotic or emerging market currencies are generally more volatile and riskier than major currency pairs. Traders should be aware of the risks involved in trading these currency pairs and adjust their position size and leverage accordingly.

4) Loop of Losses

One of the biggest risks in Forex trading is the loop of losses. This happens when a trader experiences a series of losses and tries to recover the losses by taking larger positions or increasing the leverage. This can result in even larger losses and can wipe out the trader’s account.

To avoid the loop of losses, traders should have a trading plan and stick to it. They should also have a risk management strategy that includes setting stop-loss orders and limiting the position size. Traders should also be disciplined and avoid emotional trading, which can lead to impulsive decisions and losses.

Is Forex Riskier Than Stocks?

Forex trading and stock trading are different markets, and they have different risks and opportunities. Forex trading is more leveraged, and therefore, the potential for both profits and losses is higher than in stock trading. However, Forex trading is also more liquid than stock trading, meaning that traders can enter and exit positions more easily and at any time.

Therefore, it is not possible to say that Forex trading is riskier than stock trading. The risks and opportunities in each market depend on various factors, including the trader’s experience, trading strategy, and risk management.

How to Get a Stable Income in Forex?

While Forex trading can be risky, it is possible to make a stable income from it by following certain guidelines.

Here are some tips for getting a stable income in Forex trading:

- Develop a trading plan: A trading plan is a set of rules that dictate when to enter and exit trades, what currency pairs to trade, and how much to risk on each trade. A trading plan can help traders avoid emotional trading and make objective decisions based on their trading strategy;

- Use proper risk management: Proper risk management involves setting stop-loss orders, limiting position size, and avoiding over-leveraging. Traders should only risk a small percentage of their account balance on each trade, typically between 1-2%;

- Focus on the long-term: Forex trading is not a get-rich-quick scheme. Traders should focus on the long-term and aim to make consistent profits over time. This requires patience, discipline, and a sound trading strategy;

- Stay informed: Traders should stay informed about the latest news and market trends that can affect the currency pairs they trade. This can help them make informed trading decisions and avoid sudden price movements that can result in losses;

- Practice on a demo account: Before trading with real money, traders should practice on a demo account. A demo account is a simulated trading environment that allows traders to test their trading strategy and get familiar with the trading platform without risking real money [2];

Forex Funded Account Vs. Individual Trading

Individual trading, on the other hand, involves trading on your own account with your own funds. Individual traders are responsible for their own capital, trading decisions, and trading costs. While individual trading offers more independence, it also involves more risk and requires more discipline.

Pros and Cons of Forex-Funded Trading Accounts:

Pros:

- Access to significant capital;

- Reduced trading costs;

- Support from experienced traders;

- Risk management;

Cons:

- Profit sharing;

- Limited control;

- Competitive selection process;

- Limited opportunities;

Pros and Cons of Individual Trading:

Pros:

- Independence;

- Profit retention;

- Flexible trading schedule;

- Unlimited opportunities;

Cons:

- Capital requirements;

- Higher trading costs;

- Lack of support;

- Higher risk;

How to Calculate Your Potential Forex Income Correctly?

Step 1: Determine Your Trading Strategy

The first step in calculating your potential Forex income is to determine your trading strategy. Your trading strategy should be based on your trading style, risk tolerance, and market conditions. There are several trading strategies that you can use in Forex trading, including:

- Day trading: Day traders open and close positions within the same trading day;

- Swing trading: Swing traders hold positions for several days to several weeks;

- Position trading: Position traders hold positions for several months to several years;

Your trading strategy will determine the number of trades you make, the size of your trades, and your potential profits.

Step 2: Calculate Your Trading Costs

The next step in calculating your potential Forex income is to calculate your trading costs. Trading costs include spreads, commissions, and other fees charged by your broker. These costs can vary significantly between brokers and can have a significant impact on your profits.

To calculate your trading costs, you should first determine the spreads and commissions charged by your broker. The spread is the difference between the bid and ask price of a currency pair, while the commission is the fee charged by your broker for each trade.

For example, if your broker charges a spread of 1 pip on the EUR/USD currency pair and a commission of $ 5 per lot, your trading costs would be $ 15 for a 3-lot trade (1 pip spread x 3 lots + $ 5 commission x 3 lots). [3]

Step 3: Determine Your Risk/Reward Ratio

The third step in calculating your potential Forex income is to determine your risk/reward ratio. The risk/reward ratio is the ratio between your potential profit and your potential loss for each trade. A good risk/reward ratio is typically 1:2 or higher, meaning that your potential profit is at least twice your potential loss.

For example, if you place a trade with a potential profit of $ 300 and a potential loss of $ 150, your risk/reward ratio would be 1:2 (potential profit/potential loss).

Step 4: Calculate Your Potential Profits

The final step in calculating your potential Forex income is to calculate your potential profits. To do this, you need to determine the size of your trades and the number of trades you plan to make.

For example, if you plan to make 10 trades per week with an average trade size of 3 lots, and your risk/reward ratio is 1:2, your potential profits would be [4]:

Potential profit per trade = (2 x potential loss per trade) = (2 x $ 150) = $ 300

Total potential profit per week = (potential profit per trade x number of trades) = ($ 300 x 10) = $ 3,000

It’s important to note that these calculations are only estimates, and your actual profits may differ based on market conditions, your trading strategy, and your risk management techniques.

Do I Pay Taxes From My Forex Income?

In the United States, Forex trading is subject to different tax regulations than other financial markets, such as stocks and futures. Forex traders are required to report their profits and losses to the Internal Revenue Service (IRS) on an annual basis.

Here are some key things to keep in mind:

- Forex trading profits are treated as ordinary income: In the United States, Forex trading profits are treated as ordinary income and are subject to income tax at your individual tax rate;

- Capital gains tax may apply: If you hold Forex positions for longer than a year, you may be subject to capital gains tax instead of ordinary income tax. Capital gains tax rates are generally lower than ordinary income tax rates;

- Deductions may apply: Forex traders may be eligible to deduct trading-related expenses, such as trading platform fees, data fees, and educational materials;

- Form 1099: Forex brokers in the United States are required to provide traders with a Form 1099 at the end of the tax year, which outlines the trader’s profits and losses;

- Quarterly estimated taxes: Forex traders in the United States may be required to make quarterly estimated tax payments if they expect to owe more than $ 1,000 in taxes for the year [5];

It’s essential to keep detailed records of all your Forex trading activities, including profits, losses, and expenses, to accurately report your tax obligations. Failure to report Forex trading profits to the IRS can result in penalties and fines.

Mistakes and Fallacies of Traders that Prevent Them from Earning:

Starting Bidding with a Large Amount of Money

One common mistake traders make is starting bidding with a large amount of money. This strategy is based on the idea that the more money you invest, the more profit you can earn. However, a risky strategy can lead to significant losses.

Trading on Intuition

Another common mistake traders make is trading on intuition. Trading based on gut feelings or emotions is a recipe for disaster. It is essential to have a well-defined trading strategy that is based on sound analysis and risk management.

A trading strategy should include clear entry and exit points, as well as stop-loss orders to limit losses. Emotions such as fear and greed can cloud judgment and lead to poor decision-making. By following a well-defined strategy, traders can remove emotions from the equation and make rational trading decisions [6].

Training Course as a Guarantee of Success

Many traders believe that taking a training course is a guarantee of success. While education is essential, it is not a guarantee of success in trading. Trading requires practical experience, discipline, and a willingness to learn from mistakes.

It is important to approach trading as a learning experience and to constantly seek out new knowledge and skills. Traders should be open to new ideas and strategies and be willing to adapt their approach as market conditions change.

Bonus Betting

Traders may also fall into the trap of bonus betting. Bonus betting is the practice of taking advantage of bonuses offered by brokers to increase trading volume. This strategy can lead to overtrading and excessive risk-taking, which can ultimately result in significant losses.

Brokers offer bonuses to attract new clients, and traders should not make decisions based solely on bonus offers. It is important to carefully consider the terms and conditions of any bonus offer and to use it in a responsible manner.

Having Financial/Economic Education

Having a financial or economic education is not a prerequisite for trading, but it can be an advantage. Understanding economic fundamentals and financial markets can help traders make informed decisions and develop effective trading strategies.

Traders should be willing to invest time and effort in learning about the markets and the factors that influence them. This knowledge can be gained through reading books, attending seminars, and following reputable financial news sources.

The Pursuit of Quick Profits

Many traders are motivated by the pursuit of quick profits. This approach can lead to impulsive decision-making and excessive risk-taking. It is essential to have a long-term perspective and to focus on consistent, sustainable profits.

Endless News Tracking

Finally, traders may fall into the trap of endless news tracking. While it is important to stay informed about economic and political events that can affect the markets, it is also important to avoid getting caught up in the daily news cycle.

News events can create volatility in the markets, but it is important to maintain a long-term perspective and not be swayed by short-term fluctuations. Traders should focus on developing a sound trading strategy based on fundamental analysis and risk management, rather than reacting to every news event.

FAQ:

- How much do Forex traders make in a year?

The amount of money a Forex trader can make in a year varies depending on their trading strategy, risk management, and market conditions. While some traders may make a significant amount of money, others may struggle to break even or lose money. According to a survey by the European Central Bank, the median annual income of Forex traders in Europe was around € 40,000 in 2018 [7].

- How many hours of trading per day do you need to make money on Forex?

The number of hours a trader needs to spend trading per day to make money on Forex varies depending on their trading strategy and market conditions. Some traders may spend several hours a day analyzing the market and placing trades, while others may only need to spend a few minutes a day. It is important to develop a trading strategy that works for individual circumstances and to stick to it.

- Can a Forex trader make a living?

Yes, it is possible for a Forex trader to make a living, but it is not easy. Trading Forex requires a significant amount of knowledge, skill, and discipline, and there is always a risk of losing money. Successful Forex traders typically have a well-defined trading strategy, a solid understanding of risk management, and the ability to control their emotions.

- Who is the richest Forex trader?

The richest Forex trader is not publicly known, as Forex traders’ income is not publicly disclosed. However, some famous Forex traders include George Soros, who made a $ 1 billion profit in a single day in 1992, and Stanley Druckenmiller, who worked with Soros and made a significant profit from the same trade [8].

- How much profit on $ 100 in Forex?

The amount of profit a trader can make on $ 100 in Forex depends on their trading strategy, leverage, and market conditions. For example, if a trader uses high leverage and makes a successful trade, they could potentially make a significant profit, but if the trade goes against them, they could lose the entire $ 100 and more. It is important for traders to use the proper risk management and not risk more than they can afford to lose.

- Is $ 1000 enough to trade Forex?

Yes, $ 1000 is enough to trade Forex, but it is important to use the proper risk management and not risk more than a small percentage of the account balance on each trade. Traders should also consider the cost of trading, such as spreads and commissions when deciding how much to invest.

- How much can I make with $ 5000 in Forex?

The amount a trader can make with $ 5000 in Forex depends on their trading strategy, risk management, and market conditions [9]. Some traders may make several hundred dollars per month, while others may make several thousand dollars. It is important to have realistic expectations and to use proper risk management to avoid significant losses.

- How to grow $ 100 USD in Forex?

To grow $ 100 in Forex, traders need to develop a solid trading strategy and practice proper risk management. This includes using proper position sizing, setting stop-loss orders, and having a clear exit strategy. Traders can also consider using leverage to potentially increase their profits, but this also increases the risk of significant losses.

- What is the $ 100 lot size in Forex?

A lot size in Forex refers to the size of a trading position. A standard lot size is 100,000 units of the base currency, while a mini lot size is 10,000 units, and a micro lot size is 1,000 units. Therefore, a $ 100 lot size in Forex would be a micro lot size.

- What is the 90% rule in Forex?

The 90% rule in Forex refers to the idea that 90% of retail Forex traders lose money [10]. This is due to a variety of factors, including lack of knowledge, poor risk management, and emotional trading. It is important for traders to educate themselves and develop a solid trading plan to avoid falling into this statistic.

- Who is the youngest rich Forex trader?

The identity of the youngest rich Forex trader is not publicly known, as Forex traders’ income is not publicly disclosed. However, many successful Forex traders started trading at a young age and have made significant profits.

- How long can Forex make you rich?

The amount of time it takes to become rich through Forex trading varies depending on individual circumstances, such as trading strategy, risk management, and market conditions. It is important to have realistic expectations and to develop a long-term trading plan. It is also vital to remember that there is always a risk of losing money in Forex trading.

- Can I make Forex a full-time job?

Yes, it is possible to make Forex a full-time job, but it requires a significant amount of knowledge, skill, and discipline. It is important to have a well-defined trading strategy, solid risk management, and the ability to control emotions. Traders should also have realistic expectations and be prepared for the possibility of losing money.

- How much can a Forex beginner earn in trading?

The amount a Forex beginner can earn in trading varies depending on individual circumstances, such as trading strategy, risk management, and market conditions. It is important for beginners to start with a demo account to practice trading strategies before investing real money in a live trading account. With proper education, practice, and discipline, beginners can potentially earn profits from Forex trading.

- What is the highest Forex salary?

The highest Forex salary is not publicly disclosed, as traders’ income is not publicly available. The amount a trader can earn from Forex trading depends on their trading strategy, risk management, and market conditions. It is also important to remember that income from Forex trading is not guaranteed, and there is always a risk of losing money.

- Why do 95% of Forex traders lose money?

95% of Forex traders lose money due to a variety of factors, including lack of knowledge, poor risk management, and emotional trading. Many traders enter the market with unrealistic expectations, and they do not have a well-defined trading plan. Additionally, the Forex market is complex and unpredictable, which can lead to significant losses for inexperienced traders.

Useful Video: Forex Trading For Beginners – Can You Really Make Money?

References:

- https://www.audacitycapital.co.uk/trading-guides/forex-for-beginners/how-much-forex-traders-make/

- https://www.forex.in.rs/forex-traders-income/

- https://www.tradingwithrayner.com/how-much-money-can-you-make-from-forex-trading/

- https://tokenist.com/investing/how-much-do-forex-traders-make/

- https://tradersunion.com/how-much-can-you-earn/

- https://www.thebalancemoney.com/how-much-money-can-i-make-forex-day-trading-1031013

- https://www.litefinance.org/blog/for-beginners/how-much-do-forex-traders-make-per-month/

- https://www.indeed.com/career/foreign-exchange-trader/salaries

- https://www.valutrades.com/en/blog/how-much-money-do-the-top-forex-traders-make

- https://www.investopedia.com/articles/forex/073115/can-forex-trading-make-you-rich.asp

Leave a Review