One of the essential concepts in forex trading is equity. Equity refers to the value of an account after all the profits and losses have been realized. In other words, it is the amount of money that a trader has in their account to continue trading. Equity is calculated by adding the account balance and the floating profit or loss. The account balance is the amount of money that a trader has deposited into their trading account, while the floating profit or loss is the unrealized profit or loss from open positions.

Understanding equity is crucial in forex trading as it determines the amount of risk that a trader can take. The higher the equity, the more significant the position size a trader can take, and the more significant the potential profit or loss.

However, a trader should always consider their risk tolerance and trading strategy when deciding the position size, as larger positions also mean larger risks. Equity management is a crucial aspect of forex trading, and traders should aim to preserve their equity by minimizing their losses and maximizing their profits.

What Does Equity in Forex Refer To?

In forex trading, equity refers to the value of a trader’s account after considering the profits and losses from closed and open trades [1]. It is the net worth of a trader’s account at any given time. Equity is an important metric in forex trading as it directly affects a trader’s ability to take on risk and determine position sizes. A trader with higher equity can take on more risk and larger position sizes than a trader with lower equity.

It’s important for Forex traders to closely monitor their equity and adjust their trading strategies as necessary to manage risk and maintain a sustainable level of equity. Traders can use equity stop-loss orders to automatically exit trades when their equity reaches a certain level, or they can manually adjust their position sizes based on their equity to ensure they are not risking more than they can afford to lose.

How Can Equity in Forex Can Be Applied?

Equity in forex trading can be applied in several ways to manage risk and maximize profitability.

Here are some examples:

- Position sizing: A trader’s equity directly affects their ability to take on risk and determine position sizes. As a general rule, traders should not risk more than 1-2% of their equity on any single trade. By adjusting their position sizes based on their equity, traders can ensure they are not risking more than they can afford to lose;

- Risk management: Equity can also be used to set risk management parameters such as stop-loss orders. A trader can set a stop-loss order at a certain percentage of their equity to limit their losses and protect their account from being wiped out by a single trade;

- Margin requirements: Equity is also used to calculate margin requirements. Margin is the amount of money required to open and maintain a position, and it is calculated as a percentage of the position size. Traders with higher equity can take on larger positions while maintaining the same margin requirement as a trader with lower equity;

- Trading psychology: Equity can also have a psychological impact on traders. Traders with high equity may be more confident and willing to take on higher-risk trades, while traders with low equity may become fearful and hesitant to enter trades. It’s important for traders to maintain a balanced approach to risk and not let their equity levels dictate their trading decisions [2];

How To Calculate Equity:

How to Calculate Equity If You Have No Trades Open

If you have no open trades, calculating your equity is relatively straightforward. Equity is equal to the sum of your account balance and any profits or losses from closed trades.

Let’s break this down into a formula:

Equity = Account Balance + Closed Trade Profits/Losses

For example, if your account balance is $ 10,000 and you made a profit of $ 1,000 on a closed trade, your equity would be $ 11,000 ($ 10,000 + $ 1,000).

It’s important to note that if you have any pending orders (such as limit orders or stop-loss orders) that have not yet been filled, they will not affect your equity until they are executed.

How to Calculate Equity If You Have Trades Open?

Calculating equity becomes slightly more complicated when you have open trades. Equity is still equal to the sum of your account balance and any profits or losses from closed trades, but you also need to take into account any unrealized profits or losses from your open trades.

Let’s say you have two open trades: one is a long position on XYZ stock and the other is a short position on ABC stock. Your account balance is $ 10,000, and you made a profit of $ 1,000 on a closed trade.

To calculate your equity, you would use the following formula [3]:

Equity = Account Balance + Closed Trade Profits/Losses + Unrealized Profits/Losses

To calculate the unrealized profit or loss on each open trade, you need to use the following formula:

Unrealized Profit/Loss = (Current Market Price – Opening Price) x Position Size x Contract Size

Let’s break down this formula further:

- Current Market Price: The current price of the asset you are trading;

- Opening Price: The price at which you opened the trade;

- Position Size: The number of units of the asset you are trading;

- Contract Size: The value of one unit of the asset you are trading;

For example, let’s say your long position on XYZ stock has a position size of 100 shares, and the contract size is $ 1 per share. You opened the position at a price of $ 50 per share, and the current market price is $ 55 per share;

Unrealized Profit/Loss = ($ 55 – $ 50) x 100 x $ 1 = $ 500

In this case, you have an unrealized profit of $ 500 on your long position.

Now let’s look at your short position on ABC stock. This position has a position size of 50 shares, and the contract size is $ 2 per share. You opened the position at a price of $ 20 per share, and the current market price is $ 18 per share.

Unrealized Profit/Loss = ($ 20 – $ 18) x 50 x $ 2 = -$ 200

In this case, you have an unrealized loss of $ 200 on your short position.

To calculate your equity, you would add your account balance, closed trade profits, and unrealized profits and losses:

Equity = $ 10,000 + $ 1,000 + $ 500 – $ 200 = $ 11,300

In this scenario, your equity is $ 11,300.

It’s also worth noting that when trading with leverage, your equity can quickly be wiped out if your open trades move against you. This is why it’s important to use risk management techniques such as stop-loss orders to limit your potential losses [4].

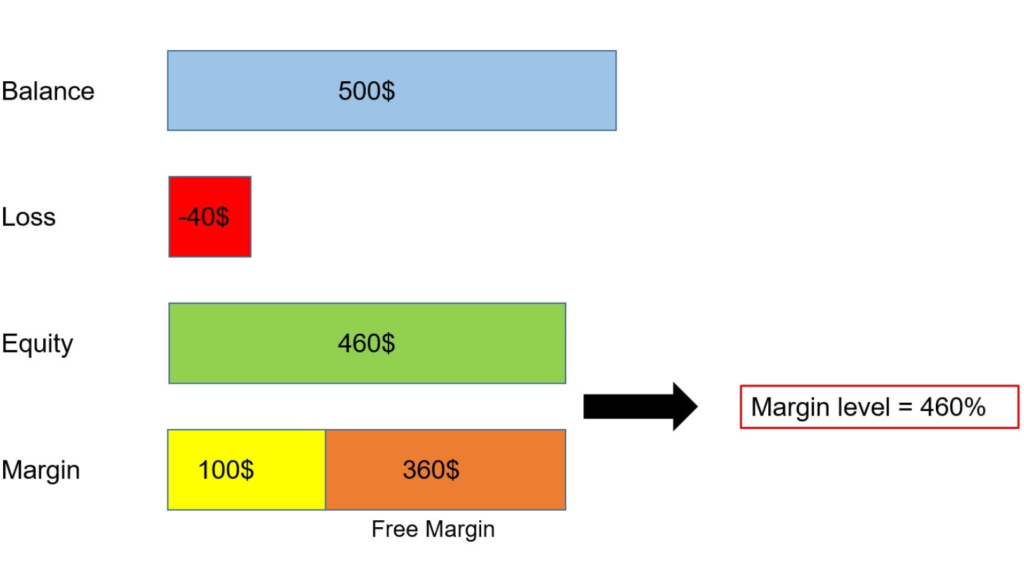

In addition to calculating your equity, it’s also important to keep an eye on your margin level. Margin level is the ratio of your equity to your used margin (the amount of money that has been set aside to open and maintain your positions). If your margin level falls below a certain threshold, your broker may issue a margin call, requiring you to deposit additional funds to maintain your open positions.

To calculate your margin level, you can use the following formula:

Margin Level = (Equity / Used Margin) x 100%

For example, if your equity is $ 11,300 and your used margin is $ 5,000, your margin level would be:

Margin Level = ($ 11,300 / $ 5,000) x 100% = 226%

In this case, your margin level is high, indicating that you have a relatively low risk of receiving a margin call.

Forex Balance vs. Equity: What’s the Difference?

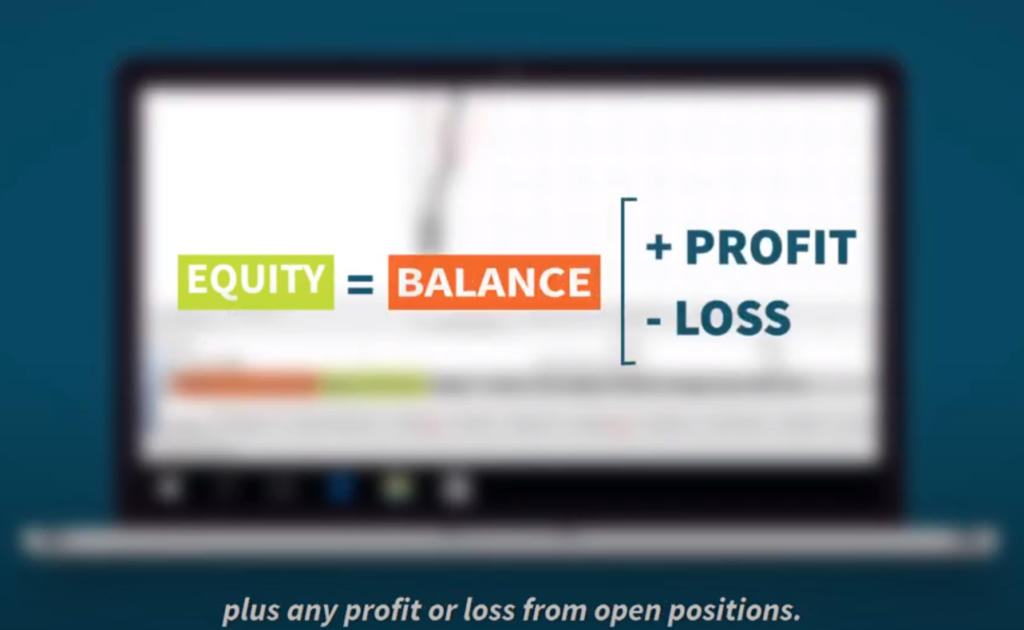

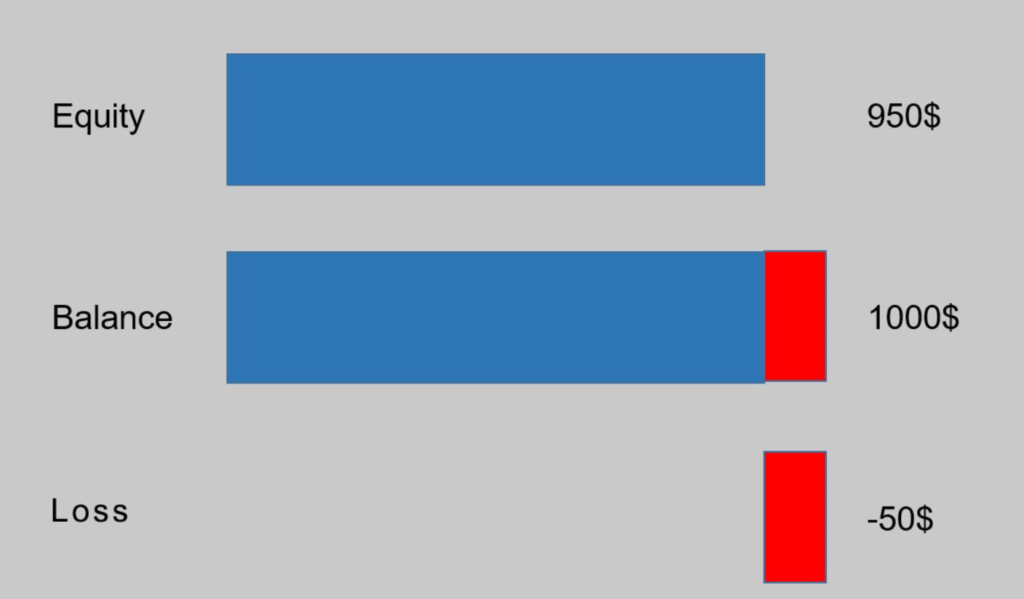

Forex balance and equity are two important concepts in forex trading that represent different aspects of a trader’s account.

Balance refers to the total amount of money in a trader’s account, including any profits or losses from closed trades. This is the amount of money that a trader initially deposited into their account, plus any profits or losses from their trading activities.

Equity, on the other hand, is the value of a trader’s account after considering the profits and losses from both closed and open trades. This takes into account the current market value of any open positions, which can fluctuate rapidly due to price movements in the market.

Equity is a more accurate measure of a trader’s current financial position as it takes into account any unrealized gains or losses from open positions. This is important because open positions can quickly generate large profits or losses that can significantly impact a trader’s overall account value.

Traders should monitor both their balance and equity closely to manage their risk and ensure they are trading within their means. A sudden drop in equity can indicate that a trader is overexposed to risk and may need to adjust their position sizes or exit trades to prevent further losses.

Equity and Margin

A margin is a deposit that a trader must make in order to open a leveraged position. Leverage allows traders to control a larger position than their account balance would otherwise allow. Margin is typically expressed as a percentage of the position size, and it is required to cover any potential losses that may occur if the trade moves against the trader.

Equity is the current value of a trader’s account, taking into account any unrealized profits or losses from open positions. Equity is calculated by adding the account balance to the floating profit or loss of all open positions.

If the value of the open positions moves against the trader and the floating loss exceeds a certain threshold, the broker may issue a margin call. This means that the trader must either deposit additional funds into their account or close out some of their positions to bring their account equity back above the required margin level.

Why Traders Should Track Their Equity?

Traders should track their equity in forex trading for several reasons:

- First, equity is an important measure of a trader’s overall financial position. It represents the current value of their account, taking into account any unrealized profits or losses from open positions. By tracking their equity, traders can get a better sense of their financial performance and make informed decisions about their trading strategies;

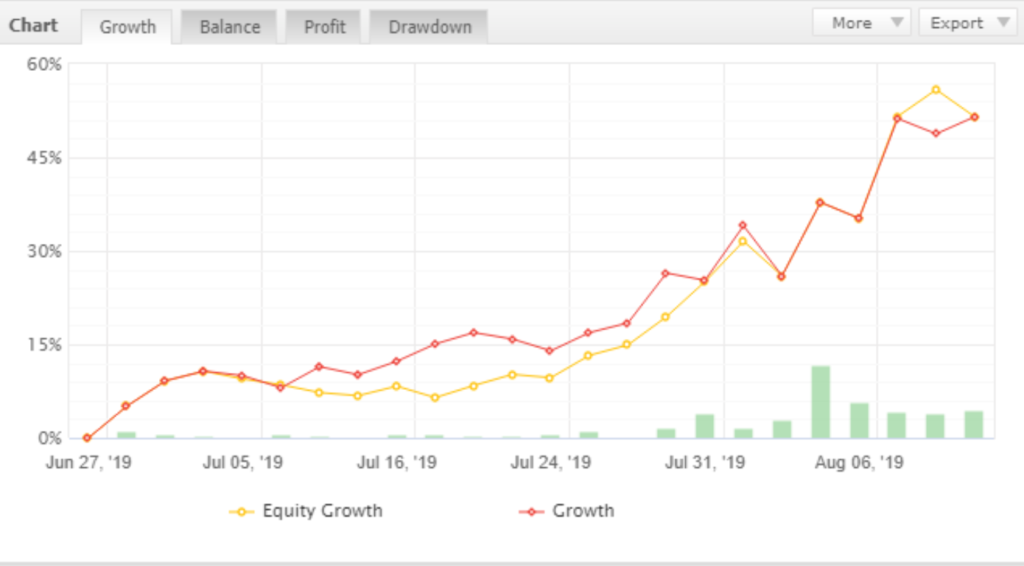

- Second, tracking equity is essential for managing risk. As traders open and close positions, their equity will fluctuate depending on the profitability of their trades. By monitoring their equity, traders can ensure they are not overexposed to risk and can adjust their position sizes or exit trades if necessary;

- Third, tracking equity can help traders optimize their trading strategies. By analyzing their equity over time, traders can identify patterns and trends in their trading performance. They can then use this information to make adjustments to their strategies, such as tweaking their entry and exit points or adjusting their position sizes;

- Finally, tracking equity is essential for ensuring compliance with margin requirements. As discussed previously, brokers require traders to maintain a certain level of equity in their accounts to cover potential losses;

By monitoring their equity, traders can ensure they are meeting these requirements and avoid margin calls, which can result in forced liquidation of positions and significant losses.

Equity in Forex: Extra Tips Understanding Leverage and Margin

Leverage and margin are the two essential concepts that can affect your equity in forex trading. Leverage allows traders to control a large amount of capital with a small initial investment. However, high leverage also means higher risk exposure, which can lead to significant losses if not managed correctly.

Margin is the amount of money required to open a position. Brokers usually require a margin to ensure that traders have enough capital to cover potential losses. Margin is calculated as a percentage of the notional value of the position. Therefore, understanding leverage and margin is crucial for managing your equity in forex trading.

Risk Management Strategies

Risk management is a critical component of successful forex trading. Managing risk involves identifying potential risks and developing strategies to minimize their impact. One common risk management strategy is to limit the amount of capital that you risk on any single trade.

Risk management can also involve using stop-loss orders to limit potential losses. Stop-loss orders are set at a predetermined level, and they automatically close the trade if the price reaches that level. This helps to limit losses and protect your equity [6].

Trading Psychology

Trading psychology can also impact your equity in forex trading. Emotional trading can lead to irrational decisions, which can result in significant losses. Therefore, it is essential to develop a trading plan and stick to it.

Additionally, it is crucial to maintain a positive mindset and avoid trading when you are tired, stressed, or emotional. Trading psychology also involves having realistic expectations about forex trading. Forex trading is not a get-rich-quick scheme, and it requires hard work, discipline, and patience to succeed.

Keeping a Trading Journal

Keeping a trading journal can help you monitor and manage your equity in forex trading. A trading journal allows you to track your trades, analyze your performance, and identify areas for improvement. By reviewing your trades regularly, you can identify patterns and trends, which can help you refine your trading strategy and improve your equity over time.

FAQ:

- Where is equity recorded?

Equity is recorded on a company’s balance sheet as part of the owner’s equity section. It represents the residual value of assets after deducting liabilities. Equity can also be tracked in a trader’s account statement in forex trading platforms.

- How is a company’s equity determined?

A company’s equity is determined by subtracting its total liabilities from its total assets. The resulting value represents the owner’s equity or shareholder’s equity.

- What does return-on-equity (ROE) mean?

Return-on-equity (ROE) is a financial ratio that measures a company’s profitability by comparing its net income to its shareholder’s equity. It indicates how effectively a company is using its equity to generate profits [7].

- Can I have negative equity?

Yes, it is possible to have negative equity. Negative equity occurs when the value of assets is less than the outstanding liabilities.

- Why is equity important?

Equity is important because it represents the ownership interest in a company or trading account. It indicates the value of a company or trading account and can affect financial decisions such as investment, borrowing, and risk management.

- Where can I find my equity?

In Forex trading, a trader can find their equity on the account statement provided by the broker or trading platform.

- Does equity affect me as a trader?

Yes, equity affects traders as it determines the amount of risk they can take and the position size they can trade [8].

- What is account equity in Forex?

Account equity in forex refers to the value of a trader’s account after taking into account the realized profits and losses from closed trades and the unrealized profits and losses from open trades.

- Is equity better than money?

Equity and money are not comparable as they serve different purposes. Equity represents ownership in a company or trading account, while money is a medium of exchange.

- What does 5% equity mean?

5% equity means that the value of a trader’s equity is 5% of the total value of their trading account [9].

- What is equity with an example?

Equity in a company can be illustrated with an example: if a company has total assets worth $ 100,000 and total liabilities of $ 40,000, the owner’s equity would be $ 60,000.

- Does equity mean money?

Equity does not necessarily mean money. It represents the residual value of assets after deducting liabilities [10].

- What is balance vs. equity vs. margin?

Balance is the total amount of money in a trading account, equity is the value of the account after considering the profits and losses from closed and open trades, and margin is the amount of money required to open a position.

- Do I have 20% equity?

A trader can determine if they have 20% equity by calculating the equity percentage as a ratio of equity to account balance [11].

- How much equity can I use?

The amount of equity a trader can use depends on their risk tolerance and the margin requirements set by the broker or trading platform.

- Is equity different from profit?

Yes, equity is different from profit. Profit is the difference between revenue and expenses, while equity represents the residual value of assets after deducting liabilities.

- What is a good equity percentage?

A good equity percentage depends on the trader’s risk tolerance and trading strategy. A conservative trader may aim for a higher equity percentage, while a more aggressive trader may be comfortable with a lower percentage.

- What does equity mean in Metatrader 5?

In MetaTrader 5, equity refers to the value of a trader’s account after considering the profits and losses from closed and open trades [12].

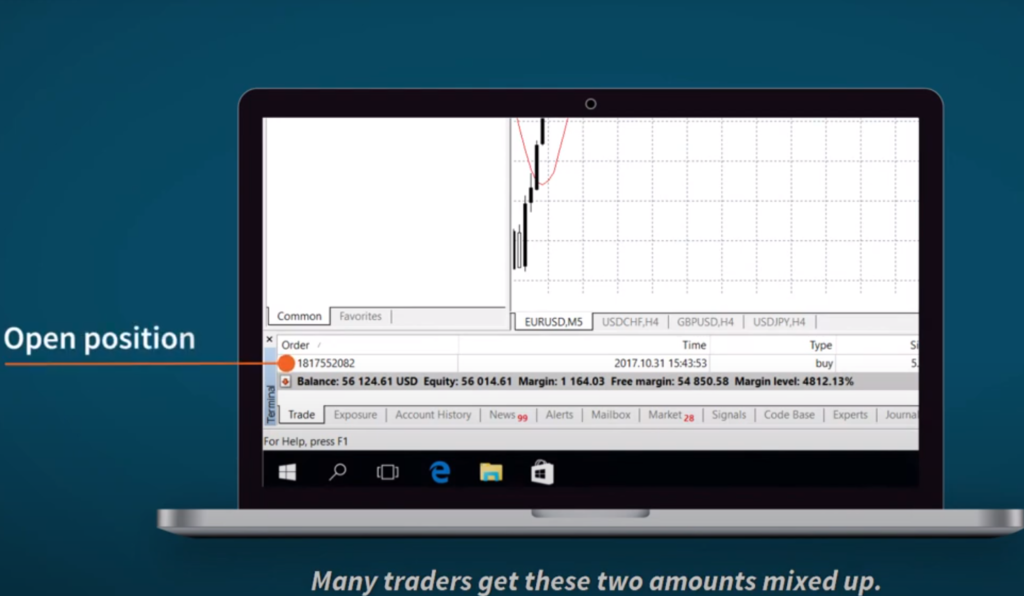

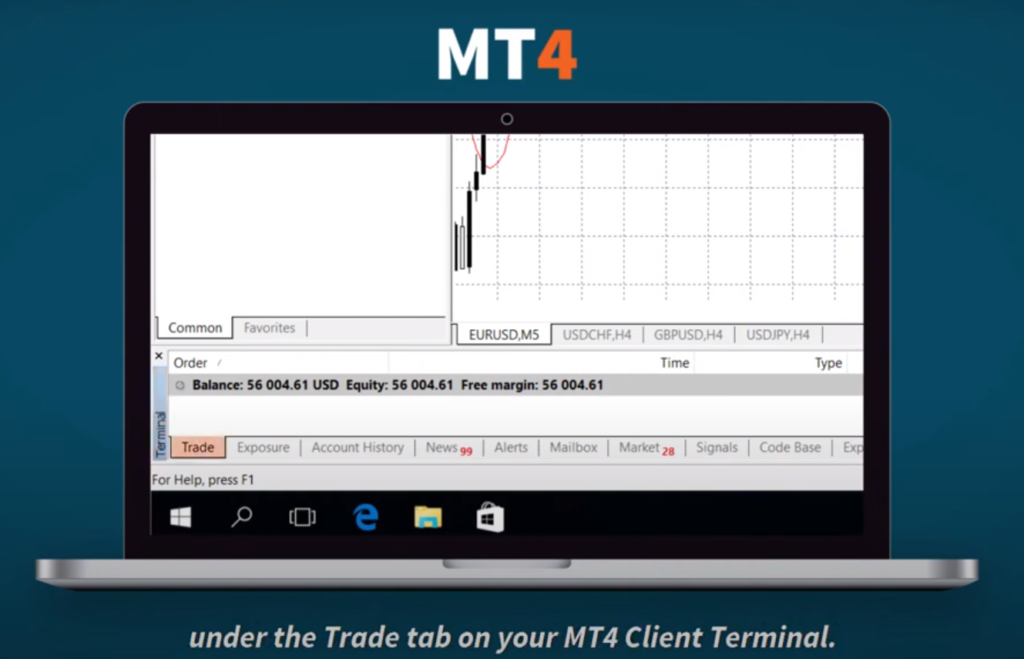

- What is the meaning of equity in MT4?

In MT4, equity refers to the value of a trader’s account after considering the profits and losses from closed and open trades. It is an important metric in forex trading as it affects the trader’s ability to take on risk and determine position sizes.

- What are the 3 types of equity?

The three types of equity are common equity, preferred equity, and retained earnings. Common equity represents ownership in a company and provides voting rights, while preferred equity provides priority in dividend payments. Retained earnings represent the portion of profits that a company keeps instead of distributing as dividends.

- Is equity a benefit?

Equity can be a benefit as it provides ownership and a potential share in the profits of a company or trading account.

- Why is low equity good?

Low equity may be good for traders who prefer to take on higher risk and potentially earn higher returns. However, it can also increase the risk of margin calls and potential losses.

- What does 100% equity mean?

100% equity means that a trader’s equity is equal to the total value of their trading account [13].

- Is equity trading safe?

Equity trading carries risks, but with proper risk management and analysis, it can be a relatively safe investment option.

- What does 20k equity mean?

20k equity means that a trader’s equity is $ 20,000 [14].

- How can I build equity fast?

Traders can build equity fast by taking on higher-risk trades with the potential for higher returns, but this also carries a higher risk of potential losses. Alternatively, traders can focus on consistent, low-risk trades over time to gradually build their equity [15].

Useful Video: What Is Your Equity?

References:

- https://admiralmarkets.com/education/articles/forex-basics/what-is-equity-in-forex-trading

- https://www.babypips.com/learn/forex/what-is-equity

- https://www.axiory.com/trading-resources/trading-terms/what-is-equity

- https://www.litefinance.org/blog/for-beginners/the-difference-between-equity-and-balance-in-forex/

- https://www.globalbrandsmagazine.com/what-is-equity-in-forex/

- https://surgetrader.com/what-is-equity-in-forex/

- https://www.forex.in.rs/what-does-equity-mean-in-forex/

- https://www.financestrategists.com/wealth-management/financial-statements/equity

- https://www.ig.com/en/glossary-trading-terms/equity-definition

- https://www.benzinga.com/money/what-is-equity-in-forex

- https://sashares.co.za/equity-in-forex/#gs.sby3hv

- https://traders-trust.com/what-does-your-equity-on-mt4-mean/

- https://www.brokerxplorer.com/article/forex-balance-vs-equity-whats-the-difference-2986

- https://miltonprime.com/trading-education/articles/forex-terms/equity/

- https://www.aximdaily.com/difference-equity-balance-forex/

Leave a Review